Michael Sankowski has a post titled Swiss Franc: Trade Of The Year in which – as the title suggests – he points to getting the timing right of the depreciation of the Swiss Franc against the Euro as one trade which can have a huge payoff. His argument is: assuming that the Euro will survive and financial markets gain confidence in the Euro, change in investor portfolio preference into Euro-denominated assets will depreciate the Franc.

Which is fine – as this New York Times article Necessity, Not Inclination, Nudges Europeans Closer Fiscally And Politically argues, it seems Germany is being forced to cede some control to the European Parliament which may act as a central government of the Euro Area (hopefully democratically elected!).

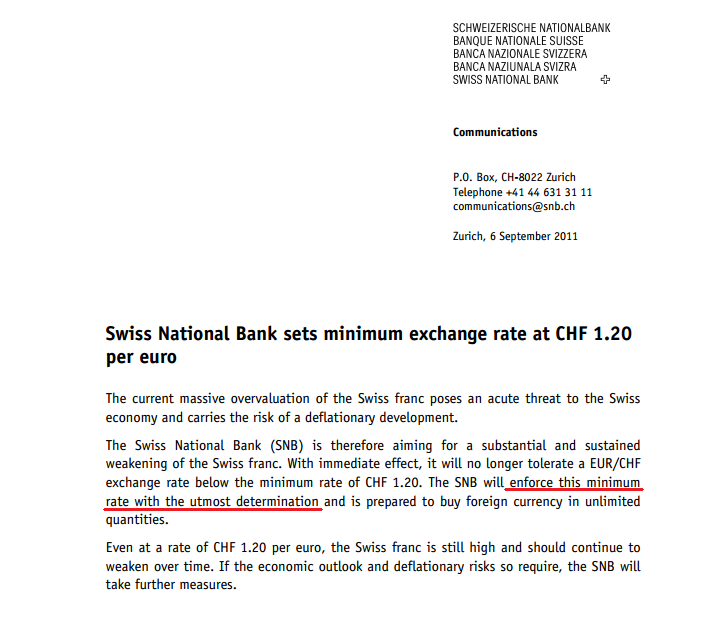

In September 2011, after the SNB found it frustrating that in spite of its intervention in the foreign exchange markets, it could not prevent an appreciation of the Franc. So it decided to say this:

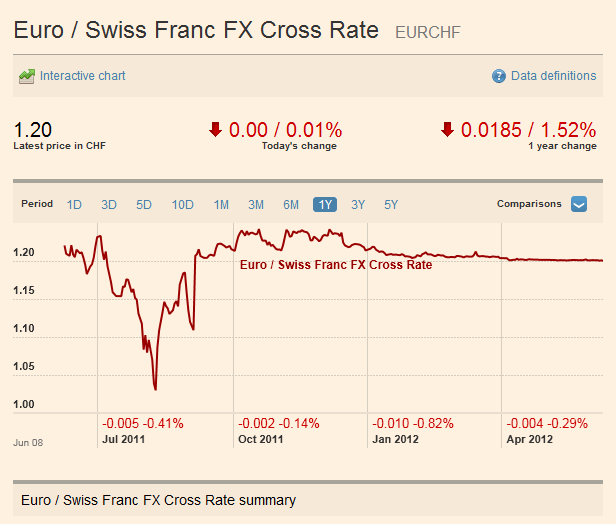

Notice that it is not really a peg but a floor on EURCHF. Here’s a chart of EURCHF (via FT)

Daniel Neilson wrote a post about this on INET but his scenario is slightly different on what may actually happen to the Euro Area.

At any rate, he has an nice study of the effects of the flows on the balance sheets of the SNB and Swiss banks.

… the SNB is facilitating the world’s portfolio reallocation out of EUR and into CHF. Even fixed at 1.20 francs per euro, funds have been fleeing the euro area as the crisis heats up again. The SNB’s policy means that any net flow results not in price adjustment, but in fluctuations in the size of its own balance sheet.

Neilson also makes an interesting observation that there is a similarity of this to TARGET2 in which Bundesbank acquires claims on foreign central banks as funds flow into Germany. He points out however that the SNB has a choice of which asset it can purchase!

Since I am more a balance of payments kind of person, I tend to see this in that language. When a financial institution or a household – either a resident or a nonresident – liquidates Euro denominated assets for its purpose, it will purchase Francs for Euros. The dealer – a bank – which makes this conversion will credit the seller’s bank account and and will try to get rid of the excess Euro denominated deposits at its correspondent bank (which it obtained). If the SNB does not intervene, this sale of EUR by Swiss banks will appreciate the Franc and hence the SNB has to accommodate this and buy EUR. It can then purchase high-quality Euro denominated assets such as German government bills (?). The Swiss bank who made the conversion will have both its assets and liabilities denominated in Franc increase (assets: SNB settlement balances, liabilities: deposits). With the short term Franc interest rate at zero – the SNB needn’t do a “sterilization” operation.

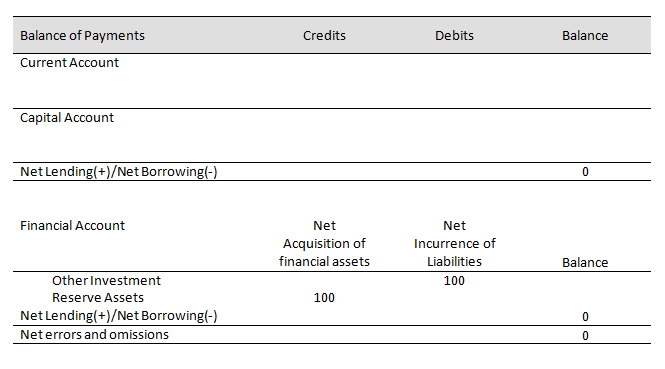

How does this look in the financial account of the balance of payments? If the initial inflow was 100, then:

We can say that the item reserve assets of the SNB is the accommodating item in the balance of payments.