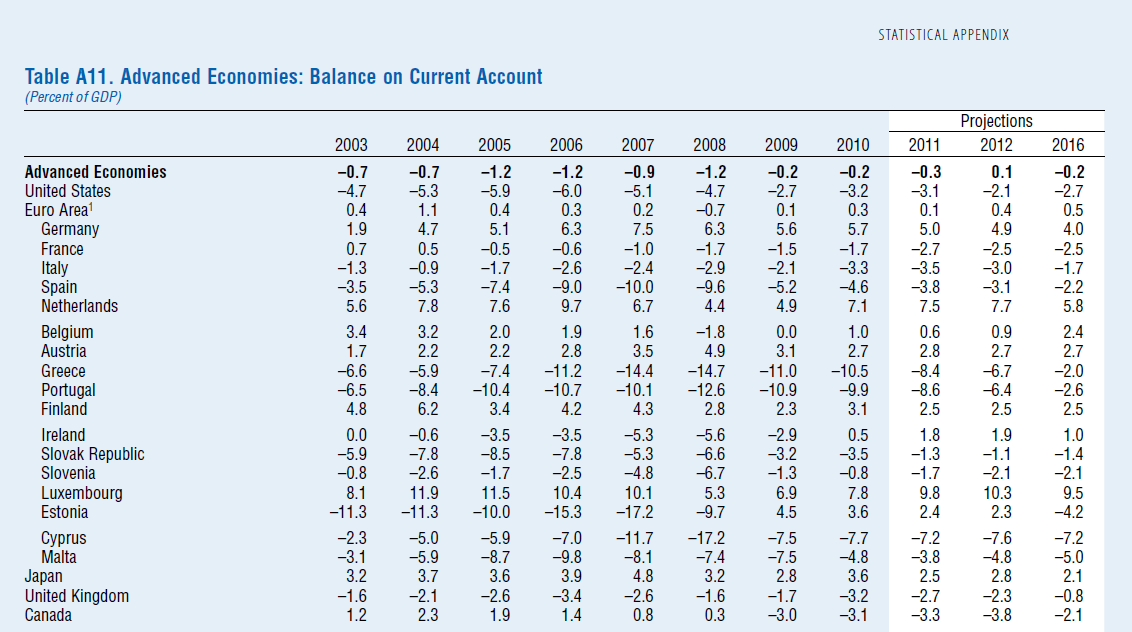

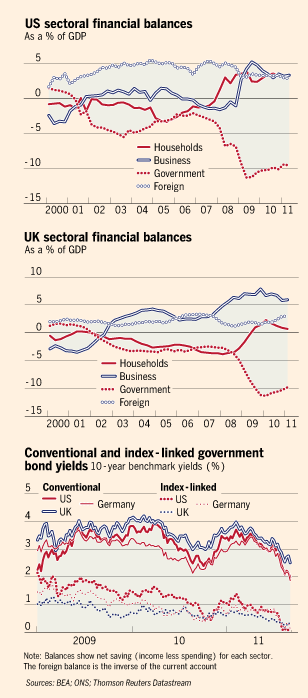

The International Monetary Fund, IMF has one full chapter devoted to the subject of “twin deficits” in their latest issue of World Economic Outlook. The subject of “twin deficits” is full of complications and can invoke the deepest emotions from economists. Naively, the argument goes as follows: The “three financial balances” identity can be written as

NAFA = DEF + BP

where NAFA, DEF and BP stand for the Net Acquisition of Financial Assets of the private sector, Government Deficit, and the current Balance of International Payments. From the above, if the government deficit increases, for a constant NAFA (rather a constant NAFA/GDP), an increase in DEF causes BP to reduce, i.e., reduces the current account balance or causes the current account deficit to increase.

Now, this is hardly the best way to put it – because it is mistaking an accounting identity for a behavioural relationship. For example, in conjecturing, one is implicitly assuming that the budget deficit is exogenous or fixed by the government. It is then argued that to reduce the current account deficit (or BP with a minus sign), the government should cut its budget deficit.

