The blog Fictional Reserve Barking … Against Fictions And Other Tall Tales has a nice post titled: On the (ir)relevance of the money multiplier model: The Fed view.

In the post, the blogger Circuit quotes Robert Hetzel who says:

Starting in mid-December 2008 when the FOMC lowered its funds-rate target to near zero with payment of interest on bank reserves, the textbook reserves-money multiplier framework became relevant for the determination of the money stock. The reason is that the Fed’s instrument then became its asset portfolio, the left side of its balance sheet, which determined the monetary base, the right side of its balance sheet. As a result, from December 2008 onward, the nominal (dollar) money stock was determined independently of the demand for real money. Although the reserves-money multiplier increased because of the increased demand by banks for excess reserves, the Fed retained control of M2 growth. Even if banks hold onto increases in excess reserves, the money stock increases one-for-one with open market purchases. (2012:237) (emphasis added)

This post is inspired by the nice comment by JKH in the same post.

JKH says:

Excellent post.

I think Hetzel is wrong though.

What is at work in QE is better described as a money duplication process rather than a money multiplier process. It’s entirely different.

The correlation between base changes and M2 changes during QE has nothing to do with the reserve ratio calculation that is part of the money multiplier math.

It has to do with the fact that non-banks were the ultimate source for most of the assets acquired by the Fed under QE. To the degree that’s the case, there is a 1:1 duplication of reserve expansion and M2 expansion at the point of transaction origin. Non-bank bond sellers basically convert their bonds to M2 at source.

Subsequent commercial bank balance sheet changes may change the one-to-oneness that appeared at origination, but that also has nothing to do with money multiplier dynamics.

So in total this has nothing to do with a standard money multiplier argument. The two should not be confused.

I have a few more things to add on Hetzel.

When the Federal Reserve buys assets such as US Treasuries and agency debt and mortgage-backed securities from the private sector, it increases the stock of money aggregates such as M1 – as most of the ultimate sellers are non-banks, even though the Federal Reserve purchases the bonds via reverse auctions from primary dealers.

Now whether the money multiplier story works or not (it doesn’t!), it superficially looks as if the Federal Reserve is determining the stock of money – supporting Hetzel’s view – again superficially.

But does it?

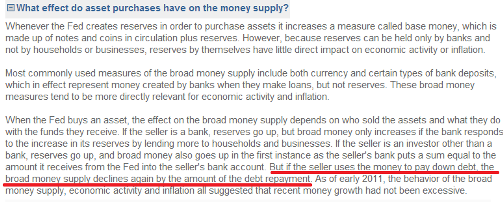

In Post-Keynesian monetary theory, economists say that the stock of money is “demand-determined” and Hetzel’s arguments seems to be against this view. However what Hetzel forgets is that while the Federal Reserve influences the stock of money, it is still demand-determined. This is because money-demand depends on agents’ portfolio preferences. If agents have “excess” stock of money, they may reflux this by reducing their loans toward the banking system – just like Post-Keynesians claim. The Federal Reserve QE Education page New York Fed 101: The Federal Reserve’s $600 Billion Treasury Purchase Program (Called by some QE or QE2) itself says so:

Also note that “money-demand” is dependent on various things such as expected returns on substitutes. To the first approximation we may say that the stock of money was determined by the Federal Reserve since it has an eye on the monetary aggregates (although not targeting in the Monetarist sense). But once the process is set in motion, it then becomes endogenous because of behaviour of economic units.

Only in the limited case of settlement balances can we say that a monetary aggregate (monetary base or MB in this case) was set by the central bank.

The correct way of seeing this is via using Wynne Godley’s asset allocation model. In this what the variable Md is still decided by household behaviour – which depends on portfolio preferences, wealth, income and expected returns on all assets. LSAP works by reducing the supply of long-term bonds and hence reducing long-term yields via the “preferred-habitat” theory and hence increasing demand for other assets via imperfect asset substitution and changing their prices.

This itself has an influence on money-demand (because money-demand also depends on expectations of returns of other assets) but the amount of asset purchases by the Fed doesn’t determine the stock of money at any point in time.

Hence Hetzel is both wrong by appealing to the money multiplier mechanism and even if he hadn’t his other point about the stock of money being supply-determined is incorrect.

You can read Nick Edmonds’ blog on how this works – he has the most precise way of describing QE/LSAP.