I believe that the basic problem today is not the exchange rate regime, whether fixed or floating. Debate on the regime evades and obscures the essential problem … Clearly flexible rates have not been the panacea which their more extravagant advocates had hoped … I still think that floating rates are an improvement on the Bretton Woods system. I do contend that the major problems we are now experiencing will continue unless something else is done too.

– James Tobin, A Proposal For Monetary Reform, 1978

Frances Coppola has written a post saying that floating exchange rates are not the panacea. Although I agree with her point, there are however a few points in her article which has some issues. She says that money stock is exogenous in gold standard.

Under a strict gold standard, the quantity of money circulating in the economy is effectively set externally. The domestic money supply can only grow through foreign earnings, which bring gold into the country.

… This is evident from the quantity theory of money equation MV = PQ, which is fundamentally flawed in a fiat currency fractional reserve system but works admirably under a strict gold standard or equivalent.

Frances is critiquing Neochartalists there but ends up accepting their notion that macroeconomics is something different when a nation’s currency is not floating and there’s an exogenous stock of money in fixed exchange rate regimes. There is absolutely no proof that it is so. Money stock can grow if there’s higher economic activity due to rise in private expenditure relative to income or via fiscal policy. But why this obsession with Monetarism? It doesn’t work anywhere: whether the exchange rate is fixed or floating. All arguments made in Post Keynesian economics carry through to the gold standard. Indeed Robert Mundell himself realized this in 1961 [1].

Here’s a quote from the book Monetary Economics by Wynne Godley and Marc Lavoie, page 197, footnote 11:

It must be pointed out that Mundell (1961), whose other works are often invoked to justify the elevance of the rules of the game in textbooks and the IS/LM/BP model, was himself aware that the automaticity of the rules of the game relied on a particular behaviour of the central bank. Indeed he lamented the fact that modern central banks were following the banking principle instead of the bullionist principle, and hence adjusting ‘the domestic supply of notes to accord with the needs of trade’ (1961: 153), which is another way to say that the money supply was endogenous and that central banks were concerned with maintaining the targeted interest rates. This was in 1961!

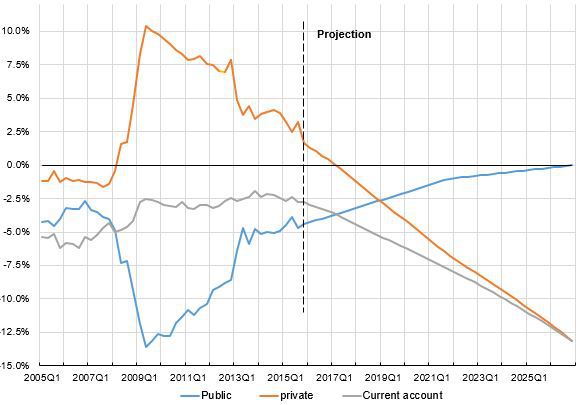

Bretton Woods was the emperor’s new clothes and floating exchange rates are the emperor’s new new clothes. The important question is whether floating exchange rates offer any market mechanism to resolve balance of payments imbalances and the answer is that it doesn’t. In gold standard, current account deficits can be financed by official sale of gold in international markets and residents borrowing from abroad. In floating exchange rate regimes, it is financed by borrowing from abroad. Hardly much difference. So the main adjustment is left to movement of the exchange rate. One needs to suspend all doubt and believe in the invisible hand to think the movement of exchange rates can do the trick. The reason it is the emperor’s new new clothes is that the promises never worked. And similar promises were made by economists that there’s a market mechanism to resolve balance of payments imbalances in fixed exchange rate regimes.

To summarize, my argument is that the only point to debate is whether floating the exchange rate resolves imbalances as compared to fixed exchange rates, not about the endogeneity of money. Although there is a role because of the movement of the exchange rate, floating exchanges is not a panacea. Although I am not on the side of the Neochartalists in the debate, I thought I’d point this out: do not fall into the pitfall of your opponent.

- Mundell, R. (1961) ‘The international disequilibrium system’, Kyklos, 14 (2),

pp. 153–72.