I got my copy of Monetary Economics by Wynne Godley and Marc Lavoie yesterday. I know some people were waiting for the second edition of the book, and had postponed their purchase to get the newer edition – so they can get it now!

There aren’t any changes in this edition – except for correction of some typos and that this edition is a paperback while the first one was hardcover. I already knew this as Marc Lavoie told me “don’t buy it” – but of course how can I not!

One thing I noticed is a nice summary by Wynne Godley which he wrote after the first edition was published.

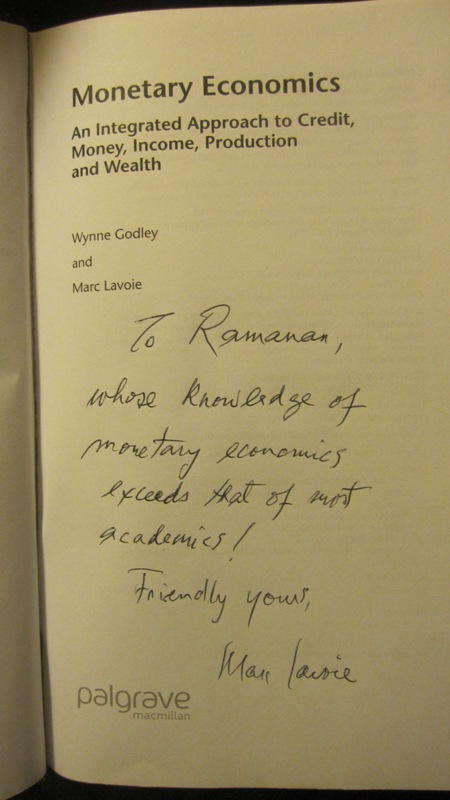

Here’s an autograph from Marc Lavoie I got last year in May – live to tell!

I hope I live up to it 🙂

The first time I saw something called the Transactions Flow Matrix in a Levy Institute paper, I rushed to buy the book. When I started reading it, it became clear that nobody has ever come close to it! After a while – and solving the models on a computer gives one greater intuition – it slowly started becoming clear to me why so much effort has been put in.

Wynne Godley always wanted to write a textbook to help others understand Cambridge Keynesianism, as he often thought that while top economists from Cambridge knew how economies work together, they never attempted to share this knowledge. I think his aim was also to sharpen his own knowledge and to think of scenarios which one may not be able to foresee using simple arguments.

With this aim, he made a first attempt with his partner at “New Cambridge”, Francis Cripps.

I really like this from the book’s introduction:

… Our objective is most emphatically a practical one. To put it crudely, economics has got into an infernal muddle. This would be deplorable enough if the disorder was simply an academic matter. Unfortunately the confusion extends into the formation of economic policy itself. It has become pretty obvious that the governments of many countries, whatever their moral or political priorities, have no valid scientific rationale for their policies. Despite emphatic rhetoric they do not know what the consequences of their actions are going to be. Moreover, in a highly interdependent world system this confusion extends to the dealings of governments with one another who now have no rational basis for negotiation.

