Source: BEA.

Eric Lonergan has written an interesting post about US trade deficits on his blog Philosphy Of Money/Sample Of One. In the post Eric claims that the United States is not a debtor of the world but that she is a creditor of the world! Eric also says that a lot of talk of all this is conventional wisdom and in reality the United States is getting paid to have lunch.

First, it’s no conventional wisdom. Most of standard macroeconomics is simply denying the importance of balance of payments. It is held that market mechanisms will correct imbalances, if only the government does its job. So there’s no conventional wisdom worrying about the trade deficit of the United States of America. It is exactly the opposite – a heterodox view.

Second, there is no “free lunch”. Imports put a drain on demand and output and because of the imbalance of the U.S. trade, full employment has been a distant dream. With so much of unemployment (especially in the crisis) and the slow recovery, one cannot claim that the U.S. has some free lunch. Only if there is full employment and that too remaining sustainable, can one claim that there’s some “free lunch”. A smaller point is that one needs the correct counter-factual: if the U.S. trade deficit had been lower, interest income (one of Eric’s main points) would have been even higher. So one more reason to avoid the phrase “free lunch”.

Moving to more important points. Eric claims that net return of FDI is high and hence BEA’s numbers are not right. Specifically he claims:

So here’s the crux: American generates a high positive net income from its net international asset position – which implies its net external asset position is a positive number. Despite running permanent current account deficits, the US has accumulated net external assets. this sounds less counterintuitive if you think that all it means is that US assets oversees are more valuable than foreign holdings of US assets.

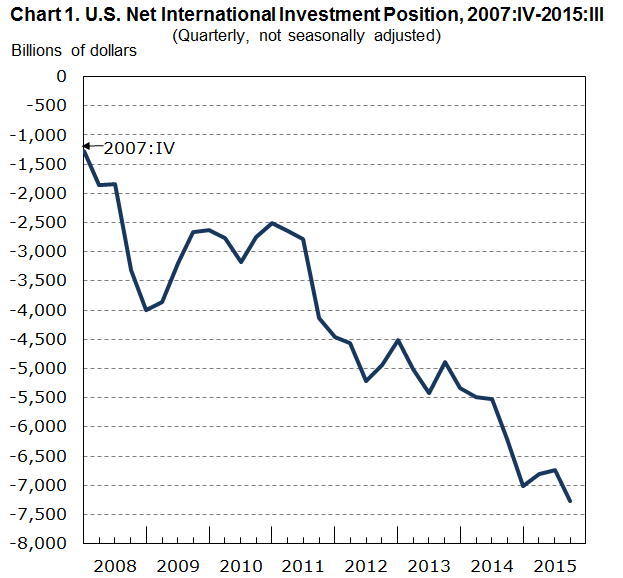

To highlight how significant the difference is, BEA measures of US net external liabilities are around $7trn, if we simply value the net income on a PE multiple of 14x, the net external assets of the US are around $2.7trn!

An inconsistency this large seems extreme, but consider the valuation of foreign direct investment (FDI). According to the BEA, net FDI of the US has a value of less than $1trn, although the US earns $424bn on its overseas FDI and foreign FDI in the US only earns $153bn. If we value both income streams on 14x earnings, the US has net FDI assets of $4.2trn – the BEA ‘market value’ estimates are out by $3trn.

Now, that is not a correct way to approach this. To see the error, assume the stock of outward FDI is $100 and the stock of inward FDI is also $100 at market prices. Suppose investment receipts is $10 and income paid is $9. So it looks like the United States is earning $1 on a net FDI of 0. So according to this argument, the return is infinite!

It is better to look at the actual numbers:

Stocks

Outward FDI: $6,695bn

Inward FDI: $6,196 bn.

Flows

Direct investment income: $776bn

Direct investment payments $592bn.

There is nothing drastically wrong about these numbers. Perhaps, it can be argued that direct investment in the US by foreigners will take time to pay off, or that foreigners are satisfied with this or something else. These numbers do not appear wrong.

Netting inward and outward and comparing returns to the net stock is an invalid argument, as I showed above with an example of inward/outward FDI of $100.

In addition, on Twitter Eric says a DCF (discounted cash flow) model also supports his thesis that the United States is a net creditor. The loophole in this argument is that it holds assets and liabilities vis-à-vis foreigners fixed. But because the United States runs current account deficits, liabilities rise faster than assets attributable to the deficit. So even if the U.S. earns interest income, net, from abroad, this effect will catch up.

There’s other way of saying all this. If r is return on assets A and L are assets and liabilities.

rA > rL

rA ·A > rL·L

is not inconsistent with

A < L

Second, using subscripts, 0 and 1 for now and some point in future,

rA0 ·A0 > rL0·L0

does not imply automatically that

rA1 ·A1 > rL1·L1

because liabilities can rise faster than assets (because of current account deficits) and even if return on assets is higher than return earned by foreigners on U.S. liabilities, net interest income can turn negative.

Anyway, the point of this post is that while netting is a good concept, one cannot blindly net accounting numbers. The example, a net FDI of $0 earning a net income of $1 and hence infinite return(!) is not a valid way of doing accounting. BEA’s numbers look correct.