It is frequently asserted by some economists and even some Post-Keynesians that as long as the effective interest rate paid on stocks of debt is less than the growth rate, stock-flow-norms do not keep rising forever. That is, ratios such as public debt/gdp, external debt/gdp do not rise forever at full employment if this condition is maintained, implying thereby that fiscal policy can be used to achieve a higher output and there is nothing one needs to do about the external sector.

It is the purpose of this post to clear such misconceptions.

Fiscal Policy

What can fiscal policy achieve and what are its limitations? In an essay from the centenary conference of 1983, Wynne Godley wrote [1]:

How did Keynes think the economy worked? Any time between 1950 and 1970 1 would have confidently attributed to Keynes, as preeminently important, the following views about economic policy:

(a) Real demand, output and employment are determined via a multiplier process by the fiscal and monetary operations or the government and by foreign trade performance.

(b) Inflation, though influenced by the pressure of demand, is largely indeterminate in terms or economic variables and therefore, if it is to be controlled, requires some kind of direct political intervention.

(c) Fiscal and monetary policies in any one country are potentially subject to important external constraints.

While there is reasonable support for these views about economic policy in Keynes’s writings, there is no warrant for them at all in the General Theory. Indeed it is strange, seeing how commonly the view is attributed to Keynes that fiscal policy is crucial to real output determination, that the General Theory is concerned with an economy in which neither a government nor for that matter a foreign sector exist at all.

Notwithstanding this I still think, not only that the propositions can be correctly attributed to Keynes, but that they are, themselves, essentially correct. I have however been forced to the conclusion that Keynes was a long way from achieving a coherent theoretical basis for maintaining them, and largely for this reason, his ideas have proved very vulnerable to the attacks from many different directions to which they have been subjected, particularly in the last fifteen years.

To points (a), (b) & (c) above, let me add

(a(i)) Higher output is also possible when the private sector expenditure is higher than private sector income.

This was highlighted by Godley himself in the late 90s, when the US economy expanded in spite of a tight fiscal stance and he was the first to write that this process is unsustainable!

Debt Convergence Analysis

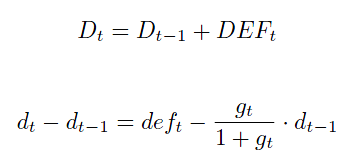

Let us now turn to the question on convergence/divergence of stock-flow norms. In what follows, I simply use debt to denote the public debt or the external debt. Assuming away complications arising from revaluations, we have the identities [2]

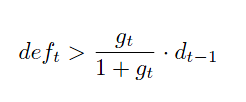

Uppercase is for stock of debts, and lower case for debt-to-gdp ratio and g is the growth rate. Note: DEF is primary deficit and excludes interest payments. We will turn to complications added by interest payments soon. Whenever

the stock of debt keeps rising.

Note, when the debt-to-gdp ratio is less than 1 (100%), the sustainability condition is strong on the deficit. The condition DEF < g is at at a debt-to-gdp ratio is 1. Beyond 100%, the condition on the deficit is a bit weaker than DEF < g because the deficit can be between g and g·d.

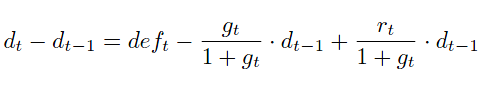

This argument is sometimes presented differently by some Post Keynesians by including the effective interest rate r. The equation looks like the following when it is included:

It is argued that the third term on the right hand side can be set to be greater than the second term (which is to say that r < g is sufficient to ensure sustainability).

This argument (r < g guaranteeing problems are solved) has no substance. This is because rearranging the terms in the way done above, shows more clearly that the stock-flow ratio rises faster than the case where the analysis was done without the interest rate term!

There is one more complication. It may be argued that growth can only bring down the deficit (the deficit here being the public sector deficit). This is true for the case of a closed economy. The convergence of the public debt-to-gdp ratio is also achieved in the case of a closed economy because interest payments by the government is income for the private sector and they will consume it (although the capitalist class’s propensity to consume is less than that of the worker class). Higher consumption leads to higher national income and hence higher taxes, bringing down the deficit.

Wynne Godley and Marc Lavoie [3] showed how this happens precisely in the case of a closed economy:

This paper deploys a simple stock-flow consistent (SFC) model in order to examine various contentions regarding fiscal and monetary policy. It follows from the model that if the fiscal stance is not set in the appropriate fashion—that is, at a well-defined level and growth rate—then full employment and low inflation will not be achieved in a sustainable way. We also show that fiscal policy on its own could achieve both full employment and a target rate of inflation. Finally, we arrive at two unconventional conclusions: (1) that an economy (described within an SFC framework) with a real rate of interest net of taxes that exceeds the real growth rate will not generate explosive interest flows, even when the government is not targeting primary surpluses, and (2) that it cannot be assumed that a debtor country requires a trade surplus if interest payments on debt are not to explode.

Also, they create some very special scenarios, where the external debt stays sustainable.

However, making the above work is difficult for the case of an open economy in general. This was what the essential argument of the New Cambridge School.

So is there a way to achieve convergence of the stock-flow norm? To achieve that, the external sector deficit (more precisely, the primary balance in the current balance of payments) should be less than the growth rate times the external debt. This creates tensions for demand-management because if the external deficit grows higher than the growth rate, it is usually brought back to a sustainable path by deflating demand. This is because the balance of payments deficit itself will grow if growth is high! (unless exports improve).

There are of course some scenarios which can lead to the convergence of the external debt (if the markets allow it). A more careful treatment will always lead one to studying income and price elasticities of imports, growth in the rest of the world etc.

Other scenarios which could lead to the improvement of the external sector are: promotion of exports leading to more success abroad and luck – market forces miraculously achieving the required depreciation to improve the external sector. Since the latter is mere wishful thinking, we see nations trying to depreciate their currencies because it makes their exports more competitive.

To bring the balance of payments deficit back into balance, there is also the option of restricting imports but in the world of “free trade”, it can create tensions between nations.

There are two more options. The first is to ask your trading partners to appreciate their currencies if they have pegged them but this has to go through negotiations because they want you to do the same! The second (which includes the previous option) is what this blog is about. Since, the external sector creates problems for demand management, one can only think of coordinated efforts by institutions running the world economy, working to achieve higher world demand instead of contracting it.

References

- Wynne Godley, Keynes And The Management Of Real Income And Expenditure, p135, Keynes And The Modern World: Proceedings Of The Keynes Centenary Conference, ed. David Worswick and James Trevithick, Cambridge University Press, 1983.

- Gennaro Zezza, Fiscal Policy And The Economics Of Financial Balances, Levy Institute Working Paper 569, 2009. Available at http://www.levyinstitute.org/publications/?docid=1161

- Wynne Godley and Marc Lavoie, Fiscal Policy In A Stock-Flow Consistent Model, p 79, Journal of Post Keynesian Economics / Fall 2007, Vol. 30, No. 1. Draft version available at http://www.levyinstitute.org/publications/?docid=911