The UK Prime Minister’s Twitter account tweeted this picture of Theresa May signing the letter to trigger Article 50 tomorrow, starting the process for the UK 🇬🇧 to leave the EU 🇪🇺.

click to view the tweet on Twitter

Nicholas Kaldor wrote a lot on this in the 1970s before the United Kingdom European Communities membership referendum in 1975. In his Collected Economics Essays, Volume 7, he wrote (Introduction, page xxvi, October 1977) :

The final section of this volume, Part III, reproduces papers written in the course of the “Great Debate” on the question of British Membership of the Common Market in 1970 and 1971, and includes as a postscript a lecture on Free Trade written in 1977. As this debate came to an end when Britain entered the market, a decision which was later confirmed in popular referendum with a 2:1 majority, the reproduction of these papers may strike as otiose and serving little purpose other than somewhat ignoble one of self-vindication in the eyes of future historians. However, if the long-run effects of our membership turn out to be as disastrous as I feared they would be in 1971—and nothing that has happened has caused me to change my views—I think it is of the utmost importance that the true arguments against membership should be accessible to successive generations of students, the more so since the political debate continues to be dominated by issues (such as our effects of membership on the cost of food, on our agriculture, or the net budgetary cost of membership) which I regard as secondary and which could be brushed aside if the long-run effects on Britain’s manufacturing industry and on our capacity to provide employment were favourable.

So Nicky Kaldor would have been happy, had he been alive today.

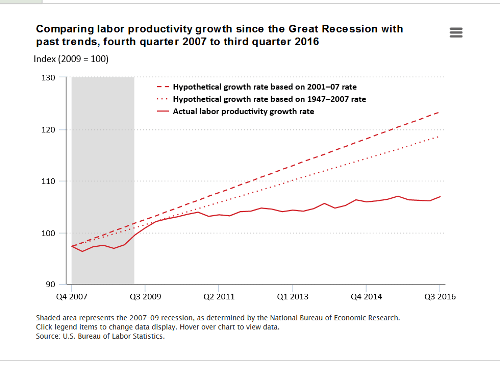

Economists’ predictions about leaving the European Union (“Brexit”) went wrong. Real GDP in the H2 2016 rose faster than H1, while they were predicting a recession. Not that the road will be simple ahead for Britain. Let’s see!