Nick Edmonds has written a nice short critique of Steve Keen’s new definition of “aggregate demand”.

Let me add a bit more.

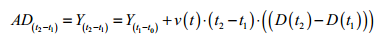

First, Keen has changed his definition of aggregate demand. So the previously we were given rigourous proofs using Lebesgue integrals to show that aggregate demand is gdp plus change in debt (as if it is right to the penny). It is now corrected to:

Second, there is an undertone in Keen’s papers and videos that he is doing something new – which even Post-Keynesians haven’t done before. This is not true. Wynne Godley wrote a textbook named Macroeconomics in 1983 with his colleague Francis Cripps – and in my opinion – a work of a supreme genius. In recent years before his death, he greatly improved his analysis with Marc Lavoie. In both these books and the papers written by the three authors, money is central to the dynamical analysis. Of course like any other subject, this is always work in progress and Keen shouldn’t give the impression to his audience that he is the first one to write dynamical Post-Keynesian models, especially when he seems to struggle at basic steps.

Let us take Keen’s new equation. It seems to suggest that if some economic unit takes out a loan from the banking system, aggregate demand necessarily rises. If some economic unit such as a production firm takes out more loans but some other economic unit such as a household reduces its propensity to consume, the total effect on output depends on these things and may fall as well if the drop in the propensity to consume is high. I suppose Keen will have to explain this by saying the velocity of money has changed but then this just means that what he calls “velocity of money” is a thing defined by his equations (which anyway make no sense whatsoever) and hence doesn’t say anything.

Apologies – this is a bit harsh and Keen has many nice things about him but he should contemplate on his ideas.