This is a continuation of posts The Eurosystem: Part 1, Part 2, and Part 3 in which I went through a description of the payment system TARGET2 both domestic and cross-border and the process of how banks obtain reserves from the Eurosystem.

This post will go into the details of the Eurosystem operations. Like all central banks, the ECB simply targets interest rates, in particular the EONIA – the Euro Overnight Index Average . It is “[a] measure of the effective interest rate prevailing in the euro interbank overnight market. It is calculated as a weighted average of the interest rates on unsecured overnight lending transactions denominated in euro, as reported by a panel of contributing banks” according to the ECB website.

It should be noted outright that at some places in the ECB website, there are claims that it controls the money stock. A closer investigation shows no sign of the ECB doing anything of the sort and this claim is just a rhetoric. The Eurosystem is acting just like other central banks, changing short term interest rates and attempting to impact demand. It is impossible for any central bank to control the money stock. I had two posts on money endogeneity: Horizontalism and More On Horizontalism.

Reserve Requirements

Credit Institutions (banks) have an account at their home NCBs and have to maintain a minimum of 2% of their liabilities subject to reserve requirements. The ECB can change this from 2%, but it has never done this so far. Different central banks have different rules on which liabilities are to be included when calculating reserve requirements. For the Eurosystem, overnight deposits, deposits with maturity up to two years are included and so are debt securities with maturity up to two years. Repos, liabilities vis-à-vis other credit institutions including the Eurosystem, debt securities with maturity greater than two years are not included.

Deposits subject to reserve requirements are remunerated at the rate of the main refinancing operations (MROs).

Needless to say, reserve requirements do not reduce banks’ ability to make loans – since loans make deposits and deposits make reserves.

How do banks, as a whole, get the extra (not excess) reserves after they make loans? Either via Standing Facilities, which we consider next or through Open Market Operations.

Standing Facilities

The Eurosystem uses a corridor system for targeting interest rates. Banks can use the deposit facility and are paid interest on excess reserves and can borrow against eligible collateral under the marginal lending facility. For latter, how much? As much as they can, provided they have collateral. According to an old document from the ECB, saying the same:

So the interest rates on the deposit and marginal lending facilities act as a corridor.

In “good times”, banks will lend all their excess reserves to other credit institutions. Since the Eurosystem is adjusting the amount to reserves to hit its interest rate target, some banks may fall short of reserves which they can easily borrow from other banks. Because of uncertainty, some banks will be driven to the marginal lending facility and the Eurosystem will try to fine tune to reduce this. In may also be the case that the banking system as a whole is left with excess reserves and the Eurosystem may try to fine tune this in reverse direction (and will in “good times”). We will see how this happens in the next section.

For what happens during the day, see the end of Part 1 of this series.

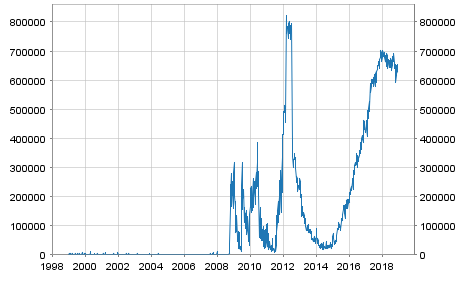

But … the crisis hit, and banks became suspicious of other banks’ creditworthiness and this led to a freeze in the interbank market. Banks were cautious in lending each other and also about their own liquidity needs. Thus, they kept a lot of deposits at their home NCB. So one hears of banks “parking” a lot of funds at the Eurosystem. The following chart from the ECB Statistical Data Warehouse highlights the stress in the interbank markets. The y-axis is in Millions of Euros.

Chart updated 6 Dec 2018, as the previous link was broken.

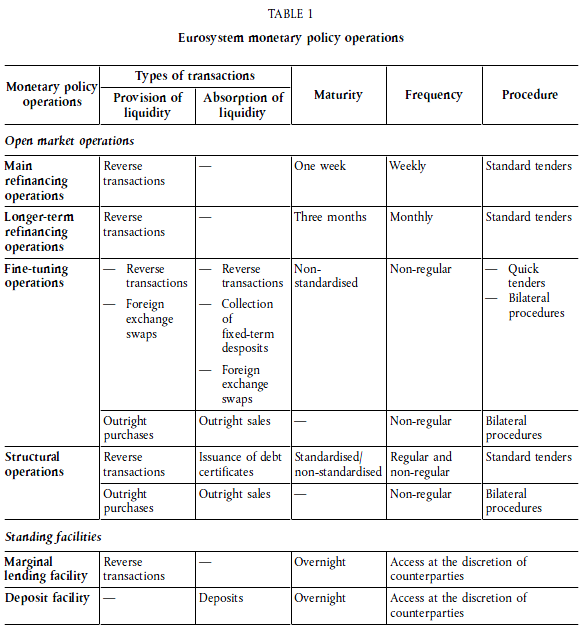

Before we go into Open Market Operations, a table summarizing the Eurosystem’s operations (from the same document linked above)

Government Deposits

For reasons not clear to me, monetary policy documents do not emphasize an important fine tuning operation – shifting of government deposits between NCBs’ and banking system’s books. Movement of funds into and from the government’s account at its home NCB can cause a lot of errors in forecasting liquidity and can cause fluctuations in the rate at which banks are lending each other overnight. At the same time, if managed sufficiently well, it becomes a good tool for fine-tuning! This link from the ECB’s website has some discussion on this.

