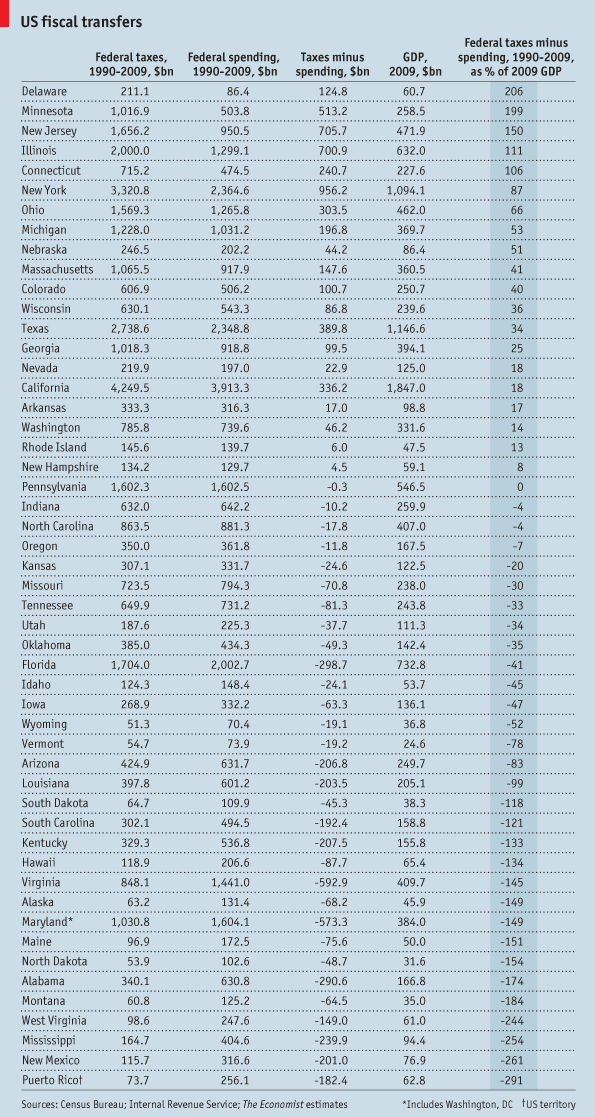

Wynne Godley used to say that fiscal transfers happen without anyone really noticing. From The Economist, fiscal transfers in the US (finally gets noticed!):

Author Archives: V. Ramanan

Nationalistic Solutions?

A few posts back, I refered to an article by James Tobin [1]. It has a nice but pessimistic ending:

Coordination of macroeconomic policies is certainly not easy; maybe it is impossible. But in its absence, I suspect nationalistic solutions will be sought – trade barriers, capital controls, and dual-exchange rate systems. Wars among nations with these weapons are likely to be mutually destructive. Eventually, they, too, would evoke agitation for international coordination.

References

- James Tobin, Agenda For International Coordination Of Macroeconomic Policies, Ch 24, p 633, Essays In Economics, Volume 4: National And International, The MIT Press, 1996

r < g Or DEF < g ?

It is frequently asserted by some economists and even some Post-Keynesians that as long as the effective interest rate paid on stocks of debt is less than the growth rate, stock-flow-norms do not keep rising forever. That is, ratios such as public debt/gdp, external debt/gdp do not rise forever at full employment if this condition is maintained, implying thereby that fiscal policy can be used to achieve a higher output and there is nothing one needs to do about the external sector.

It is the purpose of this post to clear such misconceptions.

Fiscal Policy

What can fiscal policy achieve and what are its limitations? In an essay from the centenary conference of 1983, Wynne Godley wrote [1]:

How did Keynes think the economy worked? Any time between 1950 and 1970 1 would have confidently attributed to Keynes, as preeminently important, the following views about economic policy:

(a) Real demand, output and employment are determined via a multiplier process by the fiscal and monetary operations or the government and by foreign trade performance.

(b) Inflation, though influenced by the pressure of demand, is largely indeterminate in terms or economic variables and therefore, if it is to be controlled, requires some kind of direct political intervention.

