The subject of money, credit and moneyflows is a highly technical one, but it is also one that has a wide popular appeal. For centuries it has attracted quacks as well as serious students, and there has too often been difficulty in distinguishing a widely held popular belief from a completely formulated and tested scientific hypothesis.

I have said that the subject of money and moneyflows lends itself to a social accounting approach. Let me go one step farther. I am convinced that only with such an approach will economists be able to rid this subject of the quackery and misconceptions that have hitherto been prevalent in it.

– Morris Copeland, inventor of the Flow Of Funds Accounts of the United States, in Social Accounting For Moneyflows, in Flow-of-Funds Analysis: A Handbook for Practitioners (1996) [article originally published in 1949]

Alas monetary myths continue to exist. The above referred handbook was published in 1996 starting with Copeland’s 1949 article and the editor of the book John Dawson himself had an explanation of why myths continue to exists despite some brilliant work such as that of Copeland. In page xx, Dawson says:

the acceptance of… flow-of-funds accounting by academic economists has been an uphill battle because its implications run counter to a number of doctrines deeply embedded in the minds of economists.

In a recent blog post blog post Paul Krugman is dismissive of Wynne Godley’s approach to macro modeling and instead appeals to some Friedmanism. Perhaps Dawson’s quote explains why this is so. However it may not be the only reason, given how Krugman has shown some tendency to be heteredox in recent times but his latest post ends all doubts and we can say he is highly orthodox. And that other reason is professional turf-defence.

Also, Krugman was writing in response to an NYT article Embracing Wynne Godley, an Economist Who Modeled the Crisis highlighting the importance of Wynne Godley’s work. That article was by a journalist who was perhaps unaware of the history of Post-Keynesianism. But Krugman himself dodged Godley’s work as “old-fashioned” – as if there is something fundamentally wrong about old-fashion and as if economics should proceed by one fashion after another.

A bigger disappointment is that Krugman failed to acknowledge that there has existed a heteredox approach since Keynes’ time. As Wynne Godley and Marc Lavoie begin Chapter 1 in their book Monetary Economics:

During the 60-odd years since the death of Keynes there have existed two, fundamentally different, paradigms for macroeconomic research, each with its own fundamentally different interpretation of Keynes’ work…

And Krugman’s usage of the phrase old-fashioned hides the fact that this is so.

Back to Copeland. In the same article Social Accounting For Moneyflows, Copeland is clear about his intentions and the direction he is looking:

When total purchases of our national product increase, where does the money come from to finance them? When purchases of our national product decline, what becomes of the money that is not spent? What part do cash balances, other liquid holdings, and debts play in the cyclical expansion of moneyflow?

Copeland’s analysis was not simply theoretical. It led to the creation of the flow of funds accounts of the United States and the U.S. Federal Reserve publishes this wonderful data book every quarter. Although, Copeland was simply looking and proceeding in the right direction, it can be said that a more solid theoretical framework to build upon Copeland’s brilliant work was still waiting at the time.

Of course, in the world of academics, there already existed two main schools of thought very hostile to one another. Keynes’ original work contained a lot of errors and for most economists, a bastardised version of Keynes’ work became the popular understanding. It was however the Cambridge Keynesians who founded the school Post-Keynesian Economics who believed they were true to the spirit of Keynes and this led to a parallel body of extremely high-quality intellectual work which continues to this day – and still dismissed by economists such as Paul Krugman. Of course, in this story, it should be mentioned that there was a Monetarist counter-revolution mainly led by Milton Friedman who was trying to bring back the old quantity theory of money doctrines and was “successful” in permanently distorting the minds of generations of economists to date. Greg Mankiw is quite straight on this and according to him, “New Keynesian” in the “New Keynesian Economics” is a misnomer and it should actually be New Monetarism.

Interestingly, one of Morris Copeland’s ideas was to show how the quantity theory of money is wrong. According to Dawson (in the same book referred above):

[Copeland] himself was at pains to show the incompatibility of the quantity theory of money with flow-of-funds accounting.

Meanwhile, in the 1960s and to the end of his life, James Tobin tried to connect Keynesian economics with the flow of funds accounts. While a lot of his work is the work of a supreme genius, he couldn’t manage. Perhaps it was because of his neoclassical background which may have come in the way. According to his own admission, he couldn’t connect the dots:

Monetary and financial data, so far as they are based on institutional balance sheets and prices in organized markets, are abundant. Modern machines have made it possible to improve, refine and expand the compilation of these data, and also to seek empirical regularities in financial behavior in the magnitude of individual observations. On the aggregate level, the Federal Reserve Board has developed a financial accounting framework, the “flow of funds,” for systematic and consistent organization of the data, classified both by sector of the economy (households, nonfinancial business, governments, financial institutions and so on) and by type of asset or debt (currency, deposits, bonds, mortgages, and so on). Although many people hope that this organization of data will prove to be as powerful an aid to economic understanding as the national income accounts, this hope has not yet been fulfilled. Perhaps the deficiency is conceptual and theoretical; as some have said, the Keynes of “flow of funds” has yet to appear.

– James Tobin in Introduction (pp xii-xiii) in Essays In Economics, Volume 1: Macroeconomics, 1987.