Open Market Operations

Via, open market operations, the Eurosystem manages banks’ needs for reserves. It neither controls the money stock in the Euro Area nor controls the amount of reserves in any sense of the usage of the word “control”. It may pursue a non-accommodating or a dynamic policy, where it hikes the interest rate, depending on the growth of the money stock but gone are the days of Monetarism! The Eurosystem is defending its target rate, the main refinance rate, which is usually mid-way between the rates for the deposit facility and the marginal lending facility. In recent times, due to banks’ high credit risk, it has lost control of this.

As per Table 1 above, the Eurosystem categorizes its operations as

- main refinancing operations,

- longer-term refinancing operations,

- fine-tuning operations and

- structural operations.

We can also describe them – as done by the “Monetary Policy Implementation” document – as follows:

- Reverse transactions: MROs, LTROs, Fine-tuning Reverse Operations and Structural Operations;

- Outright Transactions;

- Foreign Exchange Swaps;

- Issuance of ECB Debt Certificates, Collection of Term-deposits.

Before we get into a description of the above items, it should be made clear from the start, that the reader should keep in mind the similarities and differences between this and the procedures adopted by the Federal Reserves in the United States. As mentioned in Part 1, the Federal Reserve and the banking system can be described as asset-based type, while the monetary system in the Euro Area as an overdraft monetary system. (It should also be made clear that “overdraft” here does not mean national governments have an overdraft facility at their home NCB – they don’t have).

For example, it is easy to confuse MROs and LTROs with the (non-permanent) open market operations done by the Fed. The confusion arises because both MRO/LTROs and the Fed’s open market operations are carried out using repurchase agreements (repos). I will have another blog post on the Federal Reserve procedures, but suffice to say here that the Fed’s repos are more comparable to Fine-tuning Reverse Operations.

Reverse Transactions

As mentioned, earlier banks as a whole in the Euro Area obtain all reserves by directly borrowing from the Eurosystem. An exception is that in recent times, banks have seen their reserves increase due to the ECB’s two programs – Securities Markets Programme and Covered Bond Purchase Programme.

Let us consider MROs first.

Every week, the Eurosystem refinances the liquidity needs of the banking system via this operation. According to the implementation document,

- They are liquidity-providing operations.

– They are executed regularly each week.

– They normally have a maturity of one week.

- They are executed in a decentralised manner by the National Central Banks.

- They are executed through standard tenders.

– All counterparties fulfilling the general eligibility criteria may submit tender bids for the main refinancing operations.

- Both tier one and tier two assets are eligible as underlying assets for the main refinancing operations.

So every week, the Eurosystem lends banks amounting billions of Euros via an auction but these are executed in a decentralised manner by the NCBs as repurchase agreements. (Edit: 21 Dec 2011: A bit incorrect to term MRO/LTROs as “repos”). During the week, funds flow in all directions and banks will borrow from each other.

What about LTROs?

These are almost similar to the MROs, except that they are executed every month and normally have a maturity of three months. In recent times, the ECB has been more accommodative and has offered LTROs with longer maturities such as six months.

Since the frequency of MROs is one week, there needs to be some tool for the Eurosystem during the week to fine tune reserves so that interbank lending rates do not deviate from the target. So Fine-tuning Reverse Operations. These need not have fixed maturities and can be done in short notice but executed in a decentralised manner by the NCBs. About Structural Reverse Operations, I have nothing to say!

Outright Transactions, FX Swaps, ECB Debt Certificates & Term Deposits

In addition, the Eurosystem may employ other tools to provide or remove liquidity such as outright purchases or sales of domestic securities or entering into foreign exchange swaps with financial institutions. These are generally decentralised i.e, executed by the NCBs but the ECB may sometimes be involved. Collection of term deposits and issuance of ECB debt certificates absorb liquidity (i.e., reserves). The former is executed by the NCBs. Debt certificates are settled in a decentralised manner by the NCBs. Another difference between the two is that the former is not marketable, while the latter is.

Conclusion

A bit boring, wasn’t it? Haven’t yet covered ELA (Emergency Loan Assistance), SMP (Securities Markets Programme) and CBPP (Covered Bond Purchase Programme). My aim was to detail out the monetary operations so that we know what the Eurosystem does, what it doesn’t and what it can do (and what it cannot do!). Probably ELA, SMP & CBPP for the last part in the series – Part 5.

Addendum

How does the ECB change short term interest rates in normal times? By a simple announcement. Banks will automatically start lending each other at the target rate. MROs are done weekly, and there will be no additional MRO that needs to be done post/pre the announcement. Neither do fine-tuning reverse operations change in volume because of the decision.