There is some truth to “twin deficits”, in my opinion. A lot actually! However, conclusions from any analysis need to be studied in a proper framework and stock-flow coherent macroeconomics is the only way to do this. Money is automatically endogenous in “SFC” models – it cannot be otherwise.

The government sets its fiscal policy or fiscal stance. This can be approximated to be G/θ, where G is for government expenditures and θ is the tax rate (as opposed to total taxes). The budget deficit is out of the control of the government and is dependent among other things, the private sector propensity to consume, the exports and imports. Assuming exports remain constant, relaxing the fiscal stance (i.e., an increase of G/θ) leads to an increase in domestic demand, ceteris paribus. An increase in demand leads to an increase in imports. (If people have higher incomes, they will purchase more imported products). This leads to the widening of the current account deficit and hence through the sectoral balances identity a widening of the budget deficit.

Various things can be said about what is written in the last paragraph. Take the case when ceteris is not paribus. An increase in the propensity to save (i.e., a decrease in propensity to consume) can lead to a higher NAFA and DEF and increasing BP (as a result of lower domestic demand and hence lower imports).

Come back to ceteris paribus: assume that demand abroad has increased for some reason. This could be due to an increase in the fiscal stance of the foreign government or a private sector led credit expansion abroad. This will lead to an increase in exports for the country we are discussing. So in such a scenario, an increase in the fiscal stance – up to some limit – will not lead to a widening of CAD, i.e., decrease in BP.

Wynne Godley put it best in a Levy article in 1995 (always perfect with his wording):

Refuting the “Saving is Too Low” Argument

It is sometimes held that, in the words of the Economist (May 27. 1995, p. 18), “America’s current account deficit is enormous because its citizens save so little and its government spends too much.” The basis for this proposition is the accounting identity that says that the private sector’s surplus of saving over investment is always equal to the government’s deficit plus (or minus) the current account surplus (or deficit). As this relationship invariably holds by the laws of logic, it can be said with certainty that if private saving were to increase given the budget deficit or if the budget deficit were to be reduced given private saving, the current account balance would be found to have improved by an exactly equal amount. But an accounting identity, though useful as a basis for consistent thinking about the problem can tell us nothing about why anything happens. In my view, while it is true by the laws of logic that the current balance of payments always equals the public deficit less the private financial surplus, the only causal relationship linking the balances (given trade propensities) operates through changes in the level of output at home and abroad. Thus a spontaneous increase in household saving or a spontaneous reduction in the budget deficit (say, as a result of cuts in public expenditure) would bring about an improvement in the external deficit only because either would induce a fall in total demand and output, with lower imports as a consequence.

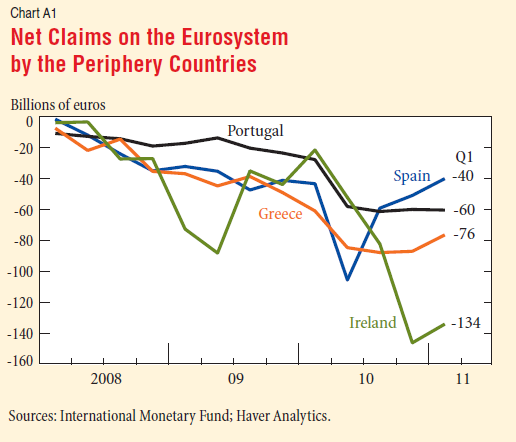

How is protectionism related to all this? When nations face severe balance of payments issues, they are forced to deflate demand in order to bring the balance of payments at sustainable levels. If that doesn’t work either, nations may try to directly reduce imports. This works via reducing the propensity to import and hence imports. However, it is difficult to take such a step because it can lead to retaliation. As John Maynard Keynes once put it:

During most of the period in which the modern world has been evolved … the failure to solve this problem has been a major cause of impoverishment and social discontent and even of wars and revolutions.

i.e., the failure to resolve the balance of payments problem. The only way to peacefully resolve this issue is by working toward a solution which is good for all. Even the Bank of England (and Mervyn King) has realized this. Else we will just have a long period of low demand and high unemployment, leading to social unrest. More on that some other time.

[Update, 3 Jan 2012: Fixed some errors]