(c) Fiscal and monetary policies in any one country are potentially subject to important external constraints.

While there is reasonable support for these views about economic policy in Keynes’s writings, there is no warrant for them at all in the General Theory. Indeed it is strange, seeing how commonly the view is attributed to Keynes that fiscal policy is crucial to real output determination, that the General Theory is concerned with an economy in which neither a government nor for that matter a foreign sector exist at all.

Notwithstanding this I still think, not only that the propositions can be correctly attributed to Keynes, but that they are, themselves, essentially correct. I have however been forced to the conclusion that Keynes was a long way from achieving a coherent theoretical basis for maintaining them, and largely for this reason, his ideas have proved very vulnerable to the attacks from many different directions to which they have been subjected, particularly in the last fifteen years.

To points (a), (b) & (c) above, let me add

(a(i)) Higher output is also possible when the private sector expenditure is higher than private sector income.

This was highlighted by Godley himself in the late 90s, when the US economy expanded in spite of a tight fiscal stance and he was the first to write that this process is unsustainable!

Debt Convergence Analysis

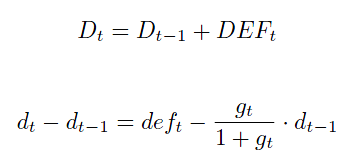

Let us now turn to the question on convergence/divergence of stock-flow norms. In what follows, I simply use debt to denote the public debt or the external debt. Assuming away complications arising from revaluations, we have the identities [2]

Uppercase is for stock of debts, and lower case for debt-to-gdp ratio and g is the growth rate. Note: DEF is primary deficit and excludes interest payments. We will turn to complications added by interest payments soon. Whenever

the stock of debt keeps rising.

Note, when the debt-to-gdp ratio is less than 1 (100%), the sustainability condition is strong on the deficit. The condition DEF < g is at at a debt-to-gdp ratio is 1. Beyond 100%, the condition on the deficit is a bit weaker than DEF < g because the deficit can be between g and g·d.

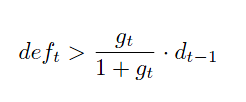

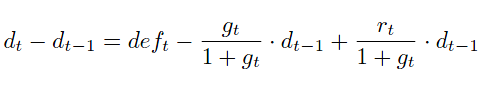

This argument is sometimes presented differently by some Post Keynesians by including the effective interest rate r. The equation looks like the following when it is included:

It is argued that the third term on the right hand side can be set to be greater than the second term (which is to say that r < g is sufficient to ensure sustainability).

This argument (r < g guaranteeing problems are solved) has no substance. This is because rearranging the terms in the way done above, shows more clearly that the stock-flow ratio rises faster than the case where the analysis was done without the interest rate term!

There is one more complication. It may be argued that growth can only bring down the deficit (the deficit here being the public sector deficit). This is true for the case of a closed economy. The convergence of the public debt-to-gdp ratio is also achieved in the case of a closed economy because interest payments by the government is income for the private sector and they will consume it (although the capitalist class’s propensity to consume is less than that of the worker class). Higher consumption leads to higher national income and hence higher taxes, bringing down the deficit.

Wynne Godley and Marc Lavoie [3] showed how this happens precisely in the case of a closed economy:

This paper deploys a simple stock-flow consistent (SFC) model in order to examine various contentions regarding fiscal and monetary policy. It follows from the model that if the fiscal stance is not set in the appropriate fashion—that is, at a well-defined level and growth rate—then full employment and low inflation will not be achieved in a sustainable way. We also show that fiscal policy on its own could achieve both full employment and a target rate of inflation. Finally, we arrive at two unconventional conclusions: (1) that an economy (described within an SFC framework) with a real rate of interest net of taxes that exceeds the real growth rate will not generate explosive interest flows, even when the government is not targeting primary surpluses, and (2) that it cannot be assumed that a debtor country requires a trade surplus if interest payments on debt are not to explode.

Also, they create some very special scenarios, where the external debt stays sustainable.

However, making the above work is difficult for the case of an open economy in general. This was what the essential argument of the New Cambridge School.

