J. W. Mason has a fantastic article titled The Fed Doesn’t Work For You in Jacobin: Reason In Revolt. I especially liked the lines where he points out economists’ inconsistency while worrying about rising wage share in the national income as coming from “demand” but explaining the fall in the share over the last 30-40 years as something “structural”.

There’s a funny disconnect in these conversations. A rising wage share supposedly indicates an overheating economy — a macroeconomic problem that requires a central bank response. But a falling wage share is the result of deep structural forces — unrelated to aggregate demand and certainly not something with which the central bank should be concerned.

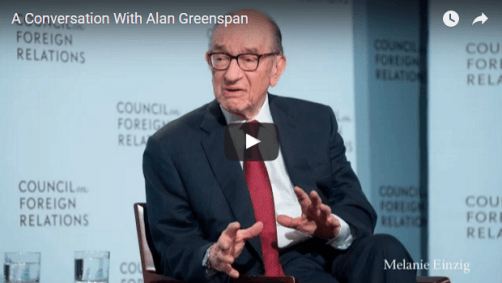

Contrast that to Alan Greenspan who spoke recently after the Federal Reserve rate hike (h/t JKH):

Greenspan talks of the money multiplier in response to a question by a lady about the Federal Reserve’s monetary policy after having conceded that he doesn’t understand how it works! To be more accurate he says that interest paid on reserves has helped in broad money not multiplying. But this explanation is as bad as the notion of the money multiplier.