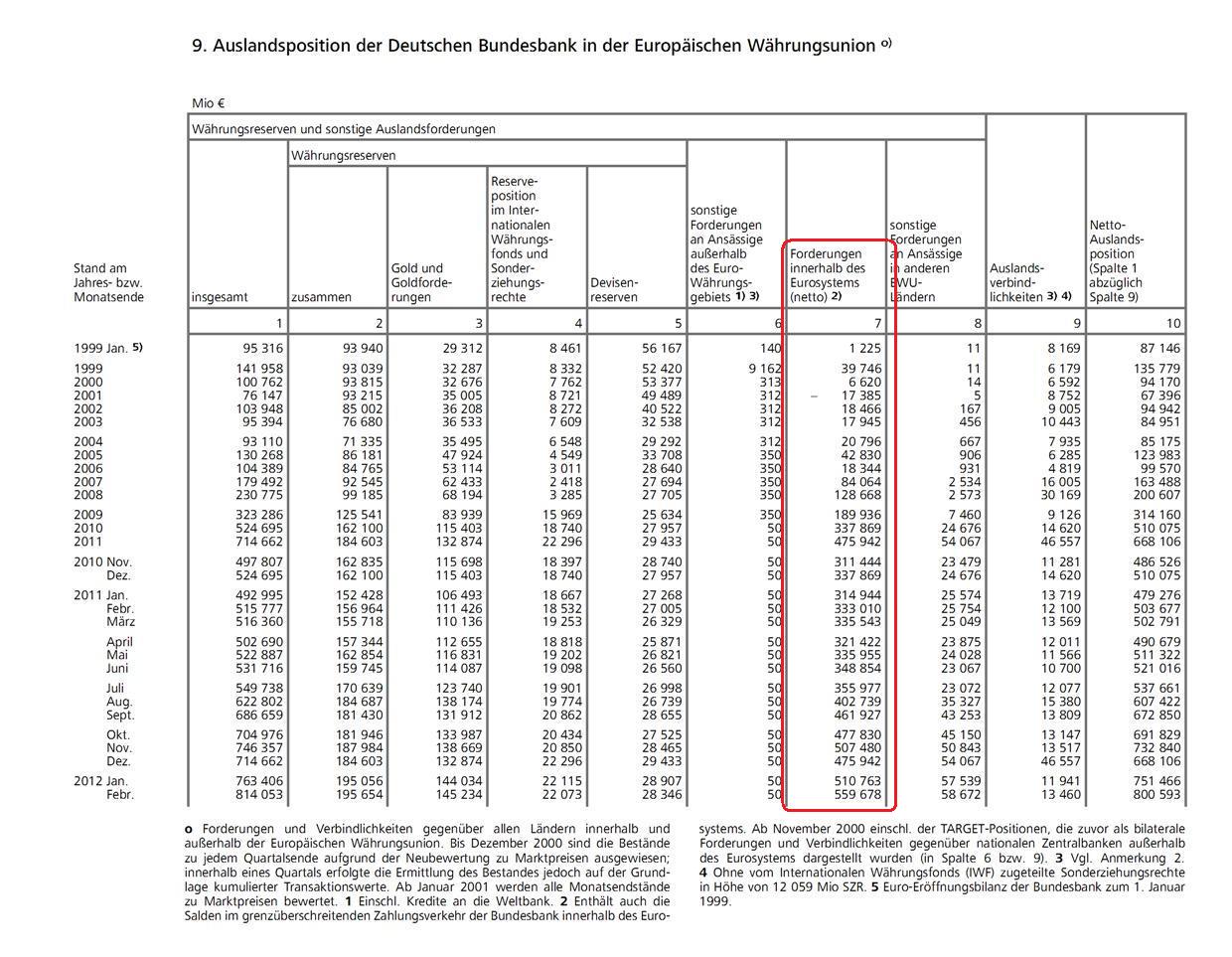

At the risk of boring readers, here’s Bundesbank’s TARGET2 claims again from its March 2012 Monthly Report. Cannot find the English version but the translation is below the first figure (with old data). This increased to almost €560bn at the end of February despite ease in financial market conditions in the Euro Area!