So is there a way to achieve convergence of the stock-flow norm? To achieve that, the external sector deficit (more precisely, the primary balance in the current balance of payments) should be less than the growth rate times the external debt. This creates tensions for demand-management because if the external deficit grows higher than the growth rate, it is usually brought back to a sustainable path by deflating demand. This is because the balance of payments deficit itself will grow if growth is high! (unless exports improve).

There are of course some scenarios which can lead to the convergence of the external debt (if the markets allow it). A more careful treatment will always lead one to studying income and price elasticities of imports, growth in the rest of the world etc.

Other scenarios which could lead to the improvement of the external sector are: promotion of exports leading to more success abroad and luck – market forces miraculously achieving the required depreciation to improve the external sector. Since the latter is mere wishful thinking, we see nations trying to depreciate their currencies because it makes their exports more competitive.

To bring the balance of payments deficit back into balance, there is also the option of restricting imports but in the world of “free trade”, it can create tensions between nations.

There are two more options. The first is to ask your trading partners to appreciate their currencies if they have pegged them but this has to go through negotiations because they want you to do the same! The second (which includes the previous option) is what this blog is about. Since, the external sector creates problems for demand management, one can only think of coordinated efforts by institutions running the world economy, working to achieve higher world demand instead of contracting it.

References

- Wynne Godley, Keynes And The Management Of Real Income And Expenditure, p135, Keynes And The Modern World: Proceedings Of The Keynes Centenary Conference, ed. David Worswick and James Trevithick, Cambridge University Press, 1983.

- Gennaro Zezza, Fiscal Policy And The Economics Of Financial Balances, Levy Institute Working Paper 569, 2009. Available at http://www.levyinstitute.org/publications/?docid=1161

- Wynne Godley and Marc Lavoie, Fiscal Policy In A Stock-Flow Consistent Model, p 79, Journal of Post Keynesian Economics / Fall 2007, Vol. 30, No. 1. Draft version available at http://www.levyinstitute.org/publications/?docid=911

More On Horizontalism

Horizontalism, Endogenous Money and ideas such as that were brought into Macroeconomics by Nicholas Kaldor. In [1] he wrote

Diagrammatically, the difference in the presentation of the supply and demand for money, is that in the original version, (with M exogenous) the supply of money is represented by a vertical line, in the new version by a horizontal line, or a set of horizontal lines, representing different stances of monetary policy.

Loans Make Deposits. Deposits Make Reserves

In 1985, Marc Lavoie [2] coined the phrase Loans Make Deposits and Deposits Make Reserves. In the article Credit And Money: Overdraft Economies, And Post-Keynesian Economics, he says:

Orthodox monetary economics is founded on the double entry hypothesis of free reserves and the credit multiplier Each individual bank may only increase its loans to the public when depositors increase their balances there, i.e., when free cash reserves augment for that one bank. In the aggregate, commercial banks are allowed to make supplementary loans when they dispose of free reserves. The latter can be obtained through modifications of the behaviour of the public, as a result of a surplus in the foreign account, as a consequence of the intervention of the central bank on the open market, or following a change in the reserve requirements. Although the credit multiplier functions on the basis of an expansion of credit, deposits make loans in the orthodox context. The usual sequence of events is as follows: the central bank buys some security from a member of the public; the deposits of this person are increased; the bank which benefits from these increased deposits now disposes of excess reserves and can make new loans …

… The credit-money view rejects this approach to money and inflation by reversing the sequence of events. According to the unorthodox view, loans make deposits. Banks do not wait for the appropriate amount of liquid resources to exists to provide new loans to the public (mainly firms). Credits are created ex nihilo. The recipient of the purchasing power is the initial recipient of the loan. When the bank makes a new loan, the borrower is being immediately credited with a deposit, the amount of which is exactly equal to the amount of the loan. Hence, the increase in the supply of money is a consequence of increased loan expenditure, not a cause of it. The loan is the causal factor …

