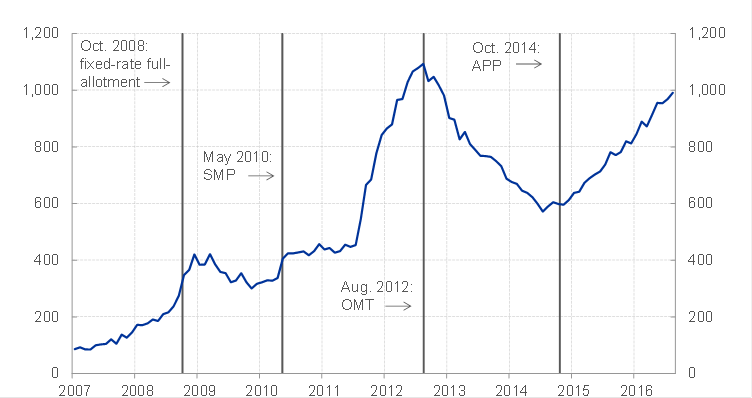

During the crisis which started in 2007 and especially around mid-2011, TARGET2 liabilities of some National Central Banks (NCBs) of the Eurosystem increased drastically (chart below) and led to heated discussion among economists and became a political subject.

Recently, the (im)balance has been increasing again but it seems that it’s mostly because of what some call QE recycling.

Peter Praet, Member of the Executive Board of the ECB explained this in his speech yesterday.

First the chart from his talk:

Sum of all positive TARGET2 balances. Source: ECB.

As Praet shows using T-accounts, what happens if Banco de España purchases securities from a German counterparty, Bundesbank’s TARGET2 assets—claims on the rest of the Eurosystem—will rise and so will Banco de España’s TARGET2 liabilities to the rest of the Eurosystem.

Once the German counterparty sells the securities to Banco de España, it will try to find the nearest substitute which may not be a Spanish security. So this is nothing to be worried about unlike earlier where TARGET2 balances were symptomatic of capital flight from some countries threatening financial meltdown.

Of course one has to be careful. Not all the recent rise may be attributed to the QE effect. But at the same time this analysis should throw some light on the topic.