Gennaro Zezza has shared a 1987 paper by him and Wynne Godley modeling the Italian economy using a “real stock flow monetary model”

The Cambridge Political Economy Society Digital Archive

I came across the Cambridge Political Economy Society digital archive today. It has scans of papers which aren’t available elsewhere.

There’s an interesting article, Causes Of Growth And Recession In World Trade, there, by Francis Cripps, in which he describes the Cambridge Keynesian idea of achieving balanced trade, because nations face a balance-of-payments constraint:

The main conclusion of the analysis presented below is that demand creation by means of fiscal and monetary action at the national level is very unlikely to be able to procure a recovery from world recession, because it does not offer a solution to the structural problem of imbalances in trade. On the other hand, demand creation at the international level, designed to boost countries’ import capacity in a manner analogous to a national budgetary stimulus of domestic spending, could in principle ensure a steady world reflation. But the political obstacles to an international programme of income creation are immense, partly because this would implicitly or explicitly involve massive transfers of income from surplus countries to deficit countries.

The alternative to a programme of income creation and redistribution would be an effective mechanism for the adjustment of trade shares, making it possible for individual countries to balance their payments at a high level of domestic activity. Exchange rate changes have hitherto been accorded this role, but experience during the past decade of large exchange rate adjustments has shown that they are quite inadequate for this purpose. The exchange rate mechanism therefore needs to be reinforced, or replaced, by some other system of trade discrimination. Import restrictions, already widely used by developing countries to regulate their trade balances, are at present more or less prohibited for Western industrial countries. Many of these could achieve a recovery of their own economies if they were allowed to introduce import controls. But such action on the part of industrialised countries would not help developing countries. Indeed to sustain growth of output and employment in every country, trade controls would have to be operated on a multilateral basis with positive discrimination in favour of the weakest. Given the desperate plight of some very poor countries, the case for positive discrimination in their favour is now becoming urgent.

…

The analysis developed below treats world trade as a demand-determined system in which the level of demand is governed by balance-of-payments constraints facing individual countries and the way these interact. …

RWER Issue On Neochartalism

The latest issue of Real World Economic Review is titled Modern Monetary Theory And Its Critics with 204 pages of papers is your weekend reading.

Marc Lavoie talks of how the neochartalists have made it look like all Post-Keynesian monetary theory has been discovered by neochartalists themselves. Lack of credit, basically. Jo Michell challenges them on open economy issues. Thomas Palley points out how their arithmetic doesn’t add up.

Long read. Just my initial impressions.

I have a few comments on Jo Michell’s article with his two co-authors. Jo points out that monetary sovereignty is a spectrum. Some neochartalists such as Fadel Kaboub and Nathan Tankus also say the same without these are contradictory to neochartalists’ claims. The idea of external constraints is an important part of Post-Keynesian work and these authors look like they are erasing the work of Kaldor, Godley, Cripps and Thirlwall and making it look like it’s all part of “M.M.T”.

Marc Lavoie — Advances In The Post-Keynesian Analysis Of Money And Finance

There’s a new article by Marc Lavoie in a newly released book which is an interesting read. Abstract:

This chapter focuses on the various monetary themes that have been emphasized by post-Keynesian economists and that turned out to have been validated by the events that occurred during and after the subprime financial crisis. These include interest rate targeting by the central bank, interest rate spreads, endogenous money, the reversed causality between reserves and money, the defensive role of central banks, the links between the central bank and the government, banks as very special financial institutions, the different role of the shadow banking system, and whether there are limits to the amounts of credit that banks can create. The chapter analyzes unconventional monetary policies, including quantitative easing (QE), QE for the people and 100% reserves. It also discusses the consequences, for the theory of endogenous central bank money, of the adoption of a system where the target interest rate is the interest rate on reserves.

UNCTAD Trade And Development Report 2019

UNCTAD has released its Trade And Development Report 2019. Always, one of the most important voices promoting a concerted action.