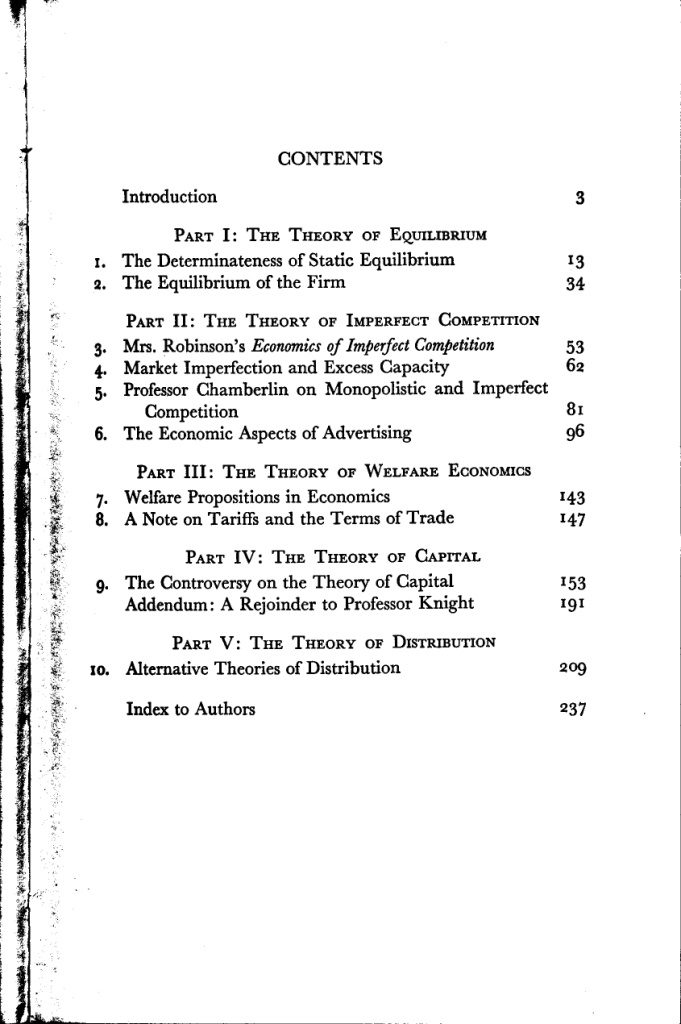

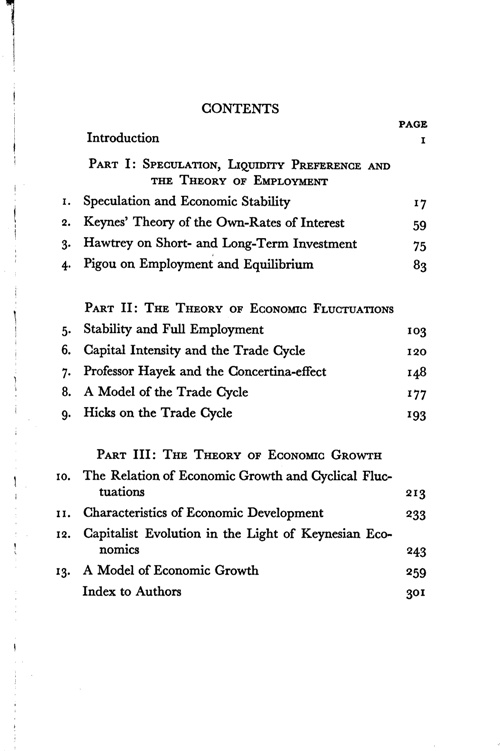

After having written a fantastic book Macroeconomics with Francis Cripps in 1983 and which has connections with the flow of funds, Wynne Godley thought he had to try hard to unify (post-)Keynesianism and the flow of funds approach which James Tobin was trying. Wynne Godley had the advantage of being close to Nicholas Kaldor who very well understood the importance of Keynes and was himself an economist of Keynes’ rank. Godley also had the advantage of having worked for the U.K. government and doing analysis using national accounts data and advising policy makers. Wynne Godley is the Keynes of “flow of funds” which Tobin was talking about!

A recent blog post by Matias Vernengo on Wynne Godley is extremely well-written.

In his later years (and his best), Wynne Godley worked with Marc Lavoie, one of the faces of Post-Keynesianism and one who had previously made highly original contributions to Post-Keynesianism and this led to the book Monetary Economics. Marc’s earlier work was also highly insightful and he highlighted – in the spirit of Morris Copeland – how poorly money is understood by economists in general and it was natural he and Wynne would meet and work together.

One of the things about Wynne Godley’s approach is how to combine abtract theoretical work and direct practical economic issues. This actually led him to warn of serious deflationary consequences of economic policy in fashion before the crisis.

Lance Taylor (in A Foxy Hedgehog: Wynne Godley And Macroeconomic Modelling) had a nice way to describe Wynne Godley:

Wynne has long been aware of the stupidity of models when you ask them to say something useful about practical policy problems. He has spent a fruitful career trying to make models more sensible and using them to support his policy analysis even when they are obtuse. As we have seen, this quest has led him to many foxy innovations.

But there is an enduring hedgehog aspect as well. Wynne has focused his energy on combining the models with his acute policy insight based on deep social concern to build up a large and internally coherent body of work. He has disciples and is widely influential. One might wish that he had pursued some lines of analysis more aggressively and perhaps put a bit less effort into others. And maybe not have written down so damn many equations. But these are quibbles. His work is inspiring, and will guide policy-oriented macroeconomic modellers for decades to come.

In this post, I have tried to provide the reader with references to go and verify how flow of funds1 cannot be separated from Keynesian Economics – Keynesian approach in the original spirit of Keynes, not some bastartized versions. It is as if they were made for each other2. While it is true that like other sciences, Macroeconomics is always work in progress, it doesn’t mean one should bring fashions such as inter-temporal utility maximising agents (read: future knowing economic actors) in the approach which Paul Krugman prefers.

1My usage of “flow of funds” is more generic than the usage which distinguishes income accounts and flow of funds accounts and hence my usage is for both.

2The ties between the flow of funds approach and Post-Keynesiansism is argued in Godley and Lavoie’s book Monetary Economics from which I have borrowed a lot.

Correction

I am mistaken about Jonathan Schlefer’s background. He is in academics.