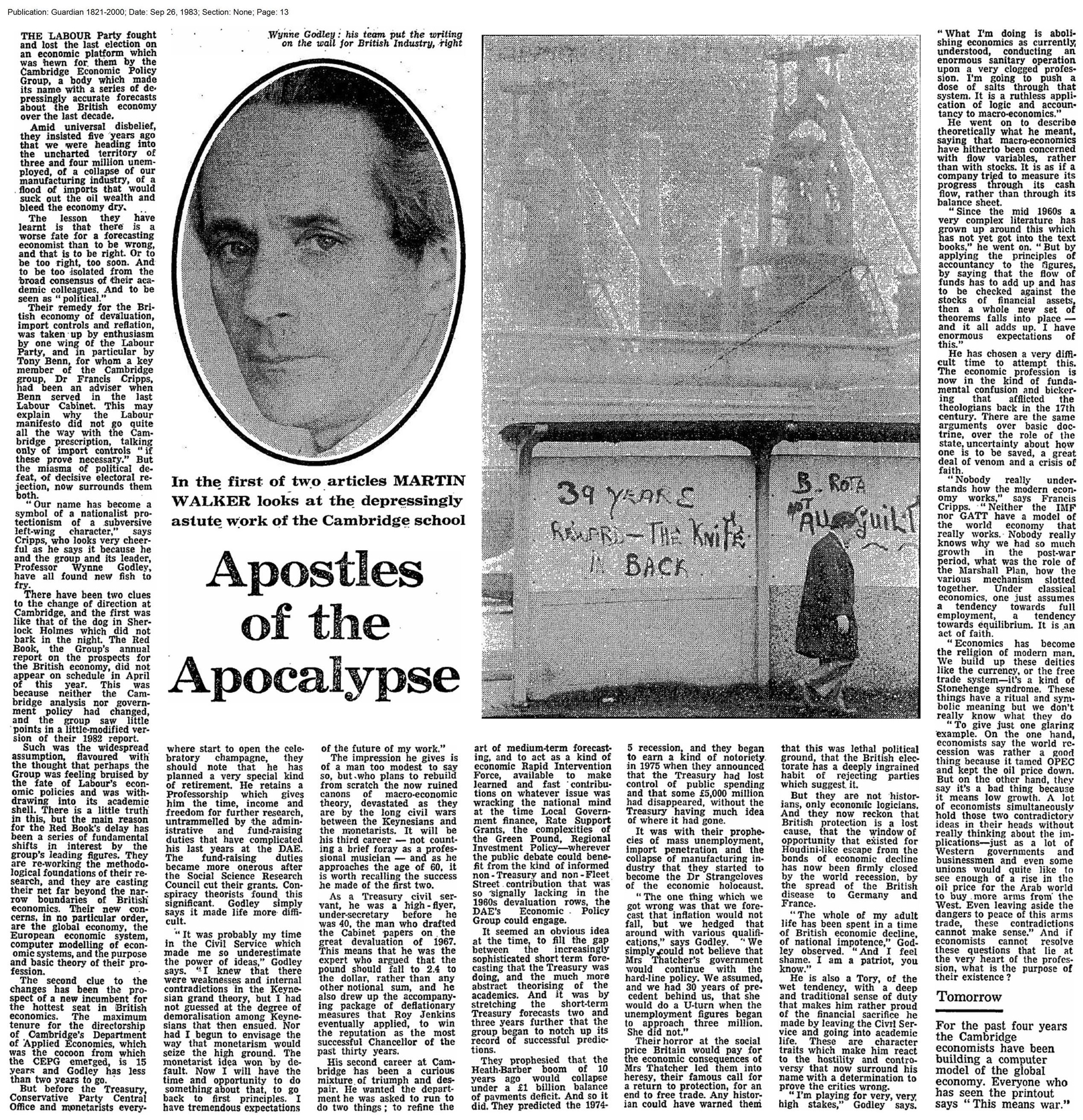

This was a great book but didn’t receive much attention except for a small group who thought (rightly!) it was a work of genius. He wanted to do more and so we see him mention in an article on him – praising his prescience on writing the fate of the British economy on the wall in the 70s and the 80s. Here’s from the Guardian:

… What I’m doing is abolishing economics as currently understood, conducting an enormous sanitary operation upon a very clogged profession. I’m going to push a dose of salts through that system. It is a ruthless application of logic and accountancy to macroeconomics.

(click to enlarge and click again)

When Wynne Godley lost the partnership of Francis Cripps (whom Wynne called the smartest Economist he ever met), he was forced to do a lot of things himself and probably felt somewhat alone. After writing some amazing papers in the 1990s, he needed someone like Cripps to write a book. Fortunately he met Marc Lavoie and they collabrated for many years in writing papers and articles and finally the book.

Marc Lavoie recalls the memories in this article from the Godley conference last year.

In an article A Foxy Hedgehog: Wynne Godley And Macroeconomic Modelling – reviewing the book and Wynne Godley’s models, Lance Taylor says:

The fox knows many things, but the hedgehog knows one big thing.

… Surely someone who puts so much effort into one complicated construct is more like Plato than Aristotle, Einstein than Feynman, Proust than Joyce.