Spain as a nation owes the rest of the world around €995bn according to the Banco de España International Investment Position data which is very high when compared to the 2011 GDP of €1,073bn. (And according to today’s release, real GDP fell 0.3% q/q in Q4 2011.)

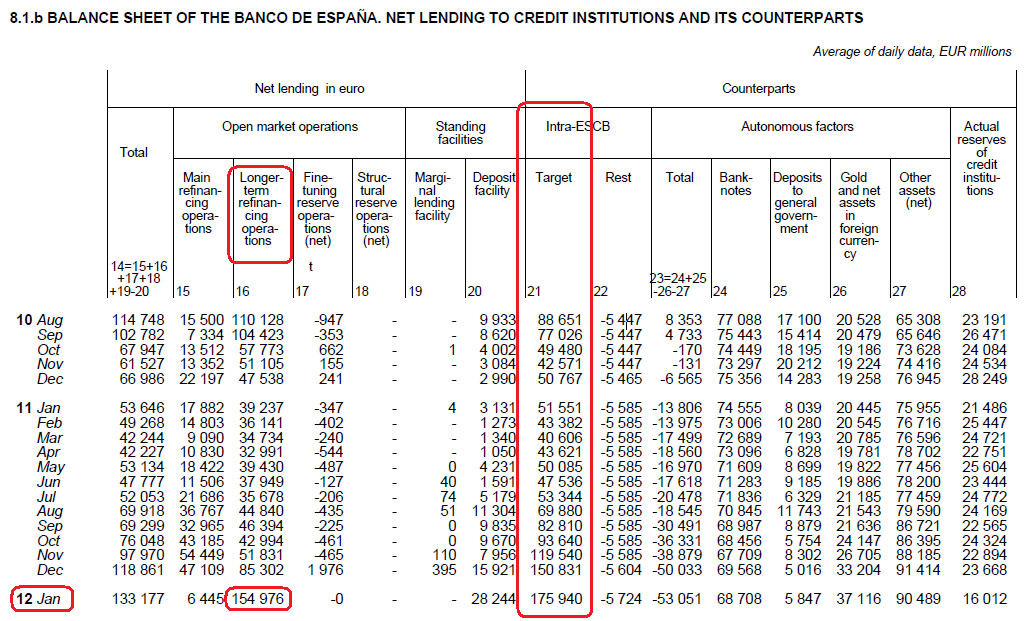

Although, credit conditions in domestic and international money markets and capital markets in the Euro Area seemed to have eased in January, it seems Spanish banks are still not in the best shape. According to a Banco de España release, TARGET2 liabilities increased to around €176bn in January from around €151bn in December. Also, as a result banks in Spain have made heavy use of the LTRO facility as per the screenshot below:

(click to enlarge)

So capital flight out of Spain continues. Of course, this process can go on for longer than one could ever imagine earlier (because of the accommodative policy of the ECB and the laws governing the operations of the Eurosystem) but it is a good indicator of stress in balance-of-payments financing for Spain and the lack of fiscal space.