In a recent paper, Bradford DeLong and Lawrence Summers suggest that a fiscal expansion can be useful to bring an economy from a depressed state (!). The rough idea being that a relaxation of fiscal policy leads to a higher output and the increase in economic activity leads to a stabilization of public debt/gdp ratio.

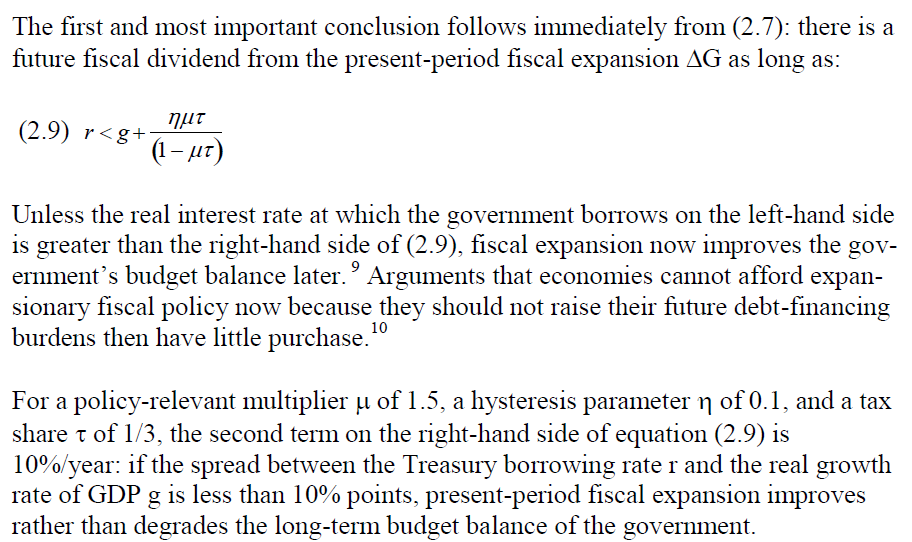

This condition is valid as long as (in the authors’ terminology):

(click to enlarge)

The interesting thing about this is that the authors suggest that even if r > g, it is possible for the public debt/gdp to remain sustainable under certain conditions.

I won’t have more to say on this because it uses a standard one-period analysis but the fact that some mainstream authors seem to understand the fiscal policy dynamics better is encouraging.

Of course, this result was known to Post Keynesians – Wynne Godley and Marc Lavoie showed this in this paper Fiscal Policy In A Stock-Flow Consistent (SFC) Model (pay-walled, for the working paper click here).

Arguing that their “… conclusions conflict with those of the “new consensus,” which holds that a correct setting of interest rates is the necessary and sufficient condition for achieving noninflationary growth at full employment, leaving fiscal policy rather in the air.”, they also derive a result for a closed economy:

It is usually asserted that, for the debt dynamics to remain sustainable, the real rate of interest must be lower than the real rate of growth of the economy for a given ratio of primary budget surplus to gdp. If this condition is not fulfilled, the government needs to pursue a discretionary policy that aims to achieve a sufficiently large primary surplus. We can easily demonstrate that there are no such requirements in a fully consistent stock-flow model such as ours.

The G&L style of modeling is extremely useful because it gives great attention to stocks and flows so that no errors creep in. The result is surprising the first time one hears this because it goes against intuition. This can be seen by thinking of the interest payments of the government as income for the domestic private sector!

So no conditions such as r < g!

Open Economy Debt Dynamics

For open economies, G&L are also able to construct select scenarios where a debtor nation can be indebted to the rest of the world without the nation’s debt (which is different from public debt) increasing relative to gdp forever. (Of course by no means proving/implying it for all possible scenarios).

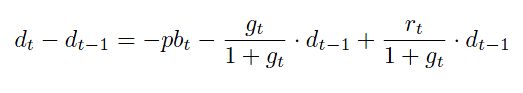

So let us consider the debt dynamics equation (see A Practical Guide To Public Debt Dynamics, Fiscal Sustainability And Cylical Adjustment of Budgetary Aggregates from the IMF, which can be equally applied to the open economy case)

where d is “external debt” and pb is the primary balance of the current account balance. (The expressions are relative to gdp)

Suppose the government and the central bank want to restrict external debt to 50% of gdp – with the view that foreigners may consider moving above it as unsustainable. Assume growth is 3.5% and effective interest rate paid on liabilities to foreigners is 1%. Then the tolerable primary deficit of current account balance is 1.25%. This is calculated by setting the left hand side to zero and just plugging the formulas. (See below)

Please note, a higher growth will worsen the external balance so it is not a good argument that growth can lead to a lower debt/gdp ratio.

To summarize, intuitions for a closed economy and the open economy can appear contradictory.

Standard Analysis

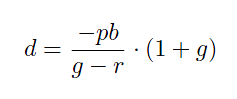

I have seen many economists including Post Keynesians (not G&L) take the above equation and interpret it rather differently. So assuming sustainability, a constant primary balance pb implies the debt sustains at

or simply,

A continuous time formulation leads to an equality sign. The above is derived by assuming the debt sustains at d and shuffling the terms in the first equation.

Note: the above is valid only if there a stabilization. Else, in the case where g < r, the above expression gives a negative answer for a negative primary balance – but that is because the derivation assumed sustainability and cannot be used when debt/gdp keeps rising.

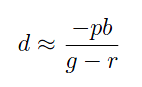

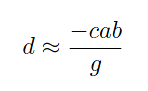

This is also written sometimes as

by expanding the denominator of the previous expression using the Taylor Theorem from Mathematics.

This raises a curiosity – how come in the G&L case for the closed economy did the debt sustain even when g > r? That’s because it was a dynamic stock-flow consistent model as opposed to the artificial assumption of a constant deficit used in standard analysis such as the third equation above.

Nonetheless the above analysis shows that for a constant deficit (though artificial), debt sustains as per the equation (assuming growth and the rate of interest paid are constant as well!)

Back to Open Economies

Moving to the open economy case, where debt and deficit denote the external debt and the current account deficit, the above shows that if the primary deficit is restricted somehow to say 5% of gdp and the differential between growth and interest rate is 2%, the external debt sustains at 250% of gdp.

This should be seen as a restriction. Instead some/many Post Keynesians just state it is sustainable. A higher growth rate will increase the deficit (current account) and the debt-dynamics can make the whole process unsustainable. So one needs to model how fiscal policy itself affects the current account deficit rather than keeping it a constant relative to gdp.

This is the reason many nations find themselves troubled by the external sector.

This can be seen for the case of the United States. A huge relaxation of fiscal policy will bring back the current account deficit to 6% of gdp (and rising) and put the world on an unsustainable path. What the United States needs to do is ask its trading partners to expand domestic demand by fiscal expansion and achieve higher growth so that it itself can achieve a higher growth rate due to the extra space created for fiscal policy.

More generally, we need a concerted action!

For a related analysis see Dean Baker’s recent analysis on the trade deficit being America’s fundamental imbalance: The Iron Grip of Accounting Identities

Summary

There is no condition such as if r <g, debt is sustainable. Debt can keep rising relative to gdp simply because deficit keeps rising.

The condition r > g can be useful in studying certain circumstances for analysis.