Here’s a new piece by Randall Wray on Economonitor claiming current accounts do not matter (once again!) and didn’t have much of a role on the Euro Area crisis. Part of his arguments are the same as those who participated in public debates 1991 (most, not all) and claimed the balance-of-payments doesn’t matter.

Perhaps he should revise his study of sectoral balances.

Before I consider his analysis, let me remind you why current account deficits matter. A current account deficit is the deficit between the income and expenditure of all resident units of an economy and because it is a deficit, it needs to be financed. Cumulative current account deficits lead to a rise in the net indebtedness of a nation (i.e., consolidated net debt of all resident sectors of an economy) and cannot keep rising forever relative to output. This is because a deficit in the current account is equal to the net borrowing of the nation which has to be financed and secondly, the debt built up needs to be refinanced again and again.

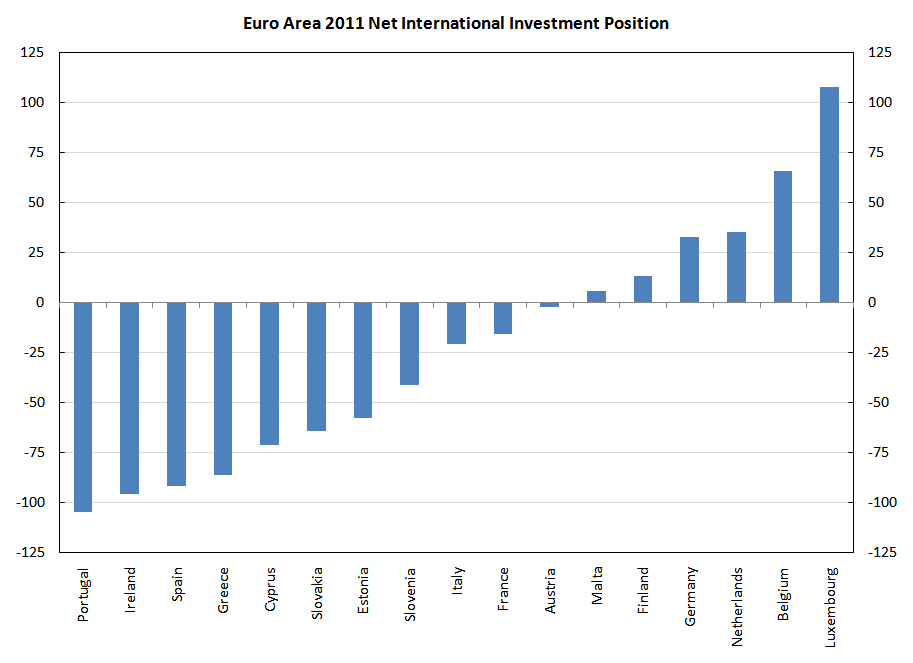

Here’s via Eurostat

It is clear from the chart that nations with high negative NIIP (and hence high net indebtedness) were/are the ones in trouble.

The accounting identity which connects the NIIP to CAB is:

Δ NIIP = CAB + Revaluations

Most of the times, revaluations have less of a role in explaining the NIIP. Of course one can always come up with exceptions – such as for the United States with huge revaluations due to outward FDI and Ireland. It should however be noted that Ireland also had high current account deficits.

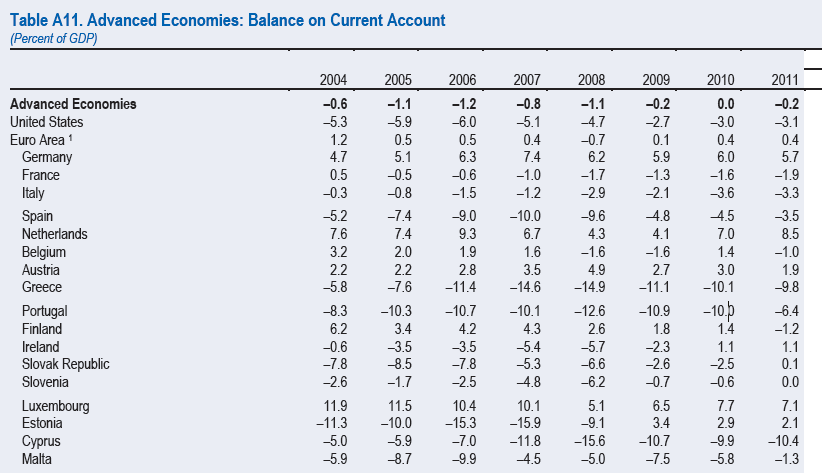

Here is data from the IMF on the current account balances:

From this you can see “Germany is not Greece”, “Netherlands is not Spain”, “Finland is not Cyprus” and so on and also the relation of CAB to NIIP.

Let me turn now to what Wray has to say:

Yesterday one presenter at this conference provided a lot of interesting data on cross border lending by European banks, most of which consisted of lending to fellow EMU members. He showed a strong correlation between cross border lending and cross border trade. Hence, posited a link between flows of finance and flows of goods and services. So far, so good. He also accepted a comment from the audience that correlation doesn’t prove causation, and that flows of finance are orders of magnitude larger than trade in goods and services—in other words, most of the financial churning has nothing to do with “real” production.

