The Banco de España released its Quarterly Economic Bulletin today and it had an interesting chart on the sectoral balances of the Spanish economy.

With a net indebtedness of €994.5bn – i.e., close to €1 trillion – as compared to the gross domestic product of €1.06tn (2010 figure) Spain has limited choices. Except via the possibility of expanding by another private sector led credit expansion which is highly unlikely, the Spanish economy faces the prospects of low output and demand. Increasing exports is another option but with all Euro Area nations’ governments being forced by a “fiscal compact” to contract, this is unlikely because of low demand in the rest of Europe.

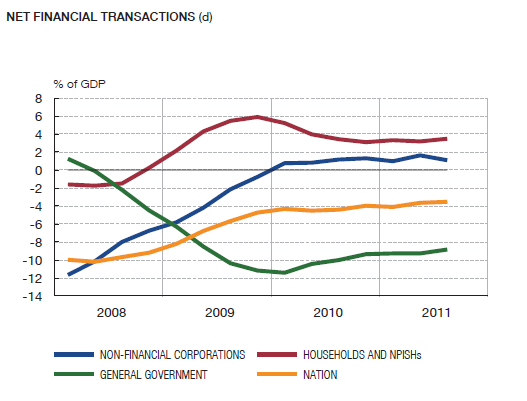

The chart is really interesting as it illustrates some of the many causalities associated with the financial balances identity

NAFA = PSBR + BP

where NAFA is the Net Accumulation of Financial Assets of the domestic private sector, PSBR is the Public Sector Borrowing Requirement or the deficit and BP is the current balance of payments.

When the domestic private sector tries to increase its saving, there is a contraction of demand, income and output (unless exports increase). As a result imports too reduce (because income is lower). The higher propensity to save also leads to an increase in the government’s budget balance.

So in the chart you see a dramatic fall in the current account deficit and a huge increase in the government’s budget deficit. (The term “Nation” is used in the chart because the current balance of payments is the difference between the incomes and expenditures of all domestic sectors of a nation).

The situation is not atypical of recent (post crisis) behaviour of other nations’ sectoral balances but the fall in the external sector balance in this case is striking, though the same could be said for various deficit nations in the Euro Area.

The Banco de España – whose short-term projections are usually accurate – also said today that unemployment will hit 23.4% in 2012!