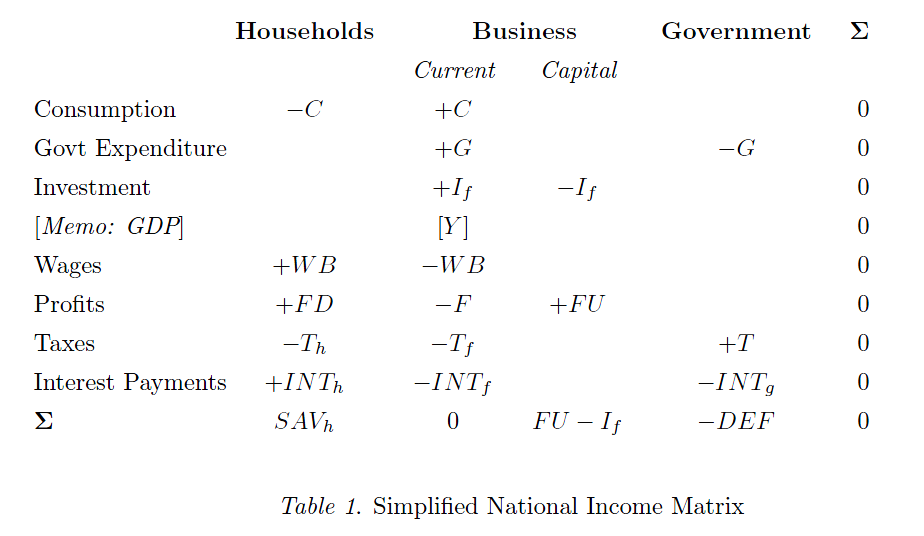

In my post The Transactions Flow Matrix, I went into how a full transactions flow matrix can be constructed using a simplified national income matrix. Let us reanalyze the latter. The following is the same matrix with some modifications – firms retain earnings and there are interest payments.

FU is the undistributed profits of firms. From the last line we immediately see that

SAVh + FU – If – DEF = 0

or that

FU = If + DEF – SAVh

This is Kalecki’s profit equation which says among other things that firms’ retained earnings is related to the government deficit! The equation appears in pages 82-83 of the following book by Michal Kalecki:

click to view on Google Books

In their book Monetary Economics, Wynne Godley and Marc Lavoie say this in a footnote:

Note that neo-classical economists don’t even get close to this equation, for otherwise, through equation (2.4), they would have been able to rediscover Kalecki’s (1971: 82–3) famous equation which says that profits are the sum of capitalist investment, capitalist consumption expenditures and government deficit, minus workers’ saving. Rewriting equation (2.3), we obtain:

FU = If + DEF − SAVh

which says that the retained earnings of firms are equal to the investment of firms plus the government deficit minus household saving. Thus, in contrast to neo-liberal thinking, the above equation implies that the larger the government deficit, the larger the retained earnings of firms; also the larger the saving of households, the smaller the retained earnings of firms, provided the left-out terms are kept constant. Of course the given equation also features the well-known relationship between investment and profits, whereby actual investment expenditures determine the realized level of retained earnings.

The above can of course also be written as:

I = SAVh + SAVf + SAVg = SAV

if one realized that the retained earning of firms is also their saving:

SAVf = FU

Business accountants know the connection between retained earnings and shareholders’ equity and in our language – which is that of national accountants/2008 SNA – it adds to their net worth just like household saving adds to their net worth.

Assuming away capital gains, we know from many posts that:

Change in Net Worth = Saving

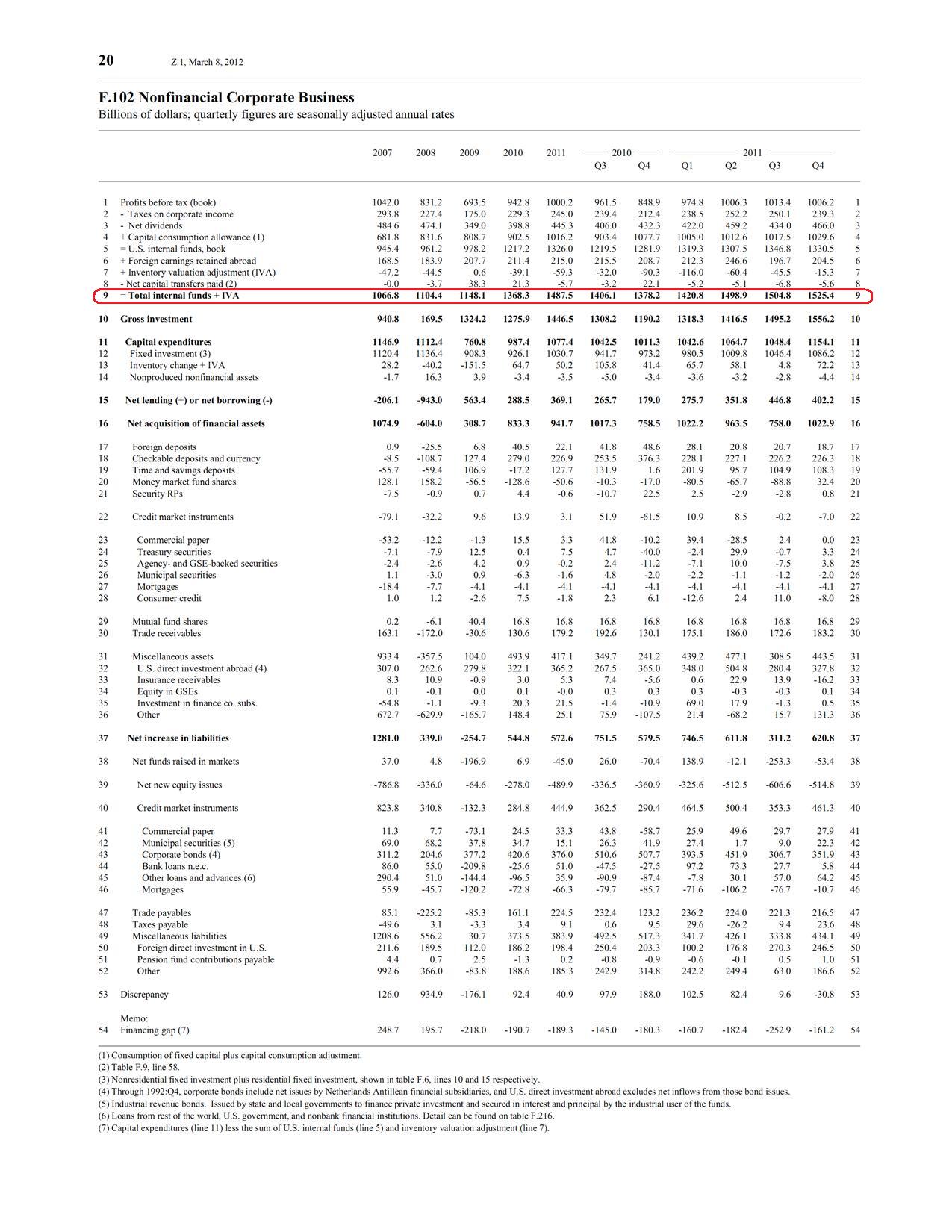

Where do we find the undistributed profits in the Federal Reserve’s Flow of Funds Statistic Z.1?

In Table F.102, there’s an item called “Total Internal Funds”:

(click to expand)