Simon Wren-Lewis has an article on his blog on stock-flow consistent/coherent models by Wynne Godley. Unlike other articles, this has a more engaging tone and isn’t dismissive.

This is a good thing but it has the tone “Oh, there’s hardly anything new” about stock-flow consistent modeling and the sectoral balances approach. 🤦. To me this is highly inaccurate, to say the least. None of the models outside SFC models —with one exception—come anywhere close to the important question about what money is and how money is created. Even in the Post-Keynesian literature, while there are various non-mathematical approaches, there’s hardly anything that comes close. That important exception is the work of James Tobin as is summarized in his Nobel Prize lecture Money and Finance in the Macroeconomic Process. Except that Wynne Godley’s model greatly improve upon the deficiencies of Tobin’s approach.

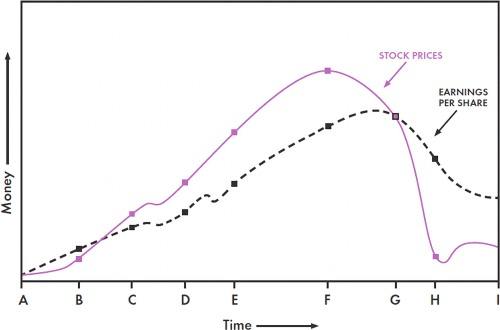

The sectoral balances approach is a mini-version of stock-flow coherent modeling. Wren-Lewis seems to say there’s hardly anything great and don’t tell much. First, almost nobody was making a cri de coeur as much as Wynne Godley. Second, the approach makes it clear why a huge recession was coming. This is because US private expenditure was rising faster than private income and the US private sector was in deficit for long and the private sector was accumulating debt on a huge scale relative to income. It’s difficult to say when this would have reversed pre-2007, but had to reverse. Once this is reversed, i.e., when private expenditure slows relative to private income, so that the private sector goes into a surplus, output will fall as a result of a slowdown of private expenditure.

Moreover, the US economy had a critical imbalance in its trade with its current account balance of payments touching almost 6.5% at the end of 2005, hemorrhaging the circular flow of national income at a massive scale.

Wynne Godley’s argument was that because of the external imbalance, the US fiscal policy will be unable to expand output to full employment easily, once the US enters a recession. Hence, he proposed import controls for the United States.

None of anybody outside Wynne Godley’s circle came anywhere close to saying anything of this sort.

But these empirical analysis is a much more complicated discussion. At a simpler level, nobody has come closer to what stock-flow coherent models achieve. All we see is economists struggling with basic questions on how money is created, what role it plays and so on.

Wren-Lewis also criticises SFC models saying they have minimal behavioural hypothesis. Now, this is far from the truth. If you write stock-flow consistent models, which are more realistic, you’ll end up with having a lot of equations and parameters. Behaviour of each “sector” is articulated in these models. How money is created by the act of loan making by banks, to how households and firms accumulate assets and liabilities, to how firms making pricing decisions and how much they produce and how much households consume. In addition, the importance of fiscal policy is articulated: how governments make spending decisions, whether government expenditure can be thought of as exogenous and how in normal times—when politicians pay attention to how much the government’s deficit and debt it has—governement’s fiscal policy can be thought of as endogenous. And crucially, the supreme importance of the government’s finance in the financial assets/liabities creation process. While most economists stop at one time-step for the expenditure process, using stock-flow consistent models, you can see the full process. Moreover, the analysis highlights the correct direction of causalities. A good example is the direction of causation from prices to money.

I want to however highlight another important point. A lot about how the economy works can be understood without going too much into behaviour. Just national accounts, flow of funds and a minimal set of behavioural assumptions would be a great progress. The rest of the profession however struggles to even understand basic flow of funds. A lot can be understood because most of the times, economists are erring on basic accounting. Hence their story doesn’t add up and produces something completely unrelated to the real world. If only economists understood this, that’ll be a lot of progress. Stock-flow consistent models are rich in behavioral analysis but even without it, understanding flow of funds with a minimal set of assumptions is the right direction.