Dani Rodrik has written a very interesting article The New Mercantilist Challenge for Project Syndicate.

Perhaps it is the main aim of this blog to argue how the sacred tenet of free trade is devastating to the world as a whole and why a sustainable resolution of a crisis can only be achieved by new international agreements on how to trade with one another combined with coordinated demand management policies with an expansionary bias.

Joan Robinson was one of the fiercest critics of free trade. A good appreciation of her work is by Robert Blecker in the book Joan Robinson’s Economics (2005)

Blecker says:

Robinson’s critique of free trade had several dimensions, including her opposition to the comparative static methodology usually employed to “prove” the existence of gains from trade, as well as her scathing criticism of the actual practice of trade policy by nations proclaiming their fealty to free trade while seeking mercantilist advantages over their neighbors. Robinson also thought that international trade relations were far more conflictive than they were usually portrayed by free traders

[emphasis: mine]

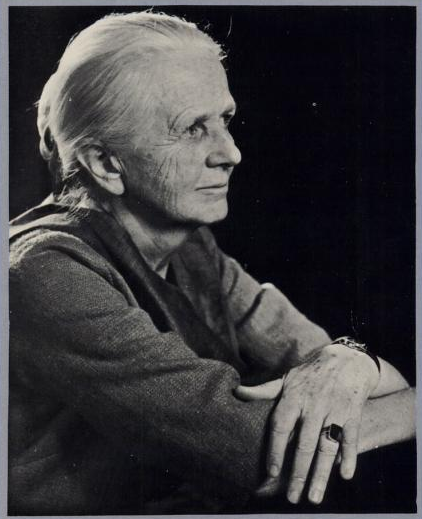

In her 1977 essay What Are The Questions? (which is full of quotable quotes) Robinson says:

A surplus of exports is advantageous, first of all, in connection with the short-period problem of effective demand. A surplus of value of exports over value of imports represents “foreign investment.” An increase in it has an employment and multiplier effect. Any increase in activity at home is liable to increase imports so that a boost to income and employment from an increase in the flow of home investment is partly offset by a reduction in foreign investment. A boost due to increasing exports or production of home substitutes for imports (when there is sufficient slack in the economy) does not reduce home investment, but creates conditions favorable to raising it. Thus, an export surplus is a more powerful stimulus to income than home investment.

In the beggar-my-neighbor scramble for trade during the great slump, every country was desparately trying to export its own unemployment. Every country had to join in, for any one that attempted to maintain employment without protecting its balance of trade (through tariffs, subsidies, depreciation, etc.) would have been beggared by the others.

From a long-run point of view, export-led growth is the basis of success. A country that has a competitive advantage in industrial production can maintain a high level of home investment, without fear of being checked by a balance-of-payments crisis. Capital accumulation and technical improvements then progressively enhance its competitive advantage. Employment is high and real-wage rates rising so that “labor trouble” is kept at bay. Its financial position is strong. If it prefers an extra rise of home consumption to acquiring foreign assets, it can allow its exchange rate to appreciate and turn the terms of trade in its own favor. In all these respects, a country in a weak competitive position suffers the corresponding disadvantages.

When Ricardo set out the case against protection, he was supporting British economic interests. Free trade ruined Portuguese industry. Free trade for others is in the interests of the strongest competitor in world markets, and a sufficiently strong competitor has no need for protection at home. Free trade doctrine, in practice, is a more subtle form of Mercantilism. When Britain was the workshop of the world, universal free trade suited her interests. When (with the aid of protection) rival industries developed in Germany and the United States, she was still able to preserve free trade for her own exports in the Empire. The historical tradition of attachment to free trade doctrine is so strong in England that even now, in her weakness, the idea of protectionism is considered shocking.

[emphasis: mine]

Joan Robinson (1981)

What Are The Questions? And Other Essays