Most interesting excerpt, from

Chapter III, A Road Map For Global Growth And Sustainable Development,

Section C, Main considerations in the design of a strategic framework,

Item 7, International coordination for growth, industrialization and crisis response

(pages 54-56 in print/81-83 in the pdf):

Reflationary strategies cannot work as intended without explicit international coordination. Whereas uncoordinated policies ignore global aggregation effects and run into multiple constraints (such as unsustainable external deficits and pressing trade-offs between emission reduction and development priorities) coordination can expand policy space and align the incentives faced by different countries.

By contrast, straightforward export-led growth promises lower-hanging fruits. Cutting unit labour costs is the main instrument, which all countries today are encouraged to use. This may pay off in the medium term, but at the cost of longer-term problems. Cutting unit labour costs means undermining real wage growth and, eventually, aggregate demand. Even if a country initially succeeds in expanding exports and export-oriented employment, wage stagnation means that domestic demand will lag behind, making growth dependent on continuous expansion of foreign markets. Furthermore, this strategy provokes competitive responses from other countries in a global race to the bottom. As labour costs are cut globally, finding expanding markets to sustain growth becomes increasingly hard. Countries may or may not succeed in increasing export shares, but they surely incur steep costs in the form of redistribution from wages to profits, slower growth, higher instability and diminished prospects for industrialization.

Medium-term gains are not an automatic prospect either, as competitive export-led growth is not a fair game in the neo-liberal era. Short-term gains from exploiting static comparative advantages are within reach only for countries whose productive systems do not need the inputs that the current international legal framework for trade and investment restricts, such as technology transfer and public investment in infrastructure. In addition, volatile cross-border capital movements can lead to undesired exchange rate movements that work against medium-term goals of export promotion. In the current framework of international rules, it is rare for deficit countries to switch to surpluses without going through recession. As a result, current account imbalances tend to last and accumulate into unsustainable external debts, posing a recurring global challenge. This makes international policy coordination inevitable, but in the perverse form of bailout programmes with strict policy conditions. In such a context, it makes sense for all countries, but especially for developing countries, to invest politically in establishing forms of coordination that preserve their policy sovereignty while supporting global aggregate demand and financial stability (Helleiner, 2014, 2019).

Therefore, international coordination has at least three constructive functions. First, it helps to counteract the pressure that international capital mobility puts on domestic policies. Agreed standards for capital controls, if widely adopted, are instrumental in reducing capital flight in the face of economic and financial tensions, as well as the related pressures on exchange rates. Coordination mechanisms can also provide buffers to withstand pressure on exchange rates when the latter does occur. Second, and more fundamentally, international coordination can shield against protracted current account imbalances while preserving global demand, such as through mechanisms requiring that all countries expand domestic spending, while surplus countries increase their spending faster (Keynes, 1929; UNCTAD, 2014). In clearing unions, mechanisms to “recycle” external surpluses can be implemented through rules that stabilize thresholds, notional currencies to measure the imbalances, and lending mechanisms to clear them. Clearing unions are particularly useful for developing countries, as they offer an effective solution to the problem of financing likely external deficits. Third, as noted in chapter V, coordination on tax policies can be hugely effective in increasing fiscal revenues for all countries.

…

National growth strategies have a greater chance of success if they are globally consistent. Crisis response is also more effective and efficient when it is coordinated. On the one hand, crises (economic, financial, environmental) often hit different countries at different times, making it more efficient, overall, for the countries that have been spared to take on some of the burden of crisis response. For example, foreign exchange reserves are a “leakage” from global demand but they are also a critical buffer during a currency or balance-of-payments crisis. If a credible commitment to mutual foreign exchange assistance can be made, for example through formal currency swap agreements or through institutions that pool and lend reserves, currency crises can be contained with less accumulation of reserves and a smaller burden for developing countries (chapter V) and for the global economy. This was the idea that inspired the Bretton Woods system. Likewise, developed countries can support the expansion of policy space in developing countries to support their ability to invest in climate stabilization.

