I was collecting some articles by Basil Moore and I found this table from an article In Praise Of Markets – Wage Imitation And Price Stability (unsure as to why the article is titled “praise of markets”). The article appeared in Challenge in 1982.

Post Keynesians adopt Kaleckian theory of pricing. There are two sectors – fix price and flex price.

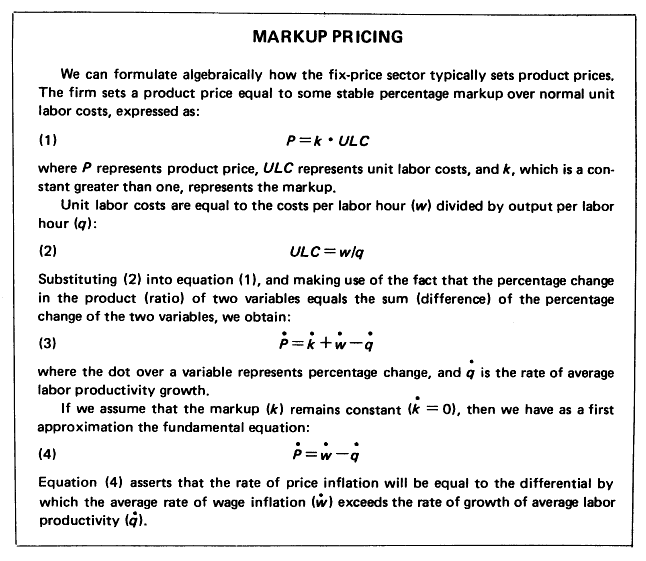

(The following table is for the fix-price sector).

Of course, this is just a quick and dirty way of getting into Post Keynesian pricing theory which has a rich literature and has obsessed all the leading PKEists for years.

During the 1970s, wages in advanced economies rose due to the rise in the bargaining power of labour unions and this led to a wage-price spiral. As wages increased, firms increased prices in response. This led workers to demand higher wages so as to be compensated for inflation – leading to further price rises. The pricing was also complicated by increase in other costs such as energy prices which led to an increase in markup as well. When firms faced more wage costs, they borrowed more from banks and this led to a huge increase in the money stock. (I am resisting the usage of the word “supply” for money, as it is misleading). Monetarism came to popularity as the Monetarists led by Milton Friedman were making a lot of noises and saw the relationship and used their political powers to ask central banks to “control” the money stock. When central banks responded saying they do not and cannot control the money stock, Milton Friedman declared them “incompetent”!

Some central banks were forced to bow into political pressures and had to raise short term interest rates (i.e, they still weren’t controlling the money stock, because it cannot be controlled). This had the additional complication that firms’ interest costs (on borrowings) increased and they were forced to increase prices more. In the end, interest rates was raised to such a high level that it led to a huge fall in demand and employment, even though Monetarists’ theories continued claiming that wages will fall and “free markets” will lead to full employment!

During the period (70s/80s), there were also debates about the “velocity of money” – the supposed stability of the relationship of money stock and money income. Some Keynesians try to argue that the relationship is not stable etc. However Marc Lavoie, in an article in response to a comment to his earlier article on endogenous money pointed out:

… The second point I want to raise is the question of the stability of the velocity of money. Gedeon says that an unstable velocity is the typical post Keynesian argument and she goes into a detailed analysis of a demand for money function that would exhibit this characteristic … I do not think that the stability or instability of the velocity of money is a fundamental question since it ignores the more vital issue of causation. Provided it is recognized that money does not determine income, post Keynesians can feel comfortable with either stable or unstable velocity.

Monetarism is no longer as popular now as it used to be, but traces can easily be found in most theories of economics such as the “New Consensus”.