I like Steve Keen. He is terrific in debunking economics! In a recent debate with Paul Krugman, Keen put Krugman on the defensive and exposed his weaknesses. Krugman obviously didn’t want to accept defeat and tried to escape with the help of comments in the comments section of Nick Rowe’s blog (that DSGE is not neoclassical – whatever!).

There are however some issues with Keen’s own methodologies. In a recent talk (video here), he claims that income is not equal to expenditure due to debt creation. Keen also claims in the video that Schumpeter and Minsky claimed that is the case.

Keen is right about an individual sector but not an economy as a whole when it is closed.

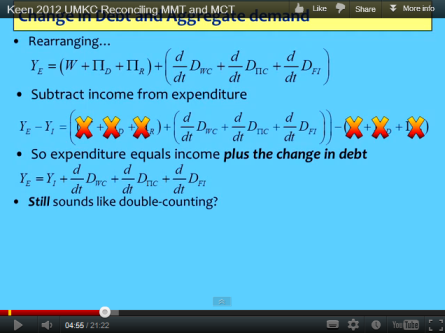

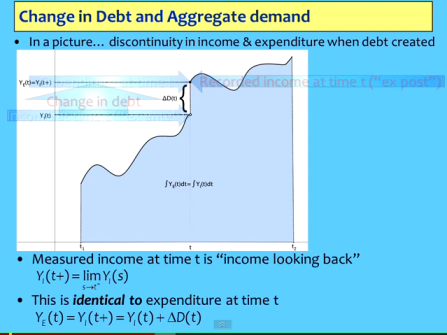

In the following I assume a closed economy – as does Keen. At least he doesn’t make any distinction and thereby his claim is a claim for a closed economy as well. So here is Keen’s claim:

Further he attributes this difference to discontinuities due to debt injections.

In the above Keen forgets that expenditure creates income.

There is no need for a claim that income is not equal to expenditure. In fact it is convenient to have them equal.

Wynne Godley and Francis Cripps wrote a nice book in 1983 named Macroeconomics. Here is from just the second page of Chapter 1: National Accounts:

It is extremely useful to choose definitions such that total income and expenditure in any year, month, day or second are identically equal to one another; they will be – because we choose to define them so that they are – two different ways of looking at the same process. We are only going to admit into the category of flows called income things which have an exact counterpart in the category of flows called expenditure. [footnote]

(with a footnote on qualifications for the case of an open economy).

Further in pages 27-29:

Although the definitions so far imply that the income of all individuals and institutions taken together equals their total expenditure on goods and services in each and every period, this need not be true of any particular person or institution …

… It is easy to understand that any one individual who does not spend all his or her income in a period will have more money left over at the end of the period. But we have chosen a system of definitions which ensures that total income in each period when summed across the whole economy equals total expenditure in the same period. It must therefore be the case that if some people or institutions are accumulating money or other financial assets, others are incurring debts on an exactly equal scale. In the economy as a whole the total increase in financial assets must always be equal in each period to the total increase in debt (financial liabilities).

But since the possibility of borrowing is included as a source of funds for spending, our formal representation of the budget constraint for any individual or institution including the government, is

Equation 1.4 simply says that any excess of income over spending must equal the acquisition of financial assets less the acquisition of debts. As this is true for all individuals it must also be true for the economy as a whole.

But since total national income equals total national expenditure (i.e., Y ≡ E) it must follow for the economy as a whole the change in financial assets must be equal to the aggregate change in debt, i.e.,

ΔFA ≡ ΔD

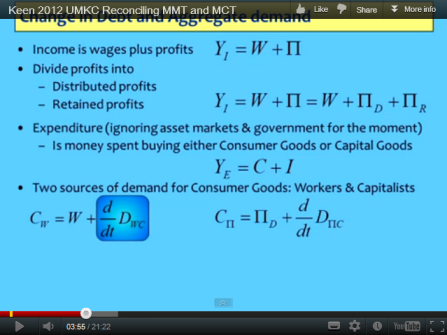

Back to Keen. He has this slide in this talk:

In the above, households consume by getting wages and going into debt. Hence households have their expenditure higher than income. Similar story for firms.

However, Keen forgets that consumption is income for firms and his accounting has black holes. The whole thing can be done right by creating a Transactions Flow Matrix, so that one is sure that nothing is missed out.

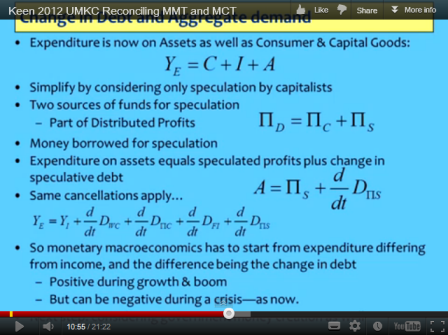

The reason Keen gets into paradoxes can be seen by looking at the following slide where he changes the definition of expenditure.

The right definition of expenditure does not include purchases of financial assets. For Keen if a household purchases financial assets, it will be counted as “expenditure”. From the above slide, it can be seen that Keen’s definition of expenditure itself is different to begin with from standard ones and obviously he gets the paradoxical claim that Income ≠ Expenditure!

If Keen wants to do an empirical study of the rise in gross assets and liabilities, there is a systematic way to do this: for example see this Bank of England paper Growing Fragilities – Balance Sheets In The Great Moderation.

I won’t pursue this further except saying a few things.

I think Keen’s intuition is that households and firms incurred liabilities at an increasing scale before the financial crisis for both expenditures and purchases of financial assets and this led to increases in asset prices and hence capital gains and hence a feedback loop leading to debt-fuelled growth. Etc etc etc. There is a way to do this but changing definitions is not the right way.

Keen’s model will look accounting consistent (highly important) and more realistic (with no need to define aggregate demand = gdp + change in debt) if he uses some sort of econometric modeling in which Private Expenditure PX is dependent on many things – for example PX-1 so that income need not be equal to expenditure for the economy as a whole (as the time periods for which they are recorded are different) and there is some sort of econometric relation with change in debt.

Else one gets hodgepodge and/or endless redefinitions.

I think his “model” mixes identities, behaviour and plausible econometric relationships.

Below are some “endnotes”

Change in Inventories

“Change in Inventories” create some issues for “Y ≡ E”. The right way is to have Expenditure equal Final Purchases plus change in inventories. As per Godley & Cripps (p 33):

Y ≡ E = FE + ΔI

Open Economies

Funnily, it is in the case of an open economy that for an economy as a whole, Income ≠ Expenditure! The difference between expenditure and income is equal to the increase in net indebtedness to foreigners.

GDP by Expenditure

Expenditure (of a resident sectors) used here shouldn’t be confused with the expenditure in “gdp by expenditure”. In the former, we include expenditures of residents while in the latter, the export component refers to expenditure of the rest of the world sector of goods and services produced by resident sectors.