… Once commercial banks have created credit money, how do they get hold of the reserves required by the newly created deposits or how do they obtain the currency cash requested by the public? In many European banking systems, France in particular, commercial banks simply borrow their requirements in high-powered money. Most banks are permanently indebted to the central bank. The money market in those circumstances does not play a fundamental role. When banks, overall, are in need of more high-powered money, they increase their borrowings with the central bank at the discount rate set by the latter. Legal reserve ratios, when they do exist, are not used to control the created quantity of money. They exist to increase the cost of the loans granted by the banks since reserves carry no interest revenue …

… It is often claimed that the North American and German banking systems function in quite a different way. This however is an illusion. Although institutional arrangements are quite dissimilar, the expansionary process of credit is the same… First… banks grant legally binding lines of credit which imply future access to reserves. Second, North American banks must respond to lagged required reserve-accounting conventions. Third, banks always have access, although limited, to the discount window of the central bank.

References

- Nicholas Kaldor, Keynesian Economics After Fifty Years, p22, Keynes And The Modern World, ed. George David Norman Worswick and James Anthony Trevithick, Cambridge University Press, 1983.

- Marc Lavoie, Credit And Money: Overdraft Economies, And Post-Keynesian Economics, pp 67-69, Money And Macro Policy, ed. Marc Jarsulic, 1985. (Available at UMKC’s course site)

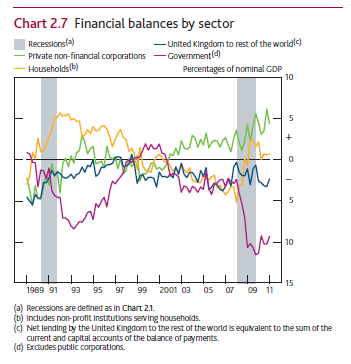

Chart: Bank Of England Tracks Financial Balances!

Today the Bank of England was out with its quarterly Inflation Report and I happened to find a graph which tracks the sectoral balances. Here it is

Not sure why it leaves out financial corporations though.

Coordinated Action? G7 Statement

Statement of G7 Finance Ministers and Central Bank Governors

August 8, 2011

In the face of renewed strains on financial markets, we, the Finance Ministers and Central Bank Governors of the G-7, affirm our commitment to take all necessary measures to support financial stability and growth in a spirit of close cooperation and confidence.

We are committed to addressing the tensions stemming from the current challenges on our fiscal deficits, debt and growth, and welcome the decisive actions taken in the US and Europe. The US has adopted reforms that will deliver substantial deficit reduction over the medium term. In Europe, the Euro area Summit decided on July 21 a comprehensive package to tackle the situation in Greece and other countries facing financial tensions, notably through the flexibilisation of the EFSF. We are now focused on the quick and full implementation of the agreements achieved. We welcome the statement of France and Germany to that effect. We also welcome the statement of the Governing Council of the ECB.

We are committed to taking coordinated action where needed, to ensuring liquidity, and to supporting financial market functioning, financial stability and economic growth.

These actions, together with continuing fiscal discipline efforts will enable long-term fiscal sustainability. No change in fundamentals warrants the recent financial tensions faced by Spain and Italy. We welcome the additional policy measures announced by Italy and Spain to strengthen fiscal discipline and underpin the recovery in economic activity and job creation. The Euro Area Leaders have stated clearly that the involvement of the private sector in Greece is an extraordinary measure due to unique circumstances that will not be applied to any other member states of the euro area.

We reaffirmed our shared interest in a strong and stable international financial system, and our support for market-determined exchange rates. Excess volatility and disorderly movements in exchange rates have adverse implications for economic and financial stability. We will consult closely in regard to actions in exchange markets and will cooperate as appropriate.

We will remain in close contact throughout the coming weeks and cooperate as appropriate, ready to take action to ensure stability and liquidity in financial markets.

So Finance Ministers and Central Bank Governors are indeed thinking about it, but with more emphasis on fiscal retrenchment (the muddle!) and more importantly …

Just today, I had two volumes of Tobin’s Essays In Economics (Volumes 1 and 4) delivered to me by amazon.com and I straightaway headed to the chapter Agenda For International Coordination Of Macroeconomic Policies. Tobin writes [1]

Coordinate policies! So economists urge governments. Financiers, journalists, pundits, politicians take up the cry. Central bankers and finance ministers agree, as do presidents and prime ministers. They meet, they talk, they announce progress. It turns out to amount to very little…

History repeats itself!

