The IMF has released a couple of chapters from its upcoming World Economic Outlook. There is one chapter Are Global Imbalances At A Turning Point, which talks of not just “flow imbalances” (current account deficits/surpluses) but also “stock imbalances” (international investment positions).

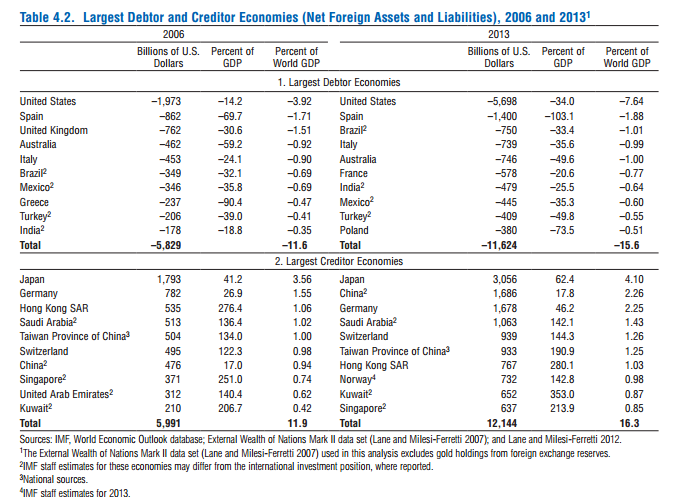

There is a nice table with a lot of information (although it is interested in absolute indebtedness and misses out small countries with high indebtedness in the list but still good information).

The article stresses that flow imbalances are not just enough to analyse the macroeconomics but stock imbalances also need to be studied. Of course, in reality deficits/surpluses are not the true measures of imbalances as Nicholas Kaldor stressed in a footnote in his 1980 article The Foundations Of Free Trade Theory And Their Implications For The Current World Recession (published in Collected Essays Vol. 9):

Morever, the actual surpluses and deficits are not a proper measure of the potential size of such imbalances (and of the deflationary force they exert) since the countries who suffer from an excessive import propensity tend, on that account, to suffer from an insufficiency of domestic demand as well so their aggregate output or income is demand-constrained; they may, in addition be forced to follow a deflationary fiscal and monetary policy, and for both of these reasons, will import less from the surplus countries than they would do under full employment conditions.

The same reasoning is valid for stock imbalances as well. The true solution to reverse the imbalances without hurting aggregate demand is to rein in free trade and expand domestic demand by fiscal policies, especially by creditor nations but with so much orthodoxy around — especially from the IMF, there still is a long way to go. The global imbalances problem itself is the result of neoliberal policies promoted by the IMF.