It seems that even post-Keynesians—with rare exceptions—are largely inattentive to open economy macro. Exceptions in this century are Wynne Godley and some people highly influenced by him.

In an article Wynne Godley Calls For General Import Controls, for LRB, published in the year 1980, Wynne Godley, argued:

For growth to be sustainable, it is essential that the management of domestic demand be complemented by the management of foreign trade (by whatever policies) in such a way that the net balance of exports less imports contributes in parallel to the expansion of demand for home production

Although in pedagogy Wynne Godley used to introduce the open economy late, it is central to his ideas. For example, you can expressions such as:

GDP ≈ (G + X)/(θ + μ)

where G, X, θ and μ are government expenditure, exports, the tax rate, and propensity to import. This is to first approximation

Even many post-Keynesians—not just neoclassical economists—giving public commentary recently in the aftermath of Trump’s tariffs however seem to be saying “do nothing“.

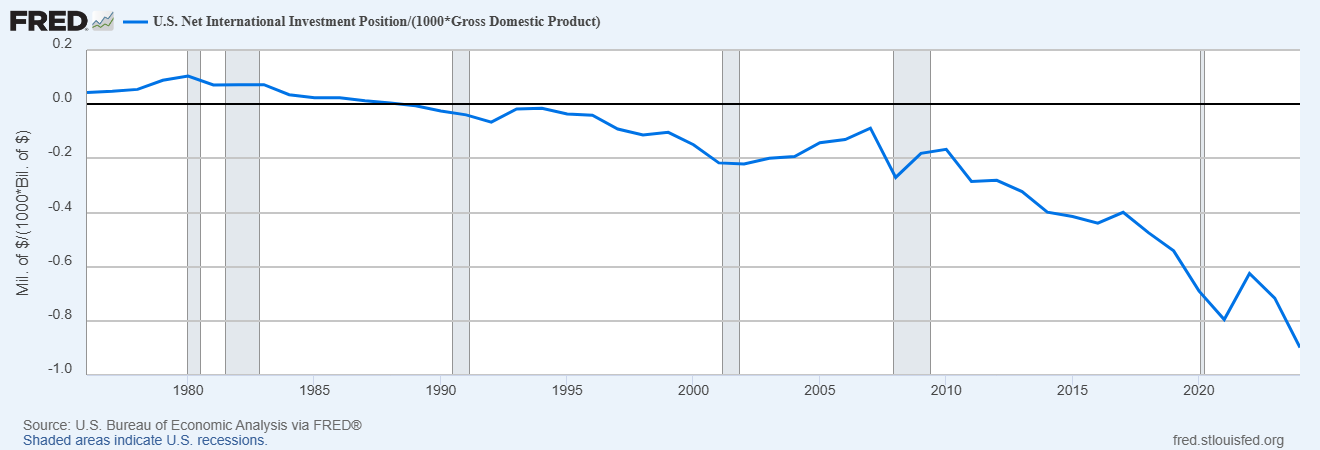

Before the financial crisis which started in 2007, fiscal stance was tight and US exports relative to imports was also low. So the above expression was lower than the actual GDP and growth was mainly driven by private sector borrowing at a large scale. When the recession happened, the fiscal part of the expression (G + X)/(θ + μ) was relaxed, although not enough to reach full employment. The process was still unsustainable since the international trade part of the expression did not grow in parallel with the fiscal part, continuing the worsening of the US balance of payments and international investment position.