The accounting identities equating aggregate expenditures to production and of both to incomes at market prices are inescapable, no matter which variety of Keynesian or classical economics you espouse. I tell students that respect for identities is the first piece of wisdom that distinguishes economists from others who expiate on economics. The second?… Identities say nothing about causation.

– James Tobin

In my previous post Income ≠ Expenditure?, I raised some accounting issues in a recent talk by Steve Keen. I found a paper European Disunion and Endogenous Money which has a background on this written with Matheus Grasselli of the Fields Institute, Toronto.

Let us look at their basic model which still has income not equal to expenditure. Now whichever way one presents it (with better defined terms using phrases “ex-ante”, “ex-post”, “planned”, “unplanned”, one cannot escape the conclusion income = expenditure).

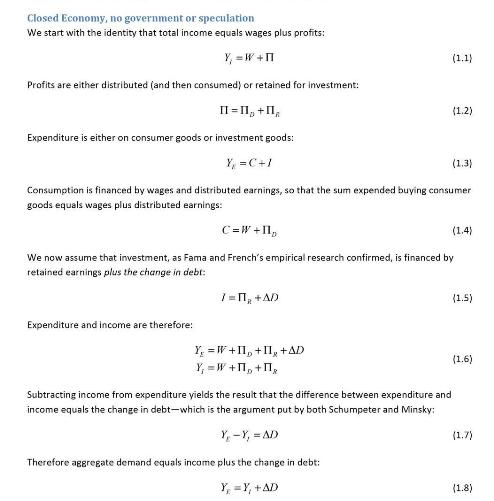

The model is below – found on page 15.

Keen has a simple two-sector model of households and production firms and it can also be thought of as a three sector model where production firms borrow from banks to finance investments.

In the last equation, you see Keen and Grasselli’s claim that expenditure is income plus change in debt.

The trouble is with Keen’s behavioural assumption (1.4)

C = W + ΠD

Unfortunately the rules of accounting do not allow this!

If the assumption (1.4) is relaxed, firms’ increase in debt is mirrored by households’ saving.

In a three sector model with households, firms and banks, the increase in firms’ debt is mirrored as increase in households’ deposits.

It can be generalized with firms issuing some securities purchased by households.

So equation 1.8 should read:

YE = YI

with no need of Lebesgue Integrals to prove (1.8) is correct because it is not correct.

The Saving = Investment Identity

The Keen-Grasselli model doesn’t respect the identity

Saving = Investment

This can be easily seen. Households (in his language workers) having zero saving and zero investment. Firms have a saving of ΠR and investment of I.

So total saving = ΠR and total investment = I

But because these terms differ by ΔD (equation 1.5), they cannot be equal unless ΔD = 0.

So in the Keen-Grasselli model,

Saving ≠ Investment

The reason Keen and Grasselli get this inconsistency is because they assume that saving is volitional.

Basil Moore was aware of this and in his book Shaking The Invisible Hand, he wrote:

The belief that aggregate saving is the sum of volitional saving decisions by individual economic units is simply a spectacular macroeconomic illustration of the “fallacy of composition.” This fallacy has been reinforced by the unfortunate use of the colloquial verb “to save,” with its very powerful transitive volitional connotations, for an economic term which is merely an intransitive accounting definition: “income not consumed.” As economists know, it is a “fallacy of composition” that what is true for the part is necessarily also true for the whole. Total “saving” is the sum of total saving undertaken by individual “savers.” But since saving is the accounting record of investment it cannot be the sum of volitional individual saving decisions. Aggregate saving is not the sum of individual savers volitional decisions to save. It follows that in all monetary economies most “saving” is “non-volitional.”

[emphasis: mine]

Ideally (i.e., realistically) Keen’s model should sit inside a model with the government and the government would end up running surpluses. Non-volitonally 🙂 S = I would be maintained and so would YE = YI

Some Higher Mathematics: The Dirac Delta Function

Keen and Grasselli claim that confusions around economists being not able to see things in continuous time is the source of errors by them and that the reason is that debt injections are sudden.

Now, in calculus, there is a thing called the Dirac Delta Function.

[Paul Dirac didn’t get the media attention that Einstein got but he was surely his equivalent. The Delta function is just a small contribution when compared to what he did elsewhere. He was Feynman’s hero.]

The delta function δ(x) is zero at all points except 0 where it is infinite. But the integral of δ(x) from over the range of real numbers is 1. That is difficult to digest initially when first tries to learn it.

A debt injection is a step function jump in debt. The delta function has a curious property that it is the derivative of the step function.

So income flows can be represented as sum of delta functions which different coefficients at different points in time.

So Keen’s chart (Figure 13) in his paper should have income represented as delta function spikes.

To get the flow over a period, one has to integrate and this will result in the income over the period to be the sum of the coefficients of these delta functions.

So whether in discrete formulation or continuous time formulation, YE = YI for the whole economy and the reason is not hard to guess because dD/dt cancels out with dA/dt since assets and liabilities are created equally.

For an individual sector it is true that YE = YI + dD/dt – nobody disagrees with that but to be more accurate the right hand side should include minus dA/dt.

Also, a continuous time formulation is just taking infinitesimal intervals and then treating infinite of them together.

It makes no sense to say income before debt injection was $100 for real world transactions in a continuous time formulation. It is actually zero just before a debt injection because all income/expenditure flows are “spikey”.

Just after the debt injection it is zero again because nobody spends the instant a loan is given. The debt injection increases assets and liabilities by the amount of the loan if the borrowing is from a bank.

So after the loan is given at the next infinitesimal, change in debt is zero and income/expenditure is also zero.

Then income/expenditure flow spikes at the moment the transaction happens – like a delta function.

But that is income for someone and for an economy as a whole Income = Expenditure.

Anyway, nothing of the analysis justifies the definition of “aggregate demand” (now renamed by Keen to “effective demand”).