Paul Krugman seems to have been thinking on issues related to open economy monetary macroeconomics these days! He has recently warned his readers to not confuse accounting identities with causation but in a recent blog post he seems to be doing it himself.

So Krugman says:

So, here we go. Start from the observation that the balance of payments always balances:

Capital account + Current account = 0

where the capital account is our sales of assets to foreigners minus our purchases of assets from foreigners, and the current account is our sales of goods and services (including the services of factors of production) minus our purchases of goods and services. So in the hypothetical case in which foreigners lose confidence and stop buying our assets, they’re pushing our capital account down; as a matter of accounting, then, our current account balance must rise.

But what’s the mechanism? (Remember the fallacy of immaculate causation.) The answer is, it depends on the currency regime.

Strange. The last statement in the quote warns of potential mistake which is present in the previous statement! ie Krugman wants to have it both ways.

So “… as a matter of accounting …” ?

Let us consider a case (fixed exchange rate or floating) where there is an autonomous capital flow – such as a foreigner liquidating a bond and repatriating funds. This by itself doesn’t affect the current account. In fact it can be compensated by some accommodative flow in the capital account of the balance of payments.

There is a nice 1991 article by the BIS Capital flows in the 1980s: a survey of major trends. The author quotes James Meade who makes this distinction between autonomous flows and accommodative flows:

[accommodative capital flows] take place only because the other items in the balance of payments are such as to leave a gap of this size to be filled … [while] autonomous payments … take place regardless of other items in the balance of payments.

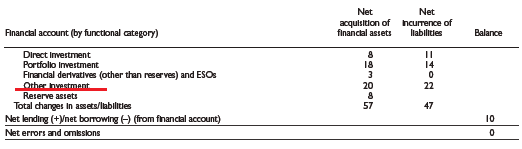

Of course because of flexible exchange rates, the distinction can become blurred but the same is also true in fixed exchange rates. So we have an item called Other Investment in the capital account of balance of payments – like the example in the IMF’s BPM6 (note: “financial account” in the BPM6 terminology, capital account means a different thing):

In addition Reserve Assets is also one. Again this is somewhat of a simplification and it is possible for other items to accommodate.

“Other Investment” is typically banking sector flows but refer to BPM6 for the full definition. “Reserve Assets” is things such as sale or purchases of foreign currency by the central bank or any other official institution. Sometimes a category Exceptional Financing is used – such as government borrowing in foreign currency in exceptional circumstances or official financing transactions from the IMF.

So changes in some items in the capital account can be balanced by changes in some other account in the capital account and not the current account. Of course this doesn’t mean that there is no causality from the capital account to the current account and I will come to it in a moment but what Krugman says is silly.

Let’s take a few examples starting with the simplest – and you guessed it right – the Euro Area 😉

Suppose there is a capital flow where a German financial firm liquidates Spanish government bonds and transfers funds back home.

As I have explained in posts long back, this will lead to a TARGET2 imbalance in which the Spanish NCB will have a rise in indebtedness to the ECB (which is considered to be a Spanish non-resident). Either it ends here or the Spanish banking system will try to attract funds from abroad. In either case there is an accommodative flow in the balance of payments – balancing the initial outflow and without affecting the current account.

Now take the example of a nation with its currency pegged to another anchor currency. Suppose a nonresident economic unit sells sells securities and transfers funds outside the country. Since banks acts as dealers in the foreign exchange markets, this leaves the banking system with a short position in foreign currency. It may try to close it by borrowing in foreign currency or try to attract funds from outside. In the latter case that is all there is to it (in the short term) and this flow is accommodating and will appear in Other Investment. In the former case, the banking system is left with an open position in foreign currency. As long as the bank’s own risk management or the central bank (with the confident knowledge that it has sufficient foreign exchange in case it has) thinks this it is alright, this is what there is for the short term. Else banks may need to attract funds from abroad. However if there is a depreciation outside the tolerable band (fixed doesn’t mean god has fixed it) in response to a huge amount of capital outflow, the central bank may sell foreign currency. It may also try to hike interest rates to get attract foreigners.

Again no change in the current account. One item in the capital account cancels another to preserve the accounting identity Krugman quotes.

In floating exchange regimes this is more complicated but the story is not too different from the BoP viewpoint. An outflow of funds will be accommodated by banks’ open position (or inventories). Banks will typically try to offload the inventories depending on market conditions and opportunities and it is sometimes said in the fx microstructure theory that the inventory half-life is around 15 minutes. The currency will depreciate to the point where expectations of the market participants reverse in the direction of appreciation bringing in flows in the opposite direction to the initial capital outflow. How this works precisely is a very challenging open question. Of course looked at from a medium term perspective, in general, it is not immediately obvious why the current account balance and capital account sum to zero since the magnitude of “Portfolio Investment” and “Direct Investment” may be quite different from the current account balance. But the sum of balances is zero as a matter of accounting. In such cases, banks may try to attract funds from abroad themselves by marketing bonds offshore – i.e., they may try to find offshore funding. More complications arise from derivative contracts with nonresidents which is not easy to go into in this post.

Of course this not guaranteed to work – pure float is the luxury of a few nations – and sometimes the central bank may need to intervene in the foreign exchange markets and in the extremis, undertake exceptional financing transactions such as borrowing from the IMF.

In recent times, the Reserve Bank of India had an interesting swap scheme with the banking system who would attract funds from abroad.

Of course, none of this means there is no causality from the capital account to the current account. A nation may face troubles financing its balance of payments and it may try to deflate domestic demand by fiscal and monetary policy to keep its current account imbalance from getting out of hand. It is important to note here this is not a straightforward result of the identity but there is a more complicated story and that output suffers because of this. Krugman makes it sound as if nothing happens to output.