On 28 December 2011, the Eurosystem conducted a large 3-year LTRO (Longer-Term Refinancing Operation) in which banks in the Euro Area bid about €489bn. I covered this in my post Today’s Eurosystem LTRO and I wrote that the LTRO was to help banks meet their funding needs and that they participated in it to roll over existing debt to the financial system excluding the Eurosystem.

My post had some responses having some issues with this but today the ECB released its January Monthly Bulletin which has a section on the bidding behaviour (page 30 of the pub, 31 of the pdf) confirming this:

(click to enlarge)

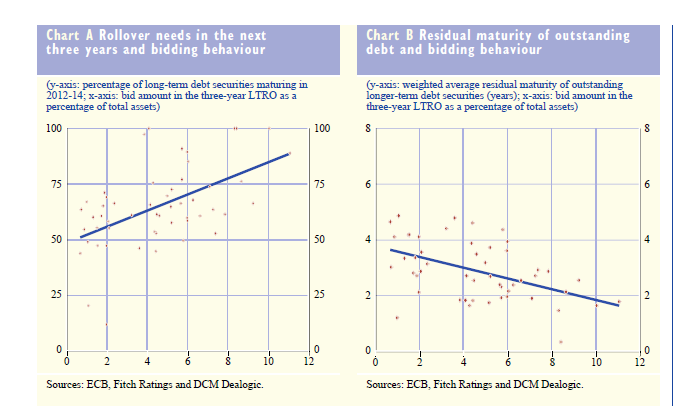

Some remarks can be made regarding the bidding behaviour in the three-year LTRO. First, the large amount of liquidity obtained by euro area banks in this operation can be viewed as a reflection of their refinancing needs over the coming three years, as shown in Chart A. Measuring the rollover needs over a shorter horizon, for instance over the next six months, even though it captures the large amount of refinancing needed in the first half of 2012, does not fully explain the bidding behaviour. This suggests that medium-term funding considerations may have had a significant influence on the bidding behaviour. Indeed, in addition to assessing the rollover risk faced by banks, it is useful to consider the residual maturity of banks’ outstanding debt. The longer the residual maturity, the lower the risk that banks will need to seek market funding under unfavourable conditions. Chart B illustrates a clear negative relationship between the size of the bids and the residual maturity of the bidders’ debt. This also suggests that funding considerations may have played a major role in determining the bidding behaviour. Second, banks may have placed relatively high bids in the first three-year LTRO as they viewed the operation as attractively priced compared with the prices that could be inferred from the EURIBOR swap curves or the spreads required by the market for bond issuance in 2011.

Overall, the analysis suggests that funding considerations played a major role in the bidding behaviour of banks in this first three-year LTRO, supporting the Governing Council’s view that the announced measures will help to remove impediments to access to finance in the economy, stemming notably from spillovers from the sovereign debt crisis to banks’ funding markets.

In the press conference following the ECB Governing Council decision on monetary policy (to keep the short-term rate targets unchanged), Mario Draghi mentioned that

Let us not forget that in the first quarter of this year, more than €200 billion of bank bonds fall due. So this decision certainly prevented a potentially major funding constraint for our banking system, with all the negative consequences this might have had on the credit side.

He also repeated this and gave out interesting details in Q&A session of the Hearing on the ESRB before the Committee on Economic and Monetary Affairs of the European Parliament. I will update the post when the transcripts of the Q&A session become available.

Without the LTRO, banks would have faced pressures to redeem maturing obligations by asset sales which could have led to a fall in asset prices, and if the assets were government bonds, it would have increased risks of a self-fullfilling prophecy.

Of course, all this just buys more time!