There’s a nice paper by George Soros from 2014, titled Fallibility, Reflexivity, And The Human Uncertainty Principle in which he gives a good alternative description of financial markets. It’s a kind of a review article of his own ideas he has developed over the years. This is in sharp contrast to the “efficient market hypothesis”.

Here I wanted to discuss just one aspect. In section 4.1 of the paper, Soros says:

Let me state the three key concepts of my approach, fallibility, reflexivity, and the human uncertainty principle as they apply to the financial markets …

…

Second, reflexivity. Instead of playing a purely passive role in reflecting an underlying reality, financial markets also have an active role: they can affect the future earnings flows they are supposed to reflect. That is the point that behavioral economists have missed. Behavioral economics focuses on only half of the reflexive process: cognitive fallibility leading to the mispricing of assets; they do not concern themselves with the effects that mispricing can have on the fundamentals.

Although, in neoclassical economics, it is difficult to see how this is the case, it is easy in stock-flow coherent macro models. Without writing equations, let’s see how this works.

- A rise in expectations of equity prices will lead to a rise in the actual value of equity prices.

- Higher equity prices implies holding gains (capital gains) for the holders ultimately households.

- This raises consumption (and purchases of houses) as households are richer.

- This rise in domestic demand raises output as producers will produce more to meet the demand.

- Higher production means higher profits.

- A boom in financial markets also leads to a rise in firms’ capital formation (“investment”). Investment is self-financing as investment expenditure for one firm is a source of revenue for another.

Of course, there are feedback effects as well and this may become a bubble which goes bust, but this is the basic mechanism by which reflexivity works.

Although this appears simple, this cannot happen in neoclassical economics because the “production function” is at the heart of it.

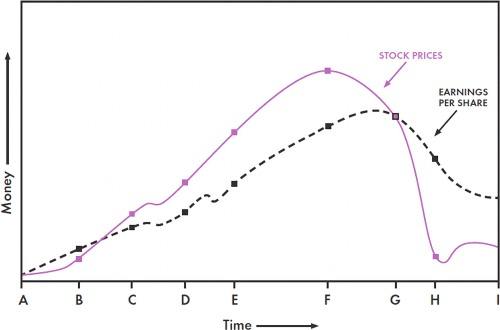

Back to Soros. In the paper, he has a nice chart with an explanation of it.

Soros explains:

A typical market boom– bust. In the initial stage (AB), a new positive earning trend is not yet recognized. Then comes a period of acceleration (BC) when the trend is recognized and reinforced by expectations. A period of testing may intervene when either earnings or expectations waiver (CD). If the positive trend and bias survive the testing, both emerge stronger. Conviction develops and is no longer shaken by a setback in earnings (DE). The gap between expectations and reality becomes wider (EF) until the moment of truth arrives when reality can no longer sustain the exaggerated expectations and the bias is recognized as such (F). A twilight period ensues when people continue to play the game although they no longer believe in it (FG). Eventually a crossover point (G) is reached when the trend turns down and prices lose their last prop. This leads to a catastrophic downward acceleration (GH) commonly known as the crash. The pessimism becomes over done, earnings stabilize, and prices recover somewhat (HI).

Of course, it’s more complicated. There can be other factors leading to the fall of both equities and earnings. But importantly, the fall in equity prices can—via the wealth effect and a fall in firms’ capital formation (“investment”)—lead to a fall in earnings.

George Soros’ criticism of neoclassical economics is great and he’s quite correct in getting an important causality. His description however lacks a mechanism. This can be provided with a demand-led stock-flow coherent behavioural model without any production function.