There is a tendency of some economic commentators going for the overkill to make inaccurate statements such as

Without a government deficit, there would be no private saving.

See here and here. (h/t Steve)

But this is mixing up saving for saving net of investment.

Now, “saving net of investment” is sometimes called “net private saving”, although the originators such as Wynne Godley always specified this.

I guess the the root of the confusion on the part of those who have inherited this terminology from the originators is to treat the “net” in net private saving as a result of netting due to aggregation alone, and take the sectoral balances identity – whereas the “net” is crucially net of investment.

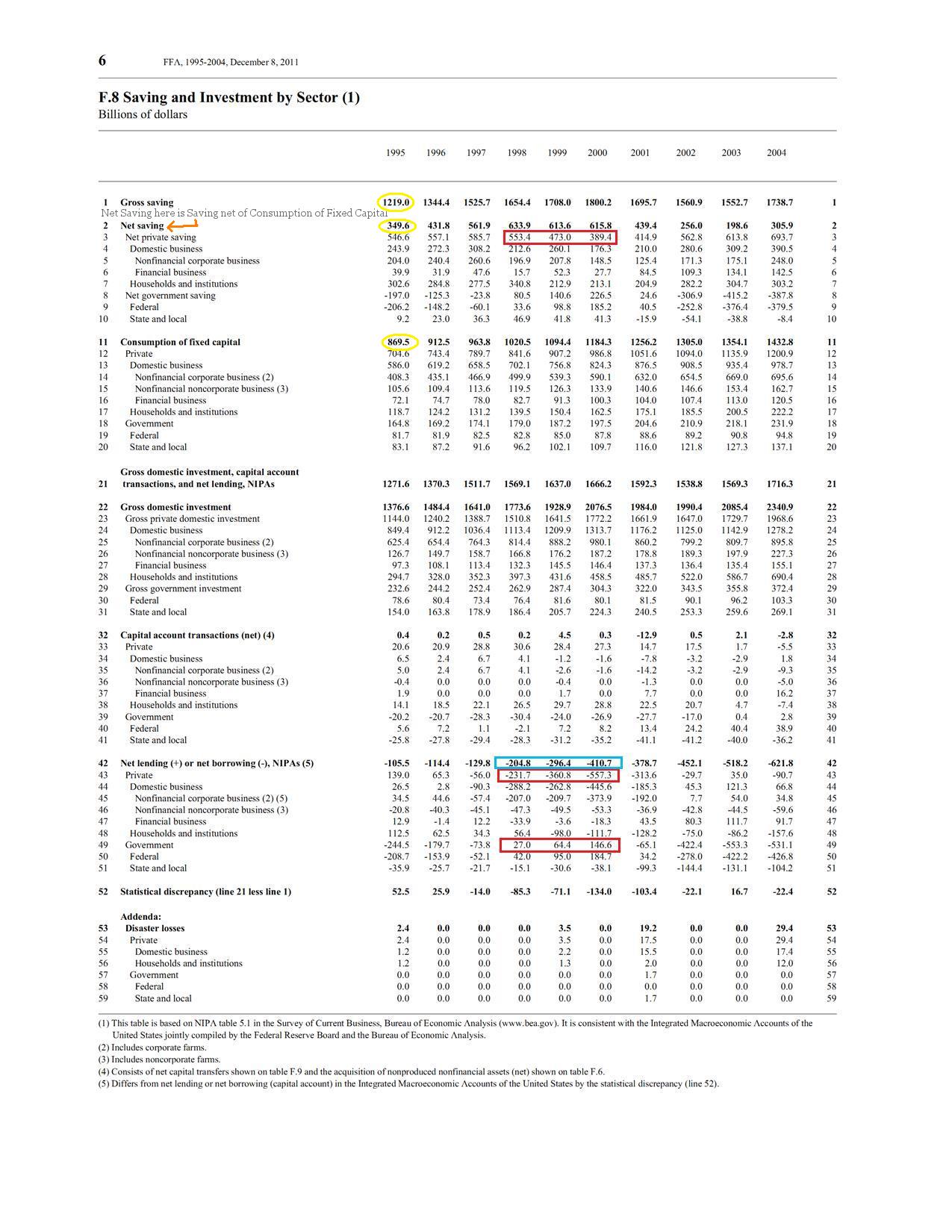

In a recent post Income And Expenditure Flows And Financing Flows, I went into concepts such as saving, saving net of investment, net acquisition of financial assets, net incurrence of liabilities, and “net lending(+)/net borrowing(-)” and you may read the example there on the calculation of these flows. I also went into clarifying this by an example but let’s just check this for the case of the United States with actual data from the Federal Reserve Z.1 Statistical Release Flow Of Funds Accounts Of The United States from the historical data from 1995-2004 available here. In particular the table F.8.

In the above, the data highlighted in blue is the current account balance. With the whole nation’s expenditure higher than income, it’s net lending was negative – i.e., it was a net borrower (from the rest of the world).

Also, the government budget was in surplus in the years (line 49 highlighted in red).

Also, here’s the part which has the potential to create more confusions. The Net Saving defined by the flow of funds accountants is Saving net of Consumption of Fixed Capital (i.e., depreciation). So this can be checked from items highlighted in yellow.

So, the private sector had a positive saving even though the budget was in surplus and the current balance of payments in deficit!

Of course, this meant that the private sector financial balance is negative and this you can see in line 43 highlighted in Red.