Recently, Martin Feldstein wrote a WSJ article The Federal Reserve’s Policy Dead End with a subheading summary “Quantitative easing hasn’t led to faster growth. A better recovery depends on the White House and Congress”.

This has led to various dubious debunking such as “Feldstein doesn’t understand how QE works”.

In the following (although I am no fan of his) I will try to show that he is about right – at least with his WSJ article.

Feldstein neatly summarizes:

Quantitative easing, or what the Fed prefers to call long-term asset purchases, is supposed to stimulate the economy by increasing share prices, leading to higher household wealth and therefore to increased consumer spending. Fed Chairman Ben Bernanke has described this as the “portfolio-balance” effect of the Fed’s purchase of long-term government securities instead of the traditional open-market operations that were restricted to buying and selling short-term government obligations.

Here’s how it is supposed to work. When the Fed buys long-term government bonds and mortgage-backed securities, private investors are no longer able to buy those long-term assets. Investors who want long-term securities therefore have to buy equities. That drives up the price of equities, leading to more consumer spending.

This has also been the position of Ben Bernanke. Here is from his Jackson Hole speech in 2012:

Imperfect substitutability of assets implies that changes in the supplies of various assets available to private investors may affect the prices and yields of those assets. Thus, Federal Reserve purchases of mortgage-backed securities (MBS), for example, should raise the prices and lower the yields of those securities; moreover, as investors rebalance their portfolios by replacing the MBS sold to the Federal Reserve with other assets, the prices of the assets they buy should rise and their yields decline as well.

and both the views are as per Tobin’s theory of asset allocation.

Now before we proceed let us agree from the start that the naive Monetarist view that central banks creating reserves and this leading to more lending because of the money-multiplier effect is incorrect because – as has been stressed by Post-Keynesians since long, the causality is the opposite. Just because banks hold more reserves doesn’t mean banks’ customers become more creditworthy. Moreover, the naive Monetarist view suffers from confusing fiscal policy and monetary policy.

This however doesn’t mean that LSAPs (Large Scale Asset Purchases) or “QE” doesn’t have any effect. So the question is if it has any effect on asset prices such as equities. This can be seen easily. The non-bank private sector allocates its wealth into various assets and with central bank purchasing government bonds, the non-bank private sector has less stock of government bonds to allocate its wealth into. Of course in the first approximation the supply of equities is independent of central bank asset purchases, so the asset allocation equations lead to a higher clearing price of equities. And this is proportional to the amount of asset purchases by the central bank.

So rise in equity prices because of central bank asset purchases isn’t inconsistent with the theory of endogenous money.

Of course, firms may issue more equities or bonds seeing the rise in asset prices so there is a competition but the net effect will be a rise in prices because firms net issuing more securities depends on many things such as their management’s outlook about demand for their products and services in the medium term and it isn’t the case that they see any significant rise.

