Last month, Matthew C Klein wrote an article for Financial Times’ blog Alphaville arguing against the concept of NAIRU. Today, Simon Wren-Lewis published a reply to Klein on his blog defending NAIRU. SWL’s argument is essentially that there is no alternative (TINA):

… But here is the rub. If we really think there is no relationship between unemployment and inflation, why on earth are we not trying to get unemployment below 4%? We know that the government could, by spending more, raise demand and reduce unemployment. And why would we ever raise interest rates above their lower bound?

… There is a relationship between inflation and unemployment, but it is just very difficult to pin down. For most macroeconomists, the concept of the NAIRU really just stands for that basic macroeconomic truth.

The sad part of this argument is that NAIRU isn’t the only answer to the relationship between (un)employment and inflation. Both of the following can be true:

- There is a relationship between employment and inflation.

- The concept of NAIRU is false.

What is NAIRU (non-accelerating inflation rate of unemployment)? According to the originators of this incorrect idea, it is the rate of unemployment U* below which inflation starts rising indefinitely. It’s a bit of a misnomer as it’s prices which is accelerating, not inflation. Nonetheless, the extreme nature of this should be clearly stated: NAIRU advocates think that a fraction of the workforce should be kept unemployed to keep inflation under control.

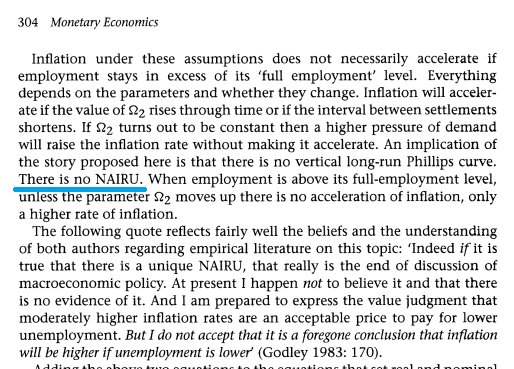

Post-Keynesians have rejected these arguments since the beginning. In their book Monetary Economics, Wynne Godley and Marc Lavoie show that in their model full employment can be achieved without a runaway inflation.

This is not the first time SWL has defended orthodoxy. A few years ago, he called rational expectations “one of economics’ major achievements” and also that:

It is not a debate about rational expectations in the abstract, but about a choice between different ways of modelling expectations, none of which will be ideal. This choice has to involve feasible alternatives, by which I mean theories of expectations that can be practically implemented in usable macroeconomic models.

…

However for the foreseeable future, rational expectations will remain the starting point for macro analysis, because it is better than the only practical alternative.