As a supporting mechanism for a long-term growth strategy and as a crisis-response instrument, international coordination is more efficient the larger the number of countries that participate. But in some cases, smaller coordination arrangements are also beneficial – as shown, for example, by the many regional funds, regional payment systems and exchange-rate agreements established to contain the risks of exchange-rate fluctuations (chapter IV).

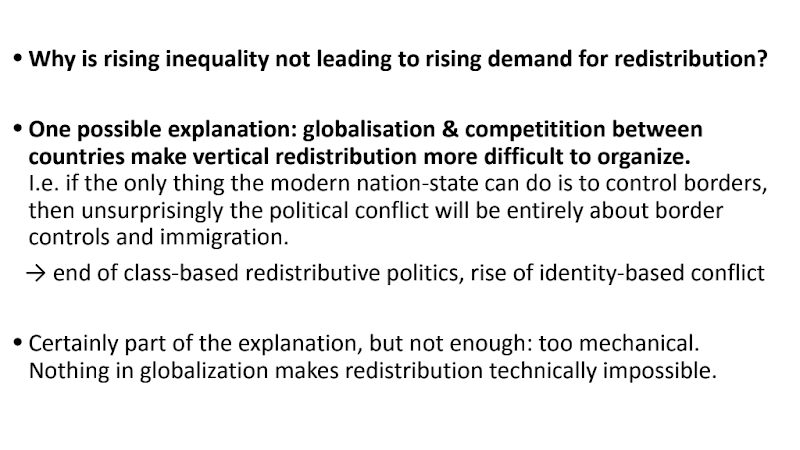

Thomas Piketty On Globalisation And Borders

Thomas Piketty has an interesting observation on globalisation and migration/borders.

From slide 11 from a lecture from July (and in earlier talks too):

Globalisation—under the current rules of the game—puts a constraint on the expansion of economies. So Piketty thinks that this can explain the debate around migration since the last few years. Although he doesn’t say that, I’d imagine that he is saying that the distribution of income favouring lower classes is difficult because of the race to the bottom caused by globalisation.

Roy Harrod by Esteban Pérez Caldentey

If you’ve worked with Post-Keynesian models of the open economy, you’ll see the expression X/μ often. This, or the “foreign trade multiplier” was first discovered by Roy Harrod in the early ’30s.

Esteban Pérez Caldentey has a new biography of Roy Harrod.

Description:

This landmark book describes and analyzes the original contributions Sir Roy Harrod made to fields including microeconomics, macroeconomics, international trade and finance, growth theory, trade cycle analysis and economic methodology. Harrod’s prolific writings reflect an astounding and unique intellectual capacity, and a wide range of interests. He became Keynes’ biographer and wrote a volume on inductive logic. At the policy level, Harrod played a central role in the formulation of the Keynes´ Clearing Union plan for international monetary reform. He also actively participated in British politics and government and gained recognition as an expert in the field of international economics. Yet, until now, Harrod has remained an underrated economist, commonly misunderstood and misrepresented. This is the first major intellectual biography of Harrod to be published.

I found an interesting bit from the book. From page 259:

He [Harrod] also introduced the asymmetry of adjustment between creditor and debtor which was pivotal to Keynes’s Clearing Union proposal.

The asymmetry of adjustment is in my view one of the most important concepts to understand in economics. From The Collected Writings Of John Maynard Keynes, Volume XXV: Shaping The Post-War World: The Clearing Union, Chapter 1, The Origins Of The Clearing Union, 1940-1942, pages 27-30:

III. The Analysis of the Problem

I believe that the main cause of failure (except in special, transient conditions) of the freely convertible international metallic standard (first silver and then gold) can be traced to a single characteristic. I ask close attention to this, because I should argue that this provides the clue to the nature of any alternative which is to be successful.

It is characteristic of a freely convertible international standard that it throws the main burden of adjustment on the country which is in the debtor position on the international balance of payments,—that is on the country which is (in this context) by hypothesis the weaker and above all the smaller in comparison with the other side of the scales which (for this purpose) is the rest of the world.