References

- James Tobin, Agenda For International Coordination Of Macroeconomic Policies, Ch 24, p 633, Essays In Economics, Volume 4: National And International, The MIT Press, 1996

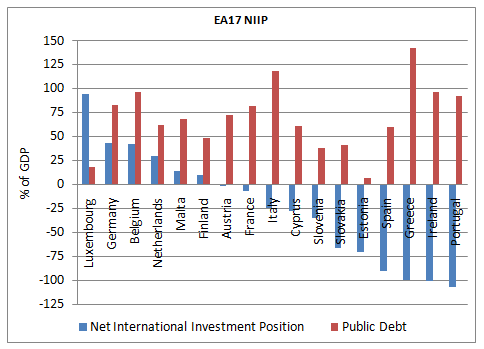

Chart: Eurozone Indebtedness

The Euro Zone is under a crisis. Is there a chart which shows what the underlying factor is which makes the difference ? Below:

You can see that the external situation is clearly the one which makes the difference as opposed to the public debt. It’s true that Belgium’s bond market is under pressure – creditors may not like high public debt but I think the graph is still useful.

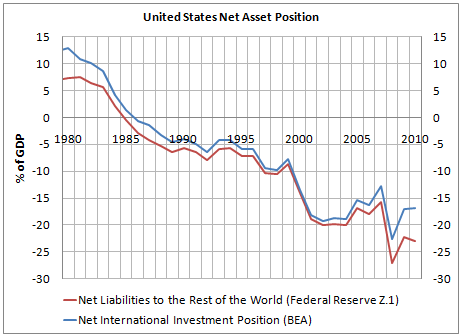

Chart: U.S. Indebtedness

The Net International Investment Position is measure of how indebted a nation is. Why is that so ? Combine all the balance sheets of the sectors of a nation. Debts between residents cancel out and one is left with assets held abroad and liabilities to non-residents. One can replace “residents” with “citizens” and define a slightly different system of accounts and hence there is more than one way of doing it. The difference between assets and liabilities is called the net international investment position or net asset position. Below you see how this has changed over the years for the United States and how it has moved from positive to negative number territory over the years.

There are many discussions we can have one this – never ending ones! This could range from sustainability of this to whether this is problematic since most of the liabilities to foreigners is in US Dollars. Also, there are many stories on the movement of this graph with puzzles such as the dark matter problem. Each is worthy of being analyzed in detail, but for now my viewpoint:

The fact that liabilities to foreigners is in US Dollars is advantageous to the United States not because of the usual reasons given but because the liabilities do not suffer from revaluation losses if the dollar depreciates. But only advantageous at best. Not more.

Enough stories over many future blogs.

bfn.

Conclusion Section Of Post #1

Too excited to get my blog going, I finished my first post midway.

Sectoral Imbalances are of many kinds. The US private sector ran deficits for a long time and this lead to the financial crisis and the Great Recession. Frequently, you hear about the shift in the distribution of income and this can also be studied with the Sectoral Balances Approach. Central bankers and policy makers have also realized that global imbalances are unsustainable.

This blog is about how to achieve sustainable growth in the short, medium and the long run and in the author’s opinion can come about only if international policies are coordinated. Policy coordination is not a new concept but for many years before the crisis, imbalances were allowed to continue even though many policy makers took notice of this. In my opinion, these were allowed to continue because the implicit assumption was that “market forces” will work toward resolving the imbalances.

When the world entered a period of catastrophe, governments took action and turned Keynesians overnight. So the G-20 made this statement in the Summit on Financial Markets and the World Economy in 2008:

Use fiscal measures to stimulate domestic demand to rapid effect, as appropriate, while maintaining a policy framework conducive to fiscal sustainability.

to prevent a bigger implosion and later in the 2011 summit

Our aim is to promote external sustainability and ensure that G20 members pursue the full range of policies required to reduce excessive imbalances and maintain current account imbalances at sustainable levels.

