Randall Wray has a new article Does America Need Global Savings To Finance Its Fiscal And Trade Deficits? at American Affairs.

Wray repeats the standard Neochartalist argument that the United States does not have to worry about its trade deficits. But a look at his previous predictions would warn us on such arguments.

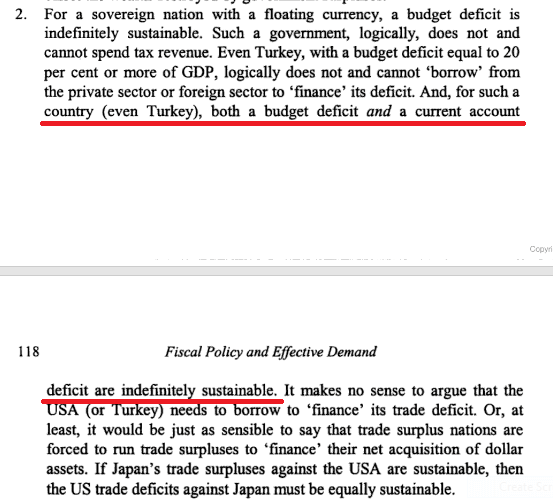

Here’s from his chapter What A Long, Strange Trip It’s Been: Can We Muddle Through Without Fiscal Policy? in the book Post-Keynesian Principles of Economic Policy written in 2006:

click to view on Google Books

🤦🏻♂️

The root of the confusion lies on the fact that imports are paid in the domestic currency (although that’s not always the case). That the importing nation creates credit to purchase does not mean that it’s not debt and without consequences. The recent experience of Turkey: the rapid fall in its currency, rise in interest rates to attract financial flows to stabilise its exchange rates and the slowdown of its economy shows the problem with current account deficits.

The United States of course is not Turkey but such arguments should warn us of the pitfalls. It’s difficult to foresee how a balance-of-payments crisis will look for the United States, considering that some its creditors are large and their actions might be damaging to themselves. Perhaps they could reduce their holdings over time and then this advantage is not available to the US.

But even if there’s no immediate risk of an external financing crisis doesn’t mean that trade isn’t damaging to the United States. Expenditure multiplier would have been bigger had the US trade parameters been in its favour. As a consequence unemployment rate would have fallen much faster after the economic and financial crisis which started in 2007.

Recent data has indicated that the US NIIP continues to deteriorate. At the end of Q3, 2018 it was −$9.62tn which is around −46% of GDP. Surely can go lower but won’t stabilise unless the US does something about its trade imbalance.