The purpose of studying economics is not to acquire a set of ready-made answers to economic questions, but to learn how to avoid being deceived by economists.

– Joan Robinson, 1955, “Marx, Marshall And Keynes”, Occasional Paper No. 9, The Delhi School of Economics, University Of Delhi, Delhi.

It is fun to watch what economists have to say after the recent Reinhart-Rogoff episode and look at their behaviour.

To be brutally straightforward, I think economists are playing games here to mislead and deceive everyone. Mainstream economists in the past few days have been trying their best to persuade everyone into believing that they are modest people and economics is a hard science* and it’s two outliers who have misled politicians into worldwide austerity etc.

So we hear Mark Thoma saying something like lack of sufficient data prevents economists from choosing the best model. It gives the impression that mainstream economists broadly know how the world works and that they are just unable to give the best solution from a pack of 10 good models. But it hides the fact that at the most elementary level, macroeconomists struggle to even understand basic macroeconomics and that there exists a supreme Post-Keynesian alternative.

In a recent NYT blog post Destructive Creativity Paul Krugman tries his best to mislead everyone about the status of macroeconomics.

According to him:

If you stayed with Econ 101, you got it right, if you went with the trendy stuff you made a fool of yourself.

It is the most inaccurate statement about the state of macroeconomics and reflects poorly on someone who has written articles such as A Dark Age Of Macroeconomics. Econ 101 – as taught in most universities – is deeply misleading and erroneous.

I won’t go into how chimerical macroeconomics is because there are already a few good blogs there. This post is not about attempting to prove how economics taught at universities is chimerical but to point out games economists play.

Krugman tries to play a supergame on top of what other economists are doing. He says:

You can already see quite a few people reacting to this affair by declaring that macro is humbug, we don’t know anything, and we should just ignore economists’ pronouncements. Some of the people saying this are economists themselves!

No, this is misleading. Mainstream economists are not saying this really but are playing games. Those who have been saying that mainstream economics is a chimera have been saying this for a long time. There is hardly any new entrant in this from within the orthodox community. And Krugman tries to defend the subject itself:

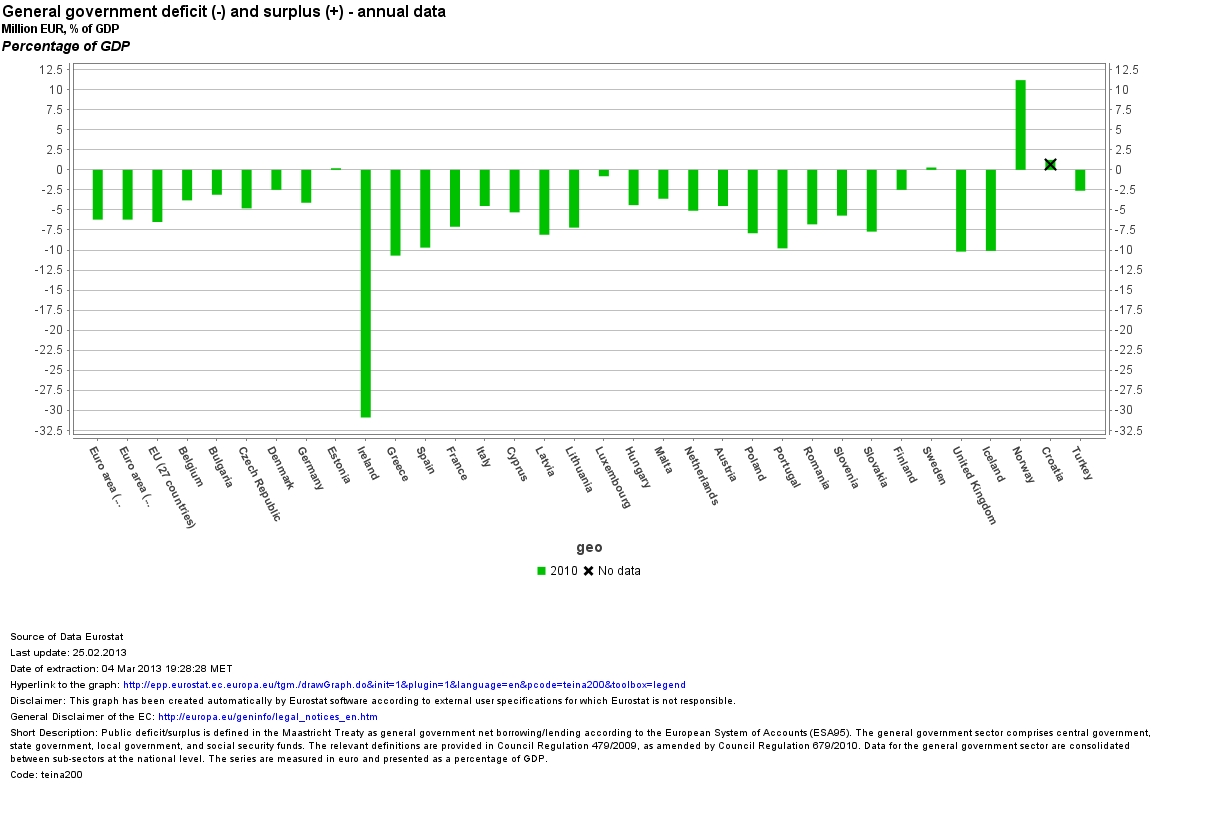

What we have experienced since 2007 is a series of huge policy shocks — and basic macroeconomics made some very counterintuitive predictions about the effects of those shocks. Unprecedented budget deficits, the model said, would not drive up interest rates. A tripling of the monetary base would not cause runaway inflation. Sharp government spending cuts wouldn’t free up resources for the private sector, they would depress the economy more than one-for-one, so that private spending as well as public would fall.

There are three things wrong about this. First, basic macroeconomics did not make these predictions. Second, Krugman – as he has done in the past – is saying that in liquidity trap situations exceptions appear and more importantly he knew it beforehand! Third, Krugman says Econ 101 notes the exception.

(Some great tactics to avoid saying that Econ 101 is garbage).

Of course some points should be given to Krugman because he has been saying things which are different from most of his colleagues but it is incorrect and thoroughly misleading and to say that Econ 101 survives the crisis.

*of course true that Macroeconomics is hard but read Luigi Pasinetti’s Keynes And The Cambridge Keynesians: A Revolution In Economics To Be Accomplished.