Review Of African Political Economy Issue On Samir Amin

Historically advanced countries have developed at the expense of poor countries. It doesn’t have to be that way, and that offers some optimism, but it is crucial to recognise this to make an alternative world without imperialism.

The latest issue of Review of African Political Economy has a special on Samir Amin who developed the dependency theory. For Amin, the international aspect of political economy is central to the subject, not something which needs to be added in the end as a sort of technicality.

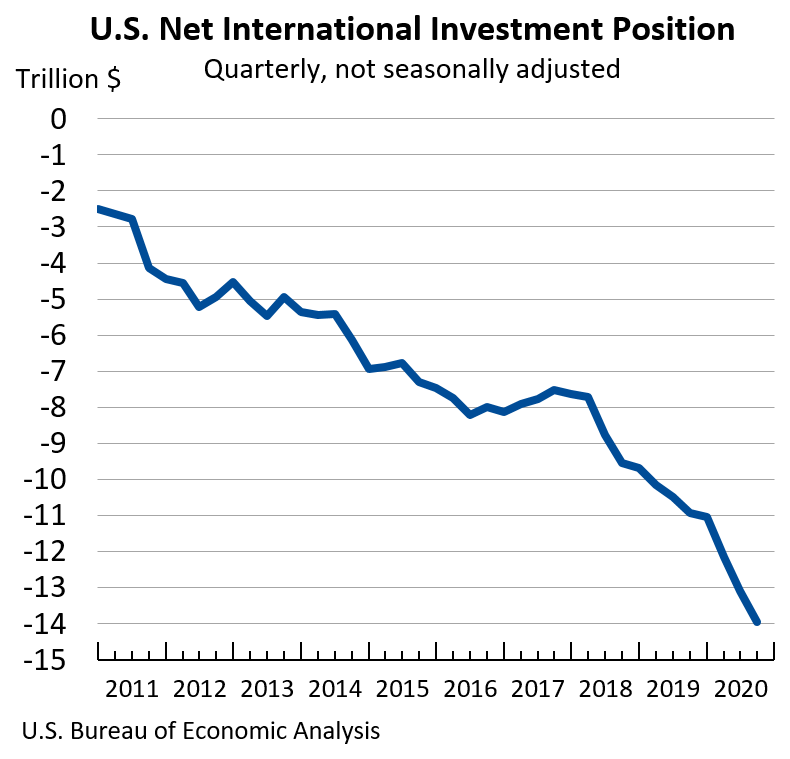

In a laissez-faire world, there is no convergence in the fortunes of economies but polarisation. Anyone who is left-leaning in political ideology and is looking for other reasons while ignoring this to explain the world is fooling themselves.

Dependency theory is quite consistent with Post-Keynesian theory. There is an explicit framework of how this happens and that framework is Kaldorian growth theory.

A new world would work to make countries economically independent and reduce the role of the hegemon, the United States in world affairs. It would work in practice by a plan like Keynes’ plan involving significant transfers from the rich to the poor.

A lot of people simply claim that countries just need to copy the Scandinavian model. It’s true that those countries have some things better than the US, but it’s not like everything is great. For example their economic orthodoxies weren’t better than Washington wisdom after the economic and financial crisis which started in 2007. Also, in recently these countries voted against removing intellectual property protections for rich countries for vaccines. When the Scandinavian countries’ governments are themselves part of imperialism, that should raise doubts about the model. More importantly, international constraints put a barrier on trying to become like these countries minus their imperialism.

Articles free to read till March end. The title is the link.

Articles free to read till March end. The title is the link.