What is the main problem of the world? It’s that there is no market mechanism to resolve imbalances in balance of payments and international investment positions. So official mechanisms are needed and countries look for reform the world order to make the world work better.

Defend Wikileaks recently reminded us of cables from 2009 on how the US and UK governments worked to prevent the reform the world economic and financial system.

- Confronting the UN

The UK and US have worked together to prevent reform of the world financial system.

In May 2009 Douglas Alexander, Secretary of State for International Development and John Sawers, then UK permanent representative to the UN who later that year became chief of MI6, held a meeting with US ambassador to the UN, Susan Rice. A US cable notes that:

Alexander and Sawers began the meeting by noting their concern that Cuba, Iran, Venezuela and other ‘radical’ G-77 countries would use the upcoming June 1-2 UN Conference on the World Financial and Economic Crisis and its Impact on Development to push for an outcome document that would for the first time, give the UN General Assembly a role in negotiations on revamping the Bretton Woods financial institutions and the world financial system.

To counter this:

Sawers urged the United States to work with the UK to monitor preparatory meetings for the conference, quickly push back against the introduction of activist policy language into the outcome document, and split off more moderate G-77 countries who are already G-20 members.

Rice agreed, stating that:

It would be important to work with the Netherlands (a co-facilitator for the negotiations on a conference outcome document) to tone down expectations and ensure that moderate G-77 countries continue to see the G-20 discussions as the proper venue for discussing BWI [Bretton Woods Institutions] reform.[32]

The link in the endnote has the link to the cable.

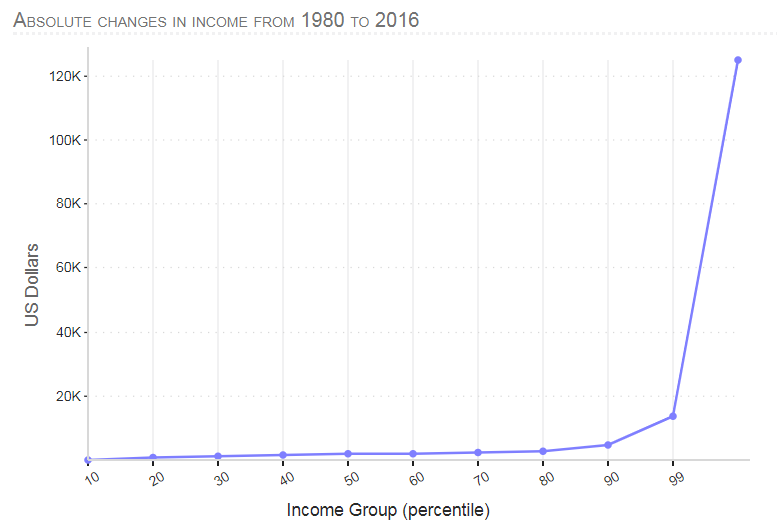

graph is a propaganda chart. Although it wasn’t the intent of original authors, it has been used by neoliberals to try to prove that globalisation is leading to convergence.

graph is a propaganda chart. Although it wasn’t the intent of original authors, it has been used by neoliberals to try to prove that globalisation is leading to convergence.