Big deal has been made out of today’s auction of 2022 bonds of the Federal Republic of Germany. How it affects the markets or will in the near future is not the point of discussion here. Rather, this post has to do with some misleading description given by Izabella Kaminska of FT Alphaville.

Izabella is writing as if the bonds which were not absorbed by the markets were purchased by the Deutche Bundesbank, which is not allowed by the Treaty governing the Euro Area.

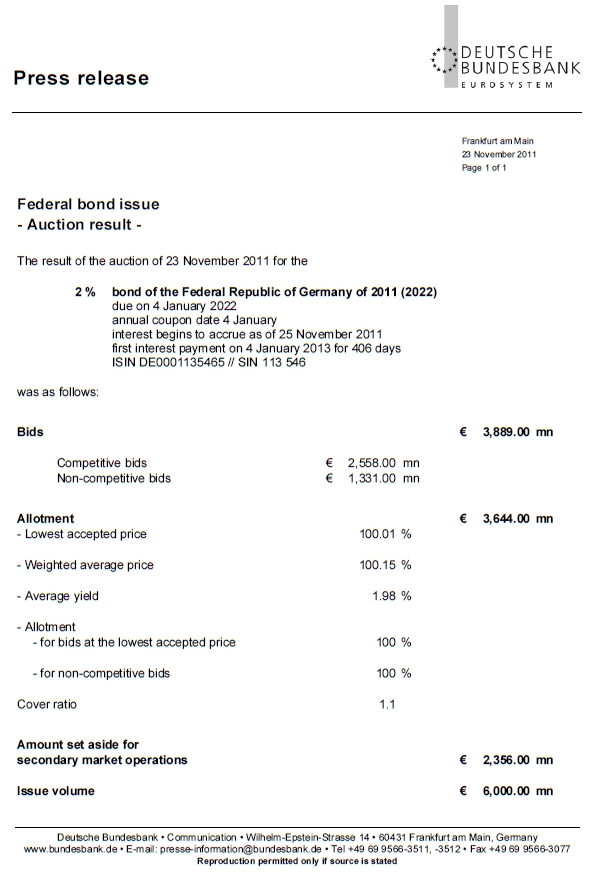

The Bundesbank website gives a description of the auction. Same as the capture below:

So of the €6,000 million of securities on auction, only €3,644 million was alloted. The remaining €2,356 million was “set aside for secondary market operations”

What is that supposed to mean? It simply means the German government is the owner of the €2,356 million of German bonds (i.e., it appears in its Assets as well as Liabilities!) and it will sell them in the secondary markets later at some point.

Some have interpreted it as the Bundesbank having bought €2,356 million of the securities(!), which is not allowed by law. As if nobody is watching!

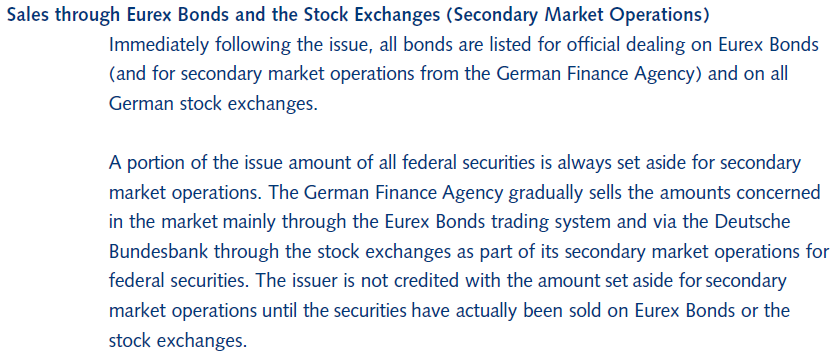

A document from Eurex, page 12 makes it clear.

So nothing unusual there. The issuer is not credited with the amount set aside for secondary market operations until the securities have actually been sold on Eurex Bonds or the stock exchanges.

Izabella writes:

The uncovered technicality comes from the fact that the Bundesbank habitually retains some of the paper from every major bond auction for the purpose of its ‘market operations’. But to understand why this is important one first has to explore how central banks actually set rates.

That is confusing “(open) market operations” of the Bundesbank with the “secondary market operations” of the German Treasury! (The Finance Agency of The Federal Republic of Germany – Bundesrepublik Deutschland – Finanzagentur GmbH)

No Treaty violation, at least till now 😉