Over his blog The Beauty Contest – A blog on Spanish and international affairs, macroeconomics and finance, Javier López Bernardo has an analysis of Bernie Sanders’ economic plan (written with his colleague Rafael Wildauer).

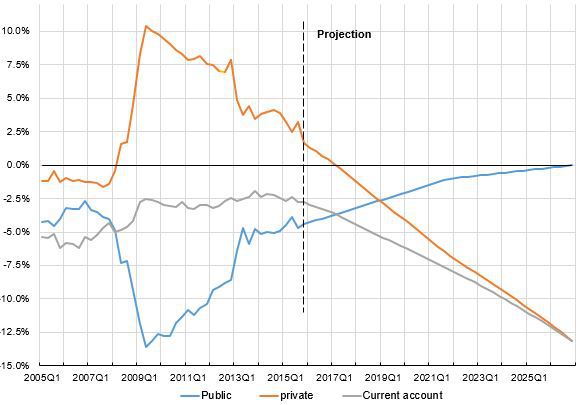

Javier López Bernardo and Rafael Wildauer stress the importance of the U.S. balance of payments constraint on U.S. growth. He uses a sectoral financial balances model to highlight how sectoral balances would look under Bernie Sanders’ plan: an exploding combination of U.S. private debt and negative net international investment position because of exploding negative financial balance of the private sector and the U.S. economy as a whole.

Also, they say:

We have not intended to bash Mr. Sanders’ economic program (actually, we are quite sympathetic with most of its measures) or Prof. Friedman’s economic exercise (which is useful to frame the economic discussion), but simply to highlight the incompleteness of economic analysis carried out in closed-economy frameworks – as the critics and Prof. Friedman’s exercise have exemplified.

Their projection is this chart: