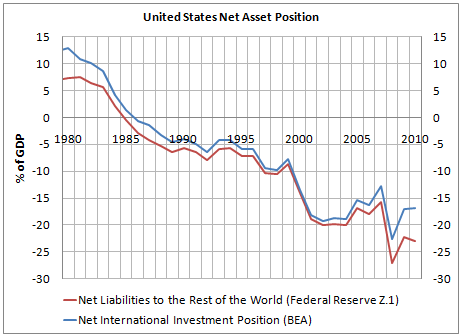

The Net International Investment Position is measure of how indebted a nation is. Why is that so ? Combine all the balance sheets of the sectors of a nation. Debts between residents cancel out and one is left with assets held abroad and liabilities to non-residents. One can replace “residents” with “citizens” and define a slightly different system of accounts and hence there is more than one way of doing it. The difference between assets and liabilities is called the net international investment position or net asset position. Below you see how this has changed over the years for the United States and how it has moved from positive to negative number territory over the years.

There are many discussions we can have one this – never ending ones! This could range from sustainability of this to whether this is problematic since most of the liabilities to foreigners is in US Dollars. Also, there are many stories on the movement of this graph with puzzles such as the dark matter problem. Each is worthy of being analyzed in detail, but for now my viewpoint:

The fact that liabilities to foreigners is in US Dollars is advantageous to the United States not because of the usual reasons given but because the liabilities do not suffer from revaluation losses if the dollar depreciates. But only advantageous at best. Not more.

Enough stories over many future blogs.

bfn.