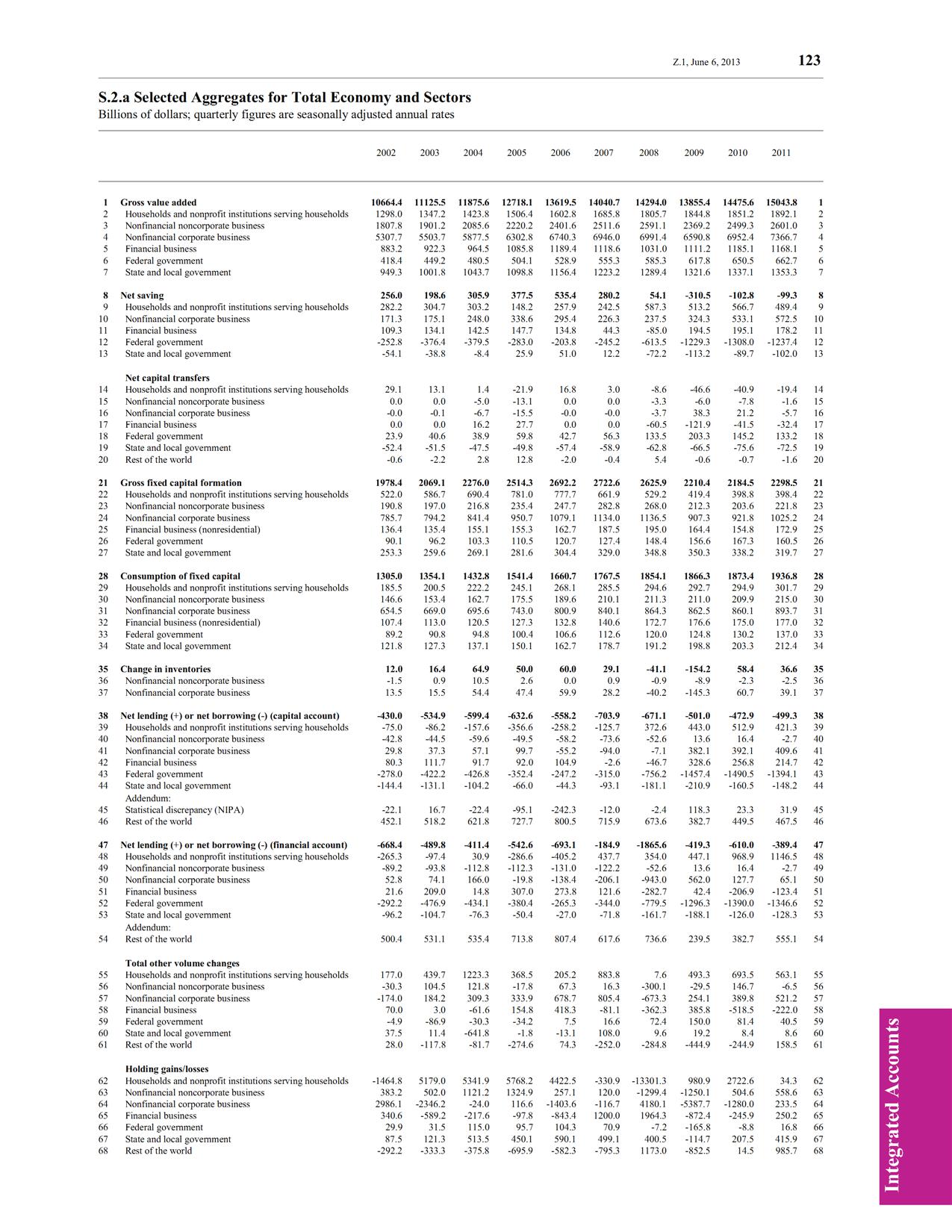

Assuming it leads to rise in prices of equity securities, this will lead to higher holding gains. Since this leads to higher household wealth, consumption will rise. However, the effect on output is too less and cannot be noticed in national accounts as pointed out by Feldstein and there is little sign that LSAP had produced this effect.

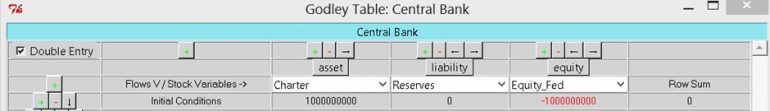

Tobin’s theory of asset allocation can’t be summarized so easily in a blog post but is roughly as follows: households receive income from various sources such as wages, dividends, interest payments etc. and consume a proportion of it. The remainder is allocated into various assets – financial and nonfinancial. They also have wealth accumulated over time and the theory of asset allocation (improved significantly by Wynne Godley) models this by writing equations for the allocation of wealth into assets. Each asset has a different return and different uncertainty attached to it and there is a different preference for each. So the allocation into one asset class depends both on the return and the portfolio preference. Of course there needs to be a system wide consistency and one has to worry about such technicalities. Some parameters are exogenous (such as the short term interest rate set by the central bank) and some are determined by the model – such as the price of equities, so that demand and supply are brought into equivalence. So the model also determines variables such as amount of money held by households and so on.

Tobin’s theory of asset allocation can also be used with little modifications to consider central bank LSAPs. So central bank purchases of financial assets won’t have direct effects on household consumption but will have an effect on asset allocation and an indirect effect on consumption and output because of capital gains.

Back to the real world from the model world.

To be clear, there are two effects here. The first is the rise in the price of equities and the second a rise in output because of higher consumption due to capital gains . The former may be high but not the latter. Or both may be high (unlikely in the current scenario). But plainly asserting there is no effect is incorrect.

Feldstein seems to understand this except emphasising the the rise in stock prices has been more due to rise in earnings than due to the asset allocation effect of LSAP. So while he seems to understand this, his emphasis is different.

In my opinion, the Federal Reserve LSAP has led to higher asset prices than otherwise but this hasn’t had any measurable effect on consumption.

Worth mentioning is the muddled Krugman IS/LM + liquidity trap view based on the loanable funds theory – although Krugman has been arguing rightly about fiscal policy in recent times. In my opinion, Krugman himself has managed to divert attention away from fiscal policy in all these years.

The unfortunate part of the debate is not the debate itself but the huge waste of time and the Federal Reserve has played a big role in this by implicitly downplaying the role of fiscal policy. Central bank asset purchases is promised land economics.