It’s frequently claimed that the US 🇺🇸 has trade deficits but since the US dollar has not collapsed, the ones saying that the US does not have a balance of payments constraint are all wrong.

Now there are several errors in this line of reasoning but going straight to the point: the balance-of-payments constraint is first a constraint on output. There’s a deflationary bias in the US output because of the imbalance in trade.

This article is written in response to a blog post Cumulative U.S. Trade Deficits Resulting in Net Profits for the U.S. (and Net Losses for China) at the blog macroblog by the Federal Reserve Bank of Atlanta. The article says:

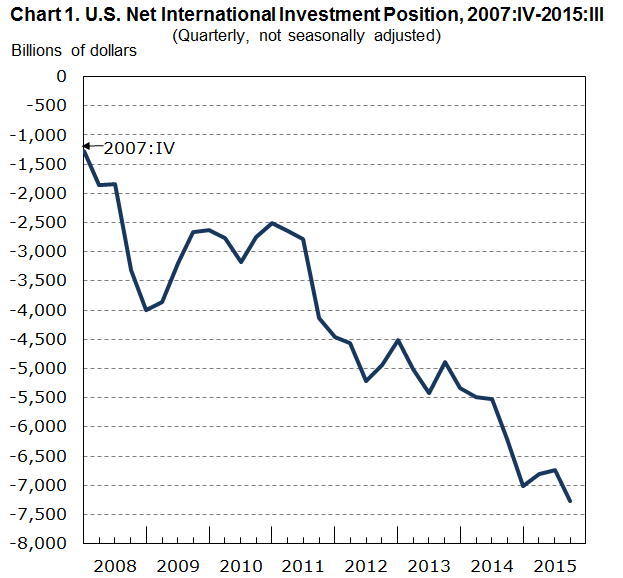

The United States has run trade deficits for decades (1976 is the last year with a recorded surplus). To illustrate this, chart 1 depicts the cumulative U.S. trade deficit since 1980, which now surpasses $10 trillion. As a result, a drastic deterioration in the U.S. net foreign asset position—the difference between the amount of foreign assets owned by U.S. residents and the amount of U.S. assets owned by foreigners—has occurred. That is, as Americans borrow from the rest of the world to finance the recurring trade deficits, the national net worth goes deeply into the red. Not long ago, many commentators predicted that as a result of this increasing U.S. foreign debt, the U.S. dollar was set to collapse, which would trigger a stampede away from U.S. assets. Of course, this has not happened.

The wording of this itself is problematic. First some definitions:

Here’s from the IMF’s Balance of Payments And International Investment Position Manual (BPM6), pg 9:

The balance of payments is a statistical statement that summarizes transactions between residents and nonresidents during a period. It consists of the goods and services account, the primary income account, the secondary income account, the capital account, and the financial account. Under the double-entry accounting system that underlies the balance of payments, each transaction is recorded as consisting of two entries and the sum of the credit entries and the sum of the debit entries is the same.

What the US has is a positive balance in the secondary income account (more credits than debits) despite running large deficits in the primary account and despite having a large negative net international position. But “net loss” or “net profit” is bad wording to start with. Also the net international investment position itself is not “national net worth” because the latter includes non-financial assets owned by resident economic units and hence doesn’t make an appearance in the international investment position.

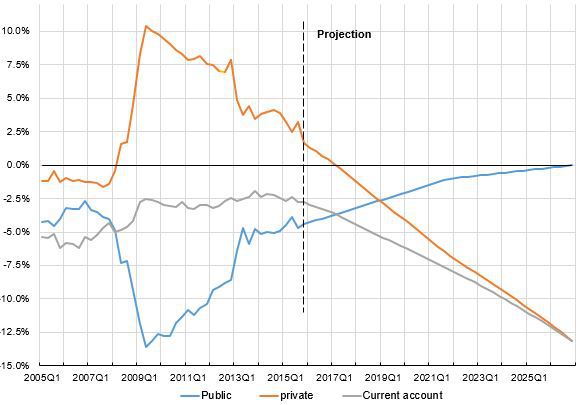

Now coming back to the point on output – If the US economy were to run under full capacity at all times with the current account deficit widening and the net international investment position deteriorating relative to gdp without limit, it can then be claimed that the US doesn’t have this problem and the economists worrying about US trade got it all wrong. But that is far from the case. Not only is the US economy not running under full capacity, but so much output has been lost since the beginning of the crisis starting in 2007.

Having an imbalance in trade means that output multipliers aren’t as high as it would have been the case otherwise. So the government expenditure multiplier and private expenditure multiplier are inversely related to the propensity to import and would have been higher if the propensity to import were less.

Usually economists talk about either trade or the financial aspect (i.e. either the current account or the financial account of the balance of payments) but not both together in a single unified framework. Most of the conclusions reached are due to lack of analysis which treat both of them simultaneously. Stock flow consistent models are an exception but other models are so messed up even for the closed-economy that it’s difficult in those models to make progress.

The fact that the US secondary income is in the US’ favour has led economists to draw any conclusion they want from their analysis. Let’s touch one aspect – the tipping point.

The tipping point

Let’s say you have assets worth $100 and earning at 6% annually (such as interest or dividend), and liabilities of $110 paying at 5%. So even though your liabilities are higher than assets, your income on assets ($6) is higher than what you pay on your liabilities ($5.5). So far, so good, so what? While this is not a bad situation, this is unlikely to remain the case forever. For example if your assets stay the same whereas liabilities rise to $130, then the net income is against your favour. You are earning $6 per year but paying $6.5.

The point of the above example is that even though the US earns more on assets held abroad than what it pays nonresident economic units on their financial assets, this process cannot continue forever. Sooner or later, the difference between the assets and liabilities (because of continuous trade deficits) will be so high that the secondary income in the current account in the balance of payments will be negative. So estimating the tipping point is estimating when this will happen.

Surely, if the US runs at full capacity and hence higher trade deficits because of higher national income and income effects on imports, the US will hit the tipping point sooner. At that point nobody can obfuscate the debate by saying that the secondary income balance in the current account of the balance of payments is positive. The international investment position will deteriorate at a much faster rate.

Of course reaching the tipping point itself is not apocalypse. Some countries do have a negative balance in the secondary income account of their balance of payments. The situation can continue as long as markets allow it to go on. When the busts, it will create a problem but nobody has a theory yet on when exactly some busts, although we’ve made progress on identifying unsustainable processes.

The point of the above analysis is that none of the arguments trying to claim directly or implicitly that “current account deficits do not matter” are erroneous.

No, the dollar won’t collapse but the US economy will run from full capacity to keep debts in check. Such as so much lost output in the last 9 years or so. To summarize, there are at least two scenarios here which are either confused or conflated or both by economic commentators:

- The US economy running closer to full capacity but with international investment position deteriorating fast and a threat to the US economy and the currency.

- Status-quo, where there’s deflationary bias to the US economy and hence consequences to output, employment and income for the bottom of the population but no immediate threat to the international investment position (although deteriorating) and in which there’s no dollar collapse.

The empiric of scenario 2 above cannot be used to argue that scenario 1 is benign because these two are different states of the world.

The solution is another scenario, a scenario 3 in which output is raises by fiscal expansion but the US government also works to address its balance of payments problems. For example, China’s strategy of exports is quite damaging to the US economy and it is important that the US establishment addresses this instead of just saying “it does matter” or that market mechanism will do the trick.