So atleast Wray accepts there is a correlation of some kind. For causation, see the arguments presented at the beginning of this post.

I won’t rehash that argument. Balances do balance, after all. For every current account deficit there’s a capital account surplus. It seems to me that the claim that the EMU suffers from “imbalances” is on even shakier ground. After all, they all use the same currency, so there’s no chance that an “imbalance” will lead to a run on the currency and to exchange rate depreciation (a usual fear following on from a current account deficit).

This argument was made by neoclassical economists around late 80s and early 90s when Europe was planning to form a monetary union. See this post Martin Wolf Pays A Generous Tribute To Anthony Thirlwall. Wray misses the point that a balance-of-payments crisis also leads to a deflationary spiral and that even though there is no exchange rate collapse, there is deflation in the Euro Area – exactly as predicted by those economists who thought the notion “current account deficits do not matter” was precisely wrong in the early 1990s.

Then Wray goes on to suggest that banks creating a boom and bust in Germany would have looked different:

Yes. But in what sense is that an “imbalance”? Look at it this way. What if instead of running up real estate prices in the sunny south—so that Brits and northern Europeans could enjoy vacation homes—the German banks had instead fueled a real estate bubble in Berlin? What if they had eliminated all underwriting standards and lent until the cows come home on the prospect that Berlin house prices would rise at an accelerating pace? Speculators from across the world would buy a piece of the bubble on the prospect that they’d reap the gains and sell-out at the peak. Construction activity would boom, workers could demand higher wages and would increase consumption, and Germany would have experienced higher price inflation than the rest of Euroland.

In the hypothetical case of Wray where German banks lend the non-financial sectors till the “cows come home”, domestic demand would have risen sharply (which he himself suggests) and this would have had the adverse effect on the balance of payments. Germany would have started running current account deficits because imports are dependent on domestic demand. Germany would have suffered similar fate but in the end it would have depended on how fast the domestic demand rose.

Wray should be careful in doing sectoral balances.

Bad bank behavior can boom or bust an economy—with or without current account deficits. And that’s pretty much what happened in Spain and Ireland (and also in Iceland).

Wray would have sounded right if he had given examples of nations having current account surpluses but from IMF’s table above it can be seen that both Spain and Ireland had huge current account deficits.

What about Iceland?

The data is from 2004-2011 and you can see that in 2008, Iceland had a current account deficit of 28.4%.

Wray then compares the Euro Area to the United States:

In Euroland, all use the same euro currency, and clearing is accomplished among the central banks and through the ECB (that is where Target 2 comes in). It works about as smoothly as the US system. But here’s the difference: the ECB “district banks” are national central banks. It is thus easier to keep mental tabs on the “imbalances” by member states in the EMU than in the USA.

Yes keeping mental tabs on imbalances (and not “imbalances”) can have its effect, but Wray crucially misses the point that in the United States, there is an automatic mechanism of compensating for trade imbalances via fiscal transfers. This acts via lower total taxes paid by regions facing slowdown caused by trade imbalances (not to be confused with lesser taxes paid due to reduced tax rates if any). A rise in public expenditure (not necessarily discretionary but resulting from government guarantees made beforehand) also helps.

Wray however quotes Mosler but he misses the point as well since it talks of directed government spending as opposed to a built in automatic mechanism which (the latter) prevents a crisis at this scale/type from happening.

Generally speaking, Wray seems to suggest that the crisis happened because the private sector credit-led boom went bust and this has nothing to do with current account imbalances. While it is true that the private sector credit-led boom ended in a bust and caused a crisis, what Wray misses is that the current account deficits contributed to exacerbating the crisis because nations in trouble built up huge indebtedness to the rest of the world and had troubles to refinance their debts. If all sectors of an economy have a consolidated net indebtedness position to the rest of the world, they will have issues borrowing and refinancing since – as a matter of accounting – foreigners have to attracted. Foreigners were unwilling because of doubts and also because there was/is a crisis in the world economy, they changed their portfolio preferences – making the whole issue of financing even more difficult.

A Digression On TARGET2

It can be argued that since the TARGET2 mechanism has a stabilizer of some sort – that since the Eurosystem TARGET2 claims arising due to capital flight from the “periphery” is an accommodative item in the balance-of-payments, current account deficits shouldn’t have been an issue.

The error in this argument is that while it is true that capital flight is automatically financed by the resultant Eurosystem TARGET2 claims and that this is helpful, it depends on the hidden assumption that banks have unlimited/uncollaterilized overdrafts at their home central banks. We have seen in various scenarios – such as with procedures such as the Emergency Liquidity Assistance (ELA) – that banks in the “periphery” can either run out of sufficient collateral needed to borrow from their home NCB or have chances to run out of collateral. They hence need to attract funds from abroad. The nation as a whole is dependent on foreigners. Current account deficits are not self-financing.