According to a Wall Street Journal article from yesterday Cyprus Seen Close to a Request for Bailout, Cyprus (2011 GDP: €18bn approximately) is set to become the fourth Euro Area nation to seek a bailout after Greece, Ireland and Portugal. According to the WSJ:

Late last year, the country negotiated a €2.5 billion ($3.1 billion) bilateral loan from Russia. Now, Cyprus is in talks with China for another bilateral loan, of an undisclosed amount, that looks unlikely to materialize in time.

Had to go into trouble considering that economists have been realizing that the Euro Area problems is an internal balance of payments crisis.

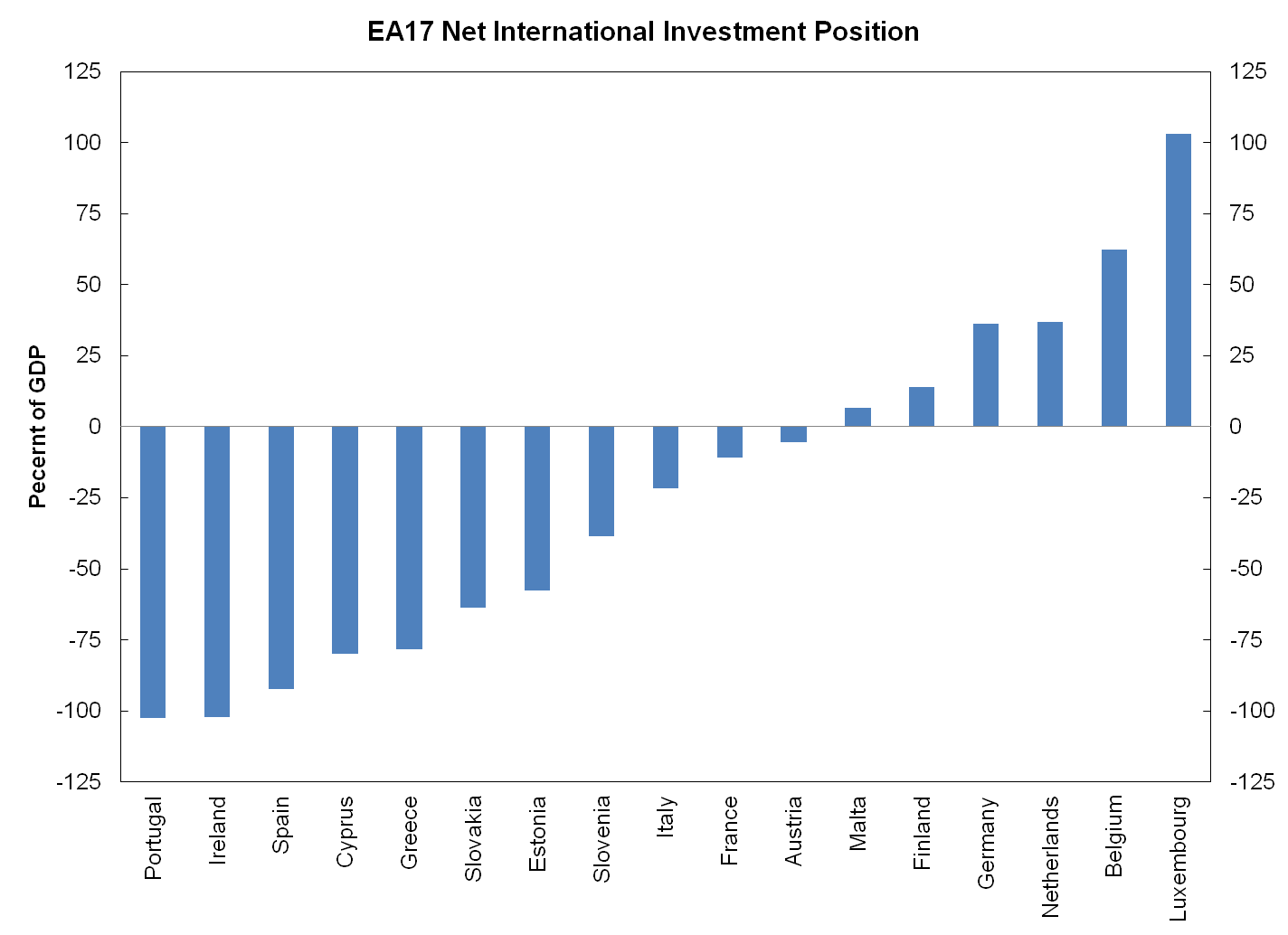

The closest proxy for a nation’s net indebtedness is the net international investment position (as opposed to “external debt” which excludes equity held by nonresidents). Here’s the chart as of 2011: the NIIP is at the end of 2011 and the GDP is the gross domestic product for the whole year.

(click to enlarge)

Note: Greece’s NIIP improved in 2011 (from minus 100% of gdp) due to large revaluation losses suffered by foreigners as Greece financial markets fell in 2011.

The financial markets is now nervous about Spain and Slovakia’s next in the line if the graph is to be believed and it’s external position is in dangerous territory also – at minus 64%.

According to Wynne Godley, anything between 20-40% of net foreign indebtedness can be highly dangerous. Of course his models also show that there is nothing intrinsically stopping such imbalances from continuing and can go on as long as foreigners do not mind but something has to give in – such as slower growth to prevent the imbalances from continuing before foreigners start minding or a crash.

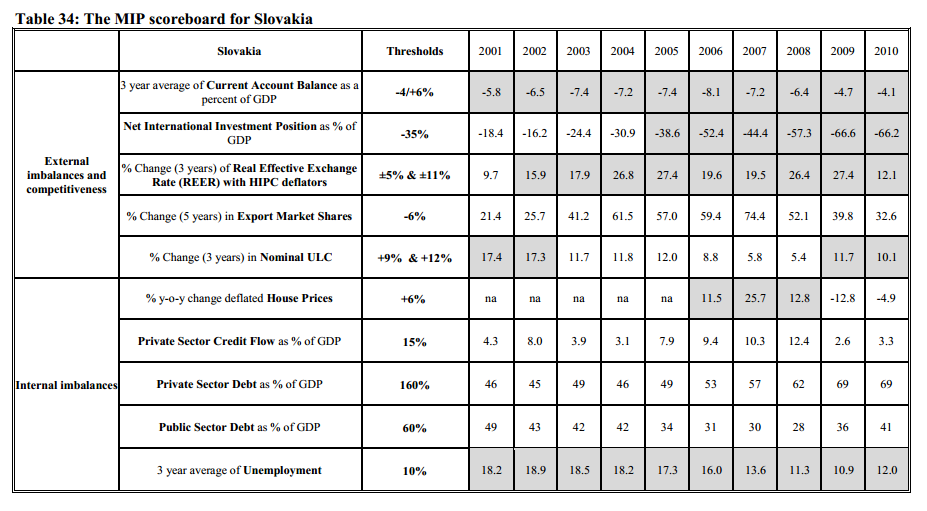

At this point, Slovakia doesn’t seem to be in trouble with its generic 10-year government bond yield at 3.645% – with its public debt at 43.3% of gdp at the end of 2011 according to Eurostat. This of course means that the domestic private sector is a net debtor (i.e., its financial assets is lesser than its liabilities). A more detailed analysis is required on how internal imbalances will play out and spill over to the external sector. Here’s from Statistical Appendix of the “Alert Mechanism Report”.

(click to enlarge)

Moving on to something different:

Heteredox Economics In Playboy!

Via Twitter:

click to view the tweet on Twitter

John Cochrane of Chicago calls heteredox economists “kooks” and claims he and his colleagues use rigorous models!