(click to enlarge)

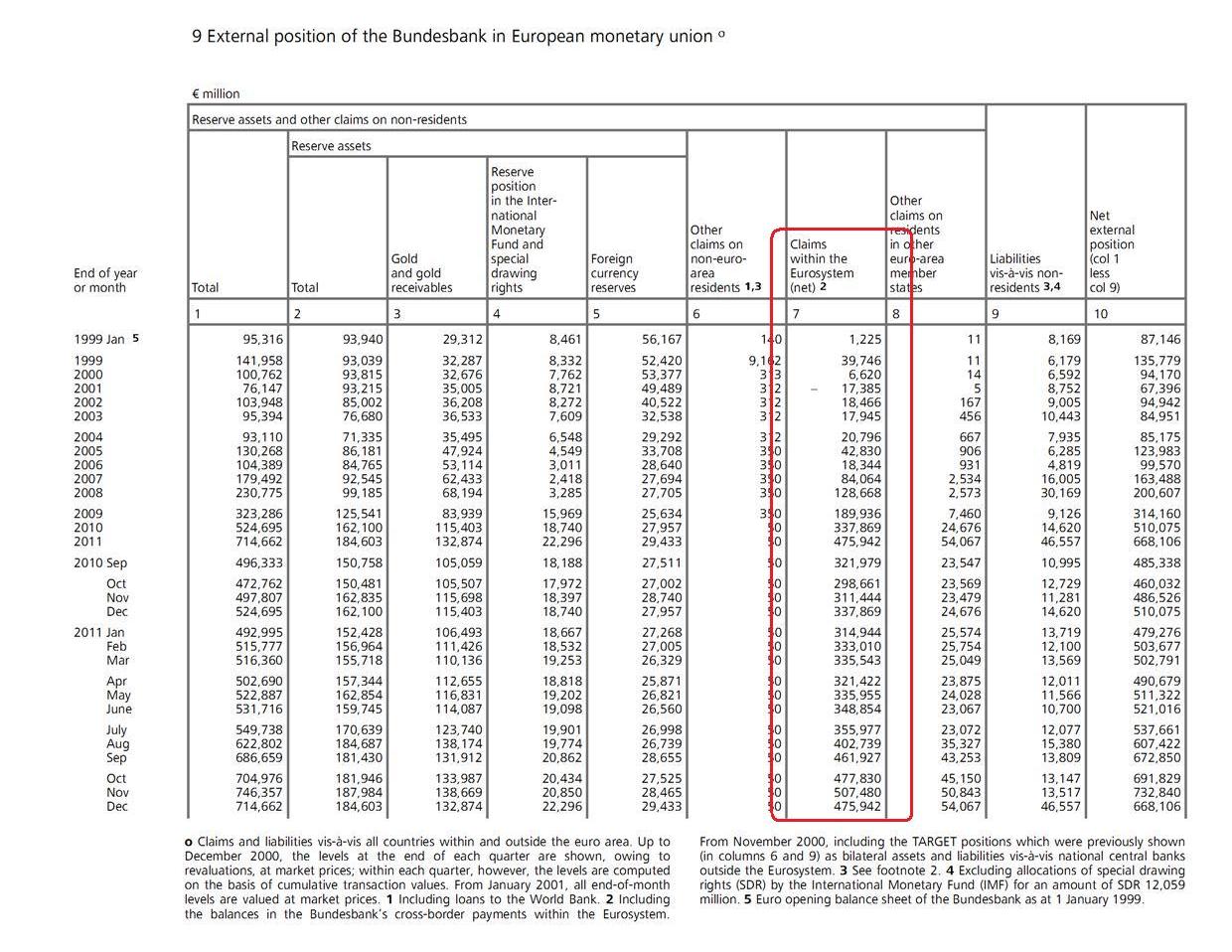

English translation from an older report:

(click to enlarge)

As mentioned earlier these arise due to capital flight into Germany from the “periphery” countries.

Some economists and financial analysts try to downplay this by saying that in reality the actual loss (in case of a breakup of the Euro Area and subsequent default by the periphery) to Bundesbank and hence Germany is lesser and this number should be multiplied by the capital key. For Bundesbank this is 18.9373% and using the February number this amounts to a maximum loss of €106bn as per this calculation.

This is misleading to the core. Firstly if the debtor nations default the creditor nations suffer in full. So if Bundesbank’s losses are low, other creditor nations’ losses will be high. Also, Bundesbank suffers due to losses incurred by other NCBs of creditor nations such as Belgium since these losses are shared. Secondly, the capital key would be some sort of weighted key among the creditor nations’ central banks and will be higher.

At any rate, the creditor nation lose the full amount of the claim of the ECB on the periphery nations in the case of a breakup. This number can vastly increase if there is a panic and further capital flight into the “core”. Of course, there will be other losses and costs of a breakup but IMO – nonetheless this is not unimportant.

Having said this, these things are very unpredictable – it is perfectly possible that a boom in financial markets for whatever reasons reverses the flight making the unsustainable process run longer than one may think. It is also possible – as Euro Area leaders have been planning wittingly or unwittingly – that trade is balanced internally by deflating demand in debtor nations and but this will come with a lower output and higher unemployment in general and injures all alike.

The above increase could also have been because banks in nations such as Spain may have redeemed some of their liabilities to banks in Germany and refinanced themselves via the three-year LTRO in February.