However, the G-20 summit participants and the IMF seem to bring about the reversal of imbalances via fiscal contraction – as if there is no negative effect of the latter on domestic and world demand!

Wynne Godley and Francis Cripps [1] described confusions in the policy makers’ minds wonderfully in the Introduction of their 1983 book Macroeconomics

Our objective is most emphatically a practical one. To put it crudely, economics has got into an infernal muddle. This would be deplorable enough if the disorder was simply an academic matter. Unfortunately the confusion extends into the formation of economic policy itself. It has become pretty obvious that the governments of many countries, whatever their moral or political priorities, have no valid scientific rationale for their policies. Despite emphatic rhetoric they do not know what the consequences of their actions are going to be. Moreover, in a highly interdependent world system this confusion extends to the dealings of governments with one another who now have no rational basis for negotiation.

To conclude, the muddle in describing how economies work in Economics has been terrible for world demand (except periods of expansion through unsustainable private sector deficits which end in crises). My blog aims to bring forward ideas in Monetary Economics and how it can be used to achieve active management of economies rather than leaving the task to “market forces”.

References

- Wynne Godley and Francis Cripps, p13, Macroeconomics, Oxford University Press, 1983.

Horizontalism

The central message of this book is that members of the economics profession, all the way from professors to students, are currently operating with a basically incorrect paradigm of the way modern banking systems operate and of the causal connection between wages, prices, on the one hand, and monetary developments, on the other. Currently, the standard paradigm, especially among economists in the United States, treats the central bank as determining the money base and thence the money stock. The growth of the money supply is held to be the main force determining the rate of growth of money income, wages, and prices.

… This book argues that the above order of causation should be reversed. Changes in wages and employment largely determine the demand for bank loans, which in turn determine the rate of growth of the money stock. Central banks have no alternative but to accept this course of events, their only option being to vary the short-term rate of interest at which they supply liquidity to the banking system on demand. Commercial banks are now in a position to supply whatever volume of credit to the economy their borrowers demand.

– Basil Moore, Horizontalists and Verticalists, 1988 [1]

Most economics books come nowhere close to starting like this. To be fair, when Moore wrote the book, many Post-Keynesians thought that this picture is too simplified. Only a few – such as Marc Lavoie – supported Moore’s view. He himself had been writing about the Post-Keynesian theory of money for some years, around that time. The supposed simplicity gave rise to the long debate Horizontalism versus Structuralism. There’s a lot of nice literature on this and its worth a read.

What do the terms horizontal and vertical refer to? Economists make supply-demand diagrams in which price is on the y-axis and quantity is on the x-axis. Moore called neoclassical economists Verticalists because according to them, the “money supply” is vertical in the diagram. “Money demand” is downward sloping. The interest rate at which the supply and demand curves meet is the market interest rate. Horizontalists, strongly believe that this is exactly wrong and the supply curve is horizontal at the rate determined by the central bank. The quantity of money, then, is the point at which the non-banking sector’s desire to hold money balances (as opposed to “demand”) determines the money stock (as opposed to “supply”). Of course, as explained by Louis-Philippe Rochon and Matias Vernengo [2], the idea of making supply-demand diagrams is only a second-best tool, the more important point being that money is endogenous.

Recommend Moore’s book. I had previewed the book at amazon.com but had to search the whole internet to get it. I tried a Greek and a French seller and ordered online, only to be told later I should expect a refund since that the book is out of stock and wrongly mentioned on the website as available. I finally found a seller at Amazon France selling a used copy for €175.38 but would deliver only to a few countries. I had to get it shipped to a friend in the US and ask him to ship it to me, which cost me an extra $94.

References

- Basil Moore, Horizontalists and Verticalists, The Macroeconomics Of Credit Money, Cambridge University Press, 1988.

- Louis-Philippe Rochon and Matias Vernengo, Introduction, p2, Credit, Interest Rates And The Open Economy: Essays On Horizontalism, ed. Louis-Philippe Rochon and Matias Vernengo, Edward Elgar Publishing, 2001.

Update: 4 Jan 2012: Fixed some errors in the quote.