There are two recent articles about Wynne Godley and Francis Cripps, and their Cambridge Economic Policy Group, also called “New Cambridge economics”, and also on Nicholas Kaldor who was closely associated with it, although not part of it:

- The Political Crisis Of British Keynesianism, 1973–1983, by Colm Murphy.

- Prudence From The Left: Economic Restraint And UK Social Democracy Since 1945, by Colm Murphy and Patrick Diamond.

The first one starts off interestingly:

‘Is it possible that the “new Keynes” we have all been waiting for is Mr Wynne Godley?’ The question seemed plausible to the leading British political journalist Peter Jenkins in December 1979. As the new prime minister, Margaret Thatcher, and chancellor, Geoffrey Howe, applied their monetarist vice, and as production collapsed and unemployment spiralled, Jenkins profiled Godley, the leader of the Cambridge Economic Policy Group (CEPG), a tight-knit collective of university economists. Jenkins was struck by the ‘growing political support’ for ‘Godleyism’ and its ‘economic prescriptions’ for the troubled United Kingdom. These centred on radical protectionism: specifically, a comprehensive system of import controls on manufactured goods.

The first one is an interesting article with lots of history featuring Tony Benn too, although I do not agree with many of the author’s opinions.

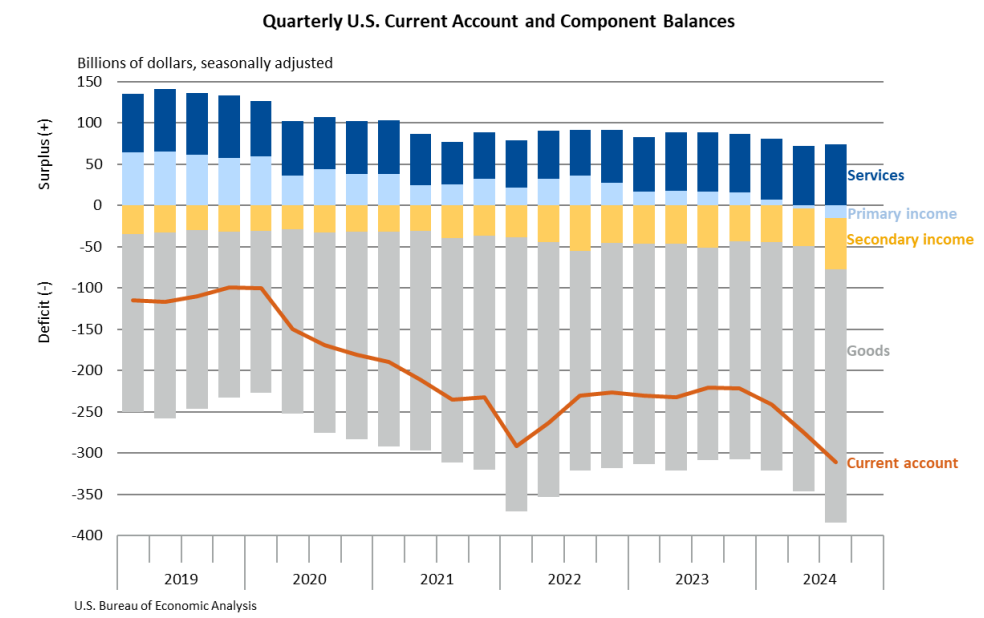

The second article accuses these authors of being austerians. That is strange because fiscal restraint when the government is facing constraints, such as a balance-of-payments constraint is different from doing austerity when you do not face such a constraint.

Here is Wynne Godley in his 1980 article Wynne Godley Calls For General Import Controls for London Review Of Books:

My alternative macro-economic strategy is altogether different. First, imports should be non-selectively controlled by a high, uniform tariff or by auctioning import licences, thereby ensuring that the pattern of imports would continue to be determined by market forces. Second, I insist that control of overall import penetration, in sharp contrast with selective protectionism, must be an integral part of an expansionary fiscal and monetary programme. Once having removed the balance-of-payments constraint on growth, the Government is free to expand domestic demand within the only constraint that ought to be operative: our own capacity to produce. All and more of the yield of a tariff (or the proceeds of auctions of import licences) should be given back to consumers in the form of tax reductions so as to raise domestic spending. The level of imports would be as high as under present policies. Domestic production and income would be much higher.

Which is not exactly austerity, isn’t it?