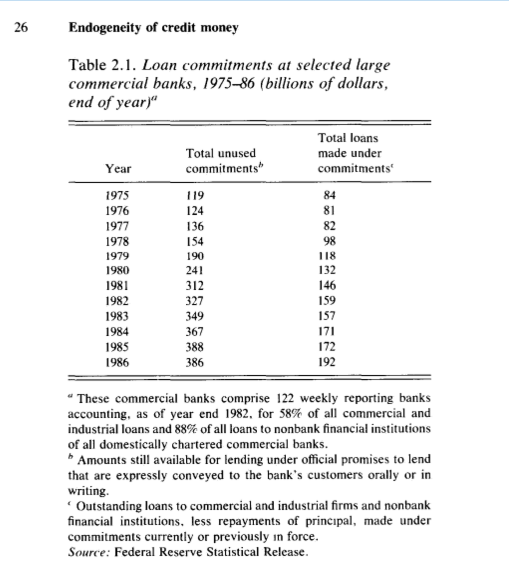

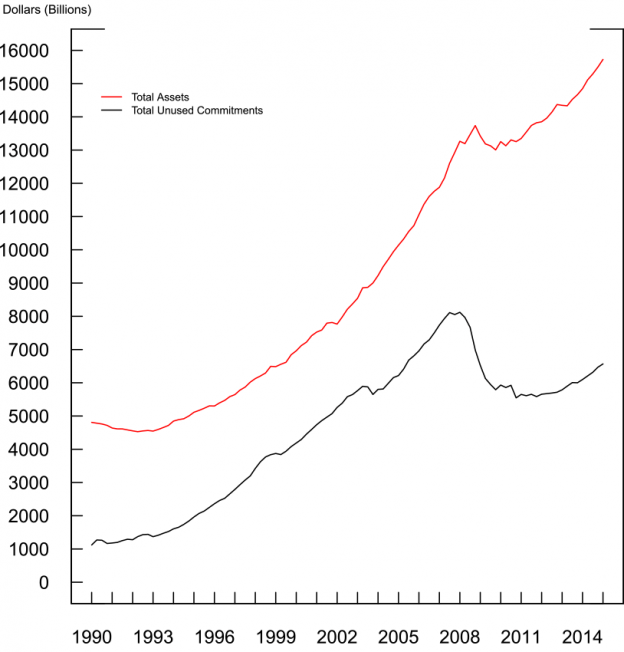

The Federal Reserve produces quarterly data for the financial accounts of the United States (earlier called “flow of funds”). There are a few notable additions termed enhanced financial accounts, which are in the process of being added. Some additions are details about money market mutual funds, off-balance sheet items of depository institutions, such as unused commitments, letters of credit and derivatives. This is the chart from the Federal Reserve’s FEDS note Off-Balance Sheet Items of Depository Institutions in the Enhanced Financial Accounts

Moore has a sophisticated way of saying things (pages 24-25):

In making a loan commitment a bank should be viewed as a participant in forward rather than spot lending markets. Viewed as a seller of contingent claims, banks themselves obviously can excercise only limited control over the volume of their lending.

On page 186 of Moore’s book, he also notes that Keynes talks about this in his book A Treatise On Money:

Keynes insists that cash facilities of the public includes unused overdraft facilities, “of which we have no statistical record whatever” (JMK, 5, p. 37). He then concludes, “Thus the cash facilities, which are truly cash for the purposes of the theory of the value of money, by no means correspond to the bank deposits which are published” (JMK, 5, p. 38).

Tracking Keynes’ writing Moore concludes that although Keynes talked of unused overdraft facilities, he fails to recognize its importance in theory. Moore says (p. 203):

Keynes then returned to the issue of unused overdraft facilities, without, however, recognizing that this was the key to the endogeneity of the money stock:

[Keynes]: In Great Britain the banks pay great attention to the amount of their outstanding loans and deposits, but not to the amount of their customers’ overdraft faclities … it means that there is no effective pressure on the resources of the banking system until the finance is employed … there is no superimposed pressure resulting for planned activity over and above the pressure resulting from actual activity. (JMK, 14, pp. 222-23).

Honestly, I am not sure what Keynes is trying to say in all this. Moore is quite clear in his book. It’s still nice to know that Keynes discussed all this. Perhaps he wanted to say something more but couldn’t translate his thoughts in words. But if you can interpret Keynes, do tell me!