I thought I should share what I found recently about who was to state the sectoral balances identity first – since it comes across as enlightening to say the least. I found the identity in Nicholas Kaldor’s 1944 article Quantitative Aspects Of The Full Employment Problem In Britain. It was published as Appendix C to Full Employment In A Free Society by William Beveridge.

(If you find the mention of this identity anywhere before, please let me know!)

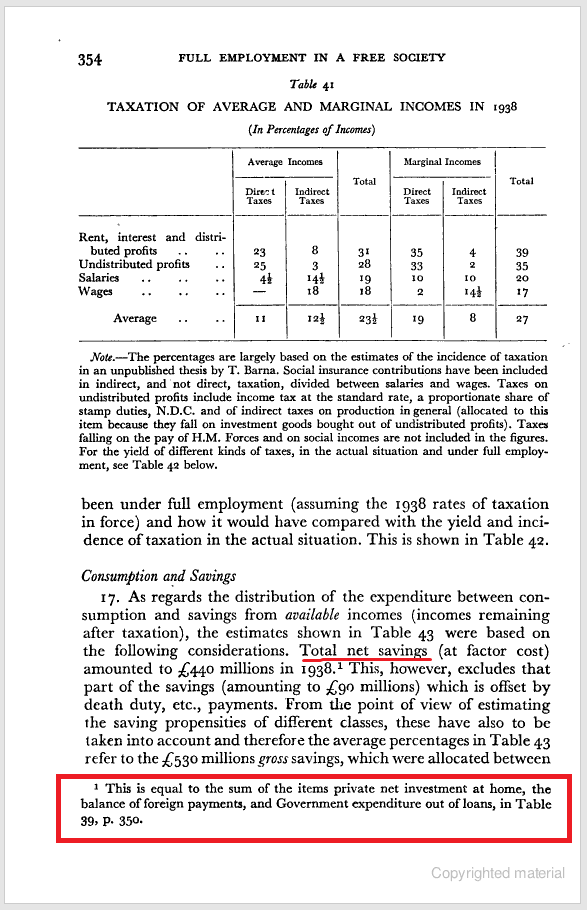

Here’s a Google Books screenshot of the page:

The article also appears in Kaldor’s Collected Essays, Vol 3 (Chapter 2, pp. 23-82).

The ‘net’ is net of consumption of fixed capital. Also ‘balance of payments’ is used for the current balance (footnote 1, page 28). (In The Scourge Of Monetarism, Kaldor used ‘net saving’ as saving net of investment).

Anthony Thirlwall wrote a biography of Kaldor in 1987 and he mentions that Kaldor kept pushing the implications of the identity in the 1960s (page 251). He managed to convinced some of his colleagues such as Wynne Godley and Francis Cripps and pick up public fights with others such as Richard Kahn.

Wynne Godley recalled how he came to appreciate this identity in his book Monetary Economics with Marc Lavoie. In Background Memories (W.G.) he wrote:

… In 1970 I moved to Cambridge, where, with Francis Cripps, I founded the Cambridge Economic Policy Group (CEPG). I remember a damascene moment when, in early 1974 (after playing round with concepts devised in conversation with Nicky Kaldor and Robert Neild), I first apprehended the strategic importance of the accounting identity which says that, measured at current prices, the government’s budget deficit less the current account deficit is equal, by definition, to private saving net of investment. Having always thought of the balance of trade as something which could only be analysed in terms of income and price elasticities together with real output movements at home and abroad, it came as a shock to discover that if only one knows what the budget deficit and private net saving are, it follows from that information alone, without any qualification whatever, exactly what the balance of payments must be. Francis Cripps and I set out the significance of this identity as a logical framework both for modelling the economy and for the formulation of policy in the London and Cambridge Economic Bulletin in January 1974 (Godley and Cripps 1974). We correctly predicted that the Heath Barber boom would go bust later in the year at a time when the National Institute was in full support of government policy and the London Business School (i.e. Jim Ball and Terry Burns) were conditionally recommending further reflation! We also predicted that inflation could exceed 20% if the unfortunate threshold (wage indexation) scheme really got going interactively. This was important because it was later claimed that inflation (which eventually reached 26%) was the consequence of the previous rise in the ‘money supply’, while others put it down to the rising pressure of demand the previous year …