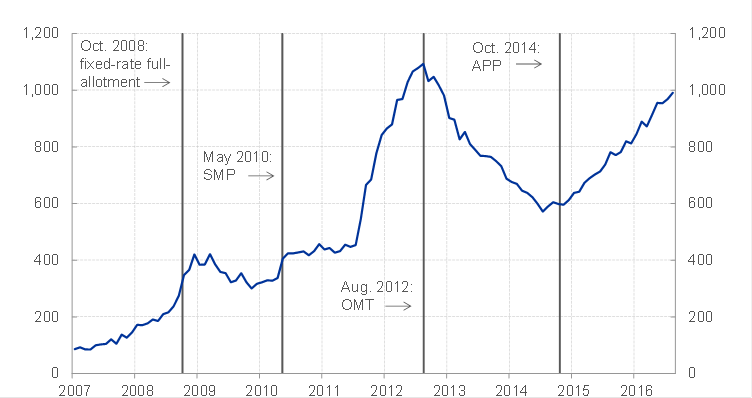

The European Union is founded on the principles of free trade. Dean Baker has a nice blog post on his blog Beat The Press titled, The Value Of The Pound Is Not A Measure Of The Success Or Failure Of Brexit. In that, he comments on Friday’s fall in the exchange rate of the Sterling.

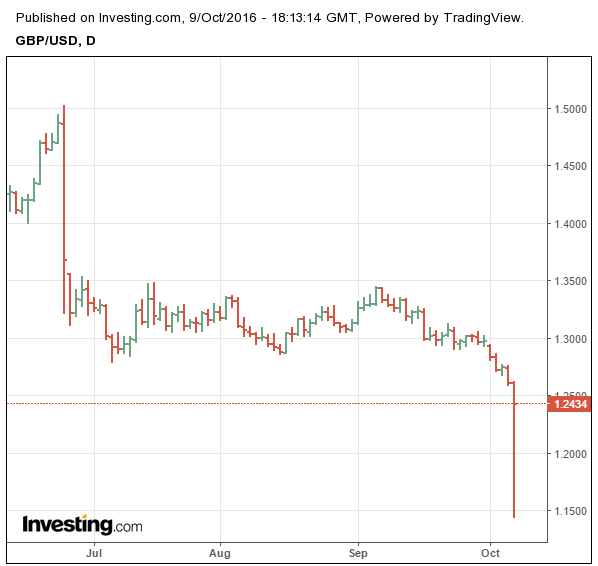

GBPUSD post EU Referendum

Reuters has even confirmed a low of $1.1378.

The fall has been claimed to be a failure of the UK 🇬🇧 exiting from the European Union. Dean Baker, although seems to side with the remain-in-the-EU camp, points out:

The Brexit vote was a case where the elites were clearly aligned against the UK leaving the European Union. While they had many good arguments on their side, and much of what the pro-Brexit crew was saying was nonsense, some of the elite gloating now also falls into the nonsense category.

The reason I say this is that he seems to think that there is no economic argument for leaving, while in my opinion, it is quite the opposite. Anyway, I really liked him saying that the elites were aligned against the non-elites. Unfortunately the UK far-right jumped on to this – arguing for exiting the European Union, and it made it easy for the neolibs to thrash arguments for leaving the European Union.

Anyway, the reason for the post is that there’s a frequent claim made around the UK’s current account deficit and the exchange rate in contrast to Baker who says:

Rather than being a negative for the economy, this is a positive development. It is the only plausible mechanism through which the UK can get closer to balanced trade.

Somewhat funnily, the neolibs whose arguments are about the magic of the “market mechanism” are making arguments similar to heterodox economists’ elasticity pessimism. According to the elasticity pessimism view income effects far outweigh the price effects and the market mechanism does not resolve imbalances in balance of payments. The elasticity pessimism view doesn’t claim that price effects do not matter at all.

But funnily, the anti-Brexit people seem to use this view since it suits their political purposes and what’s interesting is that even taking the view that price effects aren’t there! So they are claiming that the exchange rate movement can’t improve the UK balance of payments. Now an analysis of how much exchange rate movements have affected the UK’s exports and imports is difficult but instead of taking an empirical approach, let me make some theoretical arguments.

The claim is that wide movement of exchange rates hasn’t improved the UK current account balance. But that doesn’t mean it doesn’t matter. It just means that the income effects have far outweighed price effects. The depreciation of the Sterling should help the UK. To illustrate my point imagine this (numbers are just for illustration, aren’t actual):

Scenario: The UK current account deficit rises from 7% of GDP in 2016 to 8% of GDP in 2017.

This 1% rise might be explained by:

- 1.3% due to income effects: i.e. change in GNI at home and abroad, changes in non-price competitiveness.

- minus 0.3% due to price effects i.e., changes in the exchange rate and changes in price competitiveness.

So just superficially looking at empirical data might lead us to conclude that the fall in the exchange rate of the Sterling has had no improvement, but that’s not the case. The fall has helped but income effects have outweighed. If the exchange rate hadn’t changed, the current account deficit would have risen to 8.3% of GDP.

But if the UK current account balance of payments doesn’t improve, what is the point of all this you may ask. Well, for one a depreciated exchange rate helps at the margin but the more important effects—which depend on trade negotiations—tariffs etc, would depend on how the UK government manages to help its domestic industry and improve its non-price competitiveness. Leaving the EU would also mean that the UK regulates migration and this would help improve wages, employment and output.

It’s an extreme view that price effects do not matter. China, for example has a highly undervalued exchange rate obtained by official management by PBOC, China’s central bank. Elasticity pessimists do not think that price effects do not matter, only that income effects matter more typically and that the market mechanism does not resolve imbalances. Elasticity pessimism is not an extreme view but it is ironic to see the neolibs who have argue in favour of a common market to take an extremized version of the elasticity pessimism view.

There is even more irony in this. Not joining the European Union was a respectable view in the 70s when Nicholas Kaldor used to argue against joining the EU. But in recent times, it has been hijacked by the nationalists making it easier for neoliberals to claim victory. They just have to argue how the nationalists are wrong (which is true) but it doesn’t mean that the neoliberal project is correct.

Lastly, does it not matter if a currency has a run. Of course it does matter. Just that the Sterling’s fall can’t be called that and the UK is not really in danger because of the fall in the exchange rate. There are no expectations building around the Sterling like what happens to third-world nations’ currencies many times.