Michael Stephens of the Levy Institute highlights the recent Levy Institute Strategic Analysis: Back To Business As Usual? Or A Fiscal Boost? in a post Where Will US Growth Come From If Austerity Reigns on the Institute’s blog Multiplier Effect.

According to the authors Dimitri Papadimitriou, Gennaro Zezza and Greg Hannsgen,

The results of our simulation are reported in Figure 4. The government deficit falls rapidly, but if we want to achieve the CBO’s projected growth path, the private sector has to start borrowing again, switching to a deficit position. Under this scenario, we would return to a situation not so different from the one we had before the 2007–09 recession.

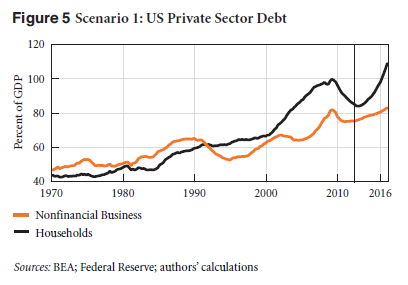

In Figure 5 we report the path of household and non-financial business debt, relative to GDP. Both of these sectors must become more indebted, given our scenario 1 assumptions. If this is the path the US economy takes, it will not be long before another crisis hits, if only because of heavy private sector indebtedness.

Here’s private indebtedness in the assumed CBO scenario of growth and lower budget deficits.

So this implies that the United States still has cracks in the foundations of growth (as per a title of the Institute’s Strategic Analysis piece before the crisis) and policy needs to change.

The Institute’s Strategic Analysis articles have always pointed out logical inconsistencies in the CBO’s projections (from mid 1995 onward) and presented more realistic scenarios on growth with solid suggestions on how to run the economy. Here’s from April 2007 in a report titled The U.S. Economy – What’s Next:

The authors said:

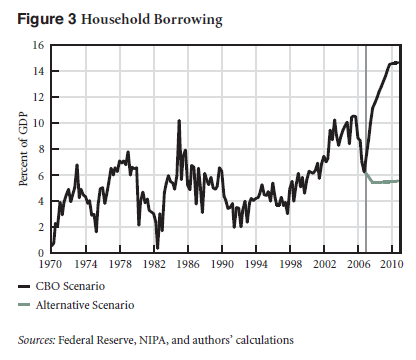

In Figure 3, we translate the debt-to-GDP ratios in Figure 2 into flows of lending relative to GDP simply by subtracting from each quarter’s debt the previous quarter’s debt. One striking feature of Figure 3, not at all obvious from inspection of Figure 2, is that net lending was already falling rapidly from the beginning of 2006. The lower line for the post-2006 period shows what would happen to the net lending flow if the debt-to-income ratio were to level off: net lending would continue to fall rapidly, though not so far or fast as happened in 1980. The projections in the figure also show the enormous gap between the leveling-off scenario, in which we are inclined to believe, and the (implied) CBO scenario, in which we don’t believe at all.

In reaching provisional conclusions about the future growth rate of output and the future configuration of the three financial balances, we have used revised assumptions about output in the rest of the world because of lower U.S. growth than in the CBO scenario (based on the solution of a world model) and the performance of the stock market. The major conclusion is that output growth slows down almost to zero sometime between now and 2008 and then recovers toward 3 percent or thereabouts in 2009–10. However, by the end of the period, the level of output is still far (about 3 percent) below that in the CBO’s projection, which implies that unemployment starts to rise significantly and does not come down again.

(emphasis: mine)

Of course every situation is different, so to see/make some scenarios and projections, do look at Back To Business As Usual? Or A Fiscal Boost?