The UK Office of National Statistics released the 2011 editions of the “Blue Book” and the “Pink Book” recently.

The UK Gross Domestic Product was £1,394 billion in 2009 and £1,458 billion in 2010.

In the last 20-40 years, external assets (and liabilities) have grown to a huge multiples of GDP. Hyman Minsky worried about gross assets and liabilities in addition to net assets/liabilities and showed the importance of “gross”. At the end of 2010, according to the Pink Book, total value of assets held abroad by UK residents was equivalent of £9,961 billion while liabilities to foreigners was £10,159 billion, leaving the United Kingdom with a net asset position of minus £197 billion.

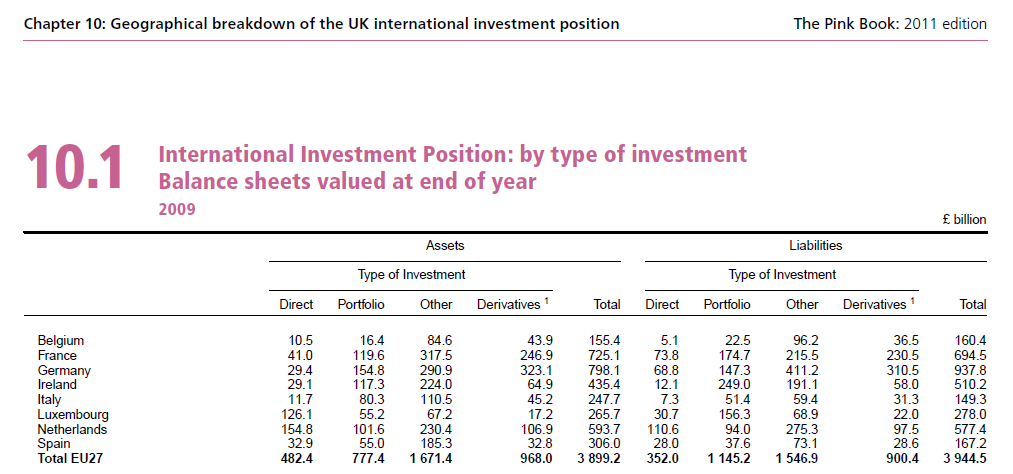

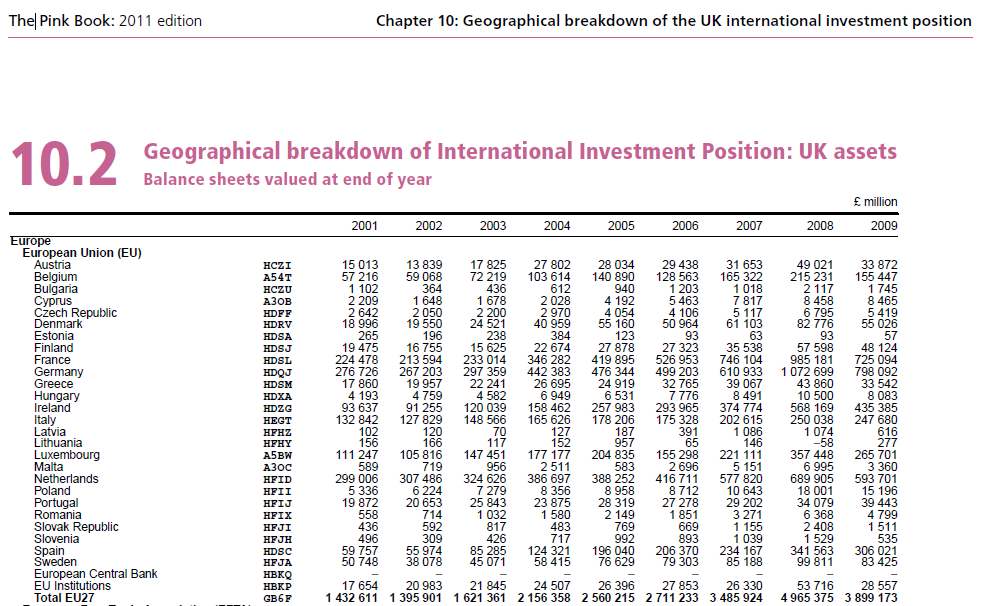

With talks of a Eurocalypse not so unthinkable these days, countries’ exposure to the Euro Area is the natural question to ask. Since London is a financial center and the United Kingdom is close to the Euro Area, it is likely to have more exposure to the Euro Area than other nations. The Pink Book 2011 edition gives the geographic breakdown of assets and liabilities only till 2009, unfortunately. Anyway the statistics below

by type:

(click to enlarge)

and in more detail on countries but consolidated across all resident sectors:

(click to enlarge)

Needless to say, huge!

The column for “Derivatives” shows assets valued less than £1,000 billion but here too there may be hidden exposures, since there can be a lot of netting, even though Derivatives appear in both Assets and Liabilities.

If there are problems in the Euro Area, assets held by residents will be impaired (such as due to defaults) and this is already happening at a lesser scale compared to the “unthinkable”. A depreciation of the Euro to the Pound Sterling will also cause revaluation losses for UK residents. On the other hand, to maintain credit ratings, it will be difficult for the UK to default on its liabilities, increasing UK’s net indebtedness to the rest of the world by a huge amount. It is really difficult to forecast how severe the crisis can be, but these numbers suggest it can be devastating to the extreme.

There are second order effects. For example, UK residents hold assets in the United States and if these assets fall in market value due to a crisis situation, there could be a further deterioration in the gross value of UK Assets held abroad.

With EFSF bonds not appealing to investors even in a flight to quality environment, and European politicians’ plans losing credibility, and the ECB’s Securities Markets Programme losing its effect, the only way forward is for the ECB to put explicit ceilings on government bond yields. The reason it is hesitant in doing it is because it creates a moral hazard problem. (See Mervyn King’s Got A Point).

Of course, there seems to be no alternative (except rumours of a €600 billion bailout for Italy!), so challenging times ahead for the ECB.

Update: Wolfgang Münchau of FT thinks the Eurozone has only a few days! Link