Take the classical theory that the unlimited free flow of gold automatically brings about adjustments of price-levels and activity between the debtor country and the recipient creditor, which will eventually reverse the pressure. It is usual to-day to object to this theory that it is too dependent on a crude and now abandoned quantity theory of money and that it ignores the lack of elasticity in the social structure of wages and prices. But even to the extent that it holds good in spite of these grave objections, if a country is in economic importance even a fifth of the world as a whole, a given loss of gold will presumably exercise four times as much pressure at home as abroad, with a still greater disparity if it is only a tenth or a twentieth of the world, so that the contribution in terms of the resulting social strains which the debtor country has to make to the restoration of equilibrium by changing its prices and wages is altogether out of proportion to the contribution asked of its creditors. Nor is this all. To begin with, the social strain of an adjustment downwards is much greater than that of an adjustment upwards. And besides this, the process of adjustment is compulsory for the debtor and voluntary for the creditor. If the creditor does not choose to make, or allow, his share of the adjustment, he suffers no inconvenience. For whilst a country’s reserve cannot fall below zero, there is no ceiling which sets an upper limit. The same is true if international loans are to be the means of adjustment. The debtor must borrow; the creditor is under no such compulsion.

…

… Thus it has been an inherent characteristic of the automatic international metallic currency (apart from special circumstances) to force adjustments in the direction most disruptive of social order, and to throw the burden on the countries least able to support it, making the poor poorer.

…

I conclude, therefore, that the architects of a successful international system must be guided by these lessons. The object of the new system must be to require the chief initiative from the creditor countries, whilst maintaining enough discipline in the debtor countries to prevent them from exploiting the new ease allowed them in living profligately beyond their means.

The book also says that Roy Harrod was a life long believer of free trade. It’s a bit shocking!

Thomas Piketty’s New Book

Thomas Piketty is out with a new book Capital Et Idéologie.

Picture credit L’Obs

His tweet, announcing. The English version will be released in a few months.

Branko Milanovic has already read it and his review has this explanation of Piketty’s brilliant phrase, Brahmin Left:

… In [the second] part, we find the Piketty who plays to his strength: bold and innovative use of data which produces a new way of looking at phenomena that we all observe but were unable to define so precisely. Here, Piketty is “playing” on the familiar Western economic history “terrain” that he knows well, probably better than any other economist.

This part of the book looks empirically at the reasons that left-wing, or social democratic parties have gradually transformed themselves from being the parties of the less-educated and poorer classes to become the parties of the educated and affluent middle and upper-middle classes. To a large extent, traditionally left parties have changed because their original social-democratic agenda was so successful in opening up education and high-income possibilities to the people who in the 1950s and 1960s came from modest backgrounds. These people, the “winners” of social democracy, continued voting for left-wing parties but their interests and worldview were no longer the same as that of their (less-educated) parents. The parties’ internal social structure thus changed—the product of their own political and social success. In Piketty’s terms, they became the parties of the “Brahmin left” (La gauche Brahmane), as opposed to the conservative right-wing parties, which remained the parties of the “merchant right” (La droite marchande).

To simplify, the elite became divided between the educated “Brahmins” and the more commercially-minded “investors,” or capitalists. This development, however, left the people who failed to experience upward educational and income mobility unrepresented, and those people are the ones that feed the current “populist” wave. Quite extraordinarily, Piketty shows the education and income shifts of left-wing parties’ voters using very similar long-term data from all major developed democracies (and India). The fact that the story is so consistent across countries lends an almost uncanny plausibility to his hypothesis.

One of the finest insights on political economy!

Mario Seccareccia and Marc Lavoie — Central Banks, Secular Stagnation, And Loanable Funds

Mario Seccareccia and Marc Lavoie comment on Larry Summers’ recent shift on his view of fiscal policy:

… At the time [2013], however, he still sought to explain this new normalcy of secular stagnation in terms of interest rate rigidity.

Now, however, he seems to have abandoned that view altogether and has embraced Keynesian and post-Keynesian ideas originating with the General Theory. For instance, nowhere in the article by Summers and Stansbury is there mention of the negative natural rate as the explanation for an incapacity of central bankers to deal with secular stagnation. Is that because he has now abandoned the loanable funds theory, which remains at the core of mainstream thinking and to which he had previously subscribed? Nor do he and his coauthor suggest now that activist fiscal policy to combat secular stagnation is needed as a temporary measure to kick-start an economy stuck in a liquidity trap.

Government Borrowing In Foreign Currency

On Twitter, people are discussing the Argentinian debt in foreign currency, as if it’s solely the error of the government to have done it. There is of course truth to it, some governments might volitionally issue bonds in foreign currency. But that alone seems insufficient as an explanation.

Also, people wonder what the government does with the funds obtained. Maybe the government buys some goods for public distribution? But if the government wants to buy something from abroad, it can anyway make an FX transaction with a bank and this question about usage for goods doesn’t seem that relevant.

The answer is: original sin.

In their paper Exchange Rates And Financial Fragility, Barry Eichengreen and Ricardo Hausmann write:

The Original Sin Hypothesis. The second view emphasizes an incompleteness in financial markets we call “original sin.” This is a situation in which the domestic currency cannot be used to borrow abroad or to borrow long term, even domestically. In the presence of this incompleteness, financial fragility is unavoidable because all domestic investments will have either a currency mismatch (projects that generate pesos will be financed with dollars) or a maturity mismatch (long-term projects will be financed with short-term loans).

Critically, these mismatches exist not because banks and firms lack the prudence to hedge their exposures. The problem rather is that a country whose external liabilities are necessarily denominated in foreign exchange is by definition unable to hedge. Assuming that there will be someone on the other side of the market for foreign currency hedges is equivalent to assuming that the country can borrow abroad in its own currency. Similarly, the problem is not that firms simply lack the foresight to match the maturity structure of their assets and liabilities; it is that they find it impossible to do so. The incompleteness of financial markets is thus at the root of financial fragility.

It follows that both fixed and flexible exchange rates are problematic.

Of course, this is a bit hypothetical but how does it work?

Ronald Mckinnnon, in his paper Money And Finance On The Periphery Of The International Dollar Standard, highlighted the mechanism:

Consider the implications for optimal short-term foreign exchange management, first when capital controls are absent, and second, when they are effectively applied.

- Case 1: No capital controls, imperfect bank regulation. Either because regulatory weakness leaves too many banks (and possibly importers) with exposed foreign exchange positions, or because the government doesn’t want to impose draconian rules against institutions assuming any open foreign exchange position, an informal hedge is provided by keeping the exchange rate steady in the short term. The short time frame over which foreign currency debts—largely in dollars—are incurred, and then repaid on a day-to-day or even a week-to-week basis, defines the same time frame over which the dollar exchange rate is (and should be) kept stable in non-crisis periods.

- Case 2: Direct capital controls. Suppose the government prevents banks, other financial institutions, and individuals from holding any foreign exchange assets or liabilities. Non-bank firms engaged in foreign trade cannot take positions in foreign exchange except for the minimum necessary in their particular trade. Importers are prevented from building up undue foreign currency debts except for ordinary trade credit, and exporters are required to repatriate their dollar earnings quickly. In particular, banks cannot accept foreign-currency deposits or hold foreign-currency deposits abroad, or make foreign-currency loans. Then private agents in general, and banks in particular, cannot act as dealer-speculators to determine the level of the exchange rate (McKinnon, 1979, Ch. 6). The exchange rate will become indeterminate (highly volatile) unless the government steps in as a dealer to clear international transactions. Thus, the government must take open positions, which determine the level of the exchange rate, and assume the exchange risk. So if the government is determining the exchange rate day-to-day anyway, why not keep it stable?

Real life is a mix of the two cases above.

The exchange rate is where asset supplies and demands clear. But it’s possible that this market clearing doesn’t happen. So the government needs to intervene to allow this happen. This requires the government to borrow in foreign currencies and sell foreign currency in in the foreign exchange markets.

But this process is unsustainable and the adjustment happens via structural reforms, i.e., wage cuts and deflation of domestic demand and output. That is unfortunate and the real solution is to reform the IMF and the WTO.