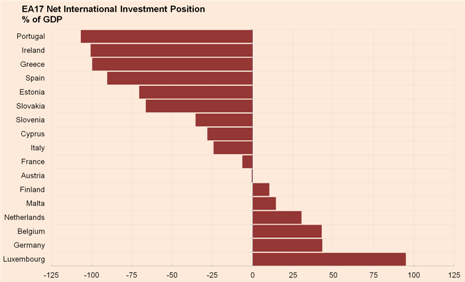

Alastair Marsh at FT Alphaville discusses the Euro Area problems looked through the prism of net international investment position (NIIP), quoting Goldman Sachs economist Lasse Holboell Nielsen:

When considering the causes of the ongoing Euro area debt crisis, it is natural to focus on public debt and deficits as the primary sources of market tensions. However, as the Irish experience demonstrates, private-sector debt can rapidly migrate onto public-sector balance sheets in the event of a financial crisis. It may therefore be more meaningful to look at the aggregate indebtedness of an economy, consolidating the public- and private- sector positions, in assessing a country’s vulnerability to sovereign yield tensions. [Italics not in original]

Nielsen is apparently trying to model government bond yields using NIIP data for some of the EA17 nations.

This blog had discussed this earlier in the post Eurozone Indebtedness. I re-did the graph and is below

A nation which is running a current account deficit and is highly indebted (proxied by the NIIP-GDP ratio) has to borrow from the international banking system, money markets and capital markets and refinance the debt and faces the risk of a run on its liabilities if the debt gets out of hand. The chart above gives an insight on why some EA17